LEARNING OBJECTIVES:

After studying this chapter, you should know about:

- Role of industry analysis in fundamental analysis - Understanding industry's position in investment research framework

- Challenges in defining an industry - Complexities of industry classification systems and boundaries

- Industry cyclicality, market sizing and trend analysis - Both top-down and bottom-up approaches with practical challenges

- Secular trends, value migration and business life cycle - Long-term trends causing business displacement and value shifts

- Various industry analysis frameworks such as Porter's Five Force Model, PESTLE analysis, BCG analysis and SCP analysis

- Key Industry specific drivers and industry KPIs - Industry-specific performance indicators and measurement frameworks

- Regulatory Framework including taxation - Impact of regulations and tax policies on industry dynamics

- Sources for industry data and information - Comprehensive list and reliability criteria for industry research

📑 Chapter Navigation

Industry Fundamentals

Strategic Analysis

📖 Complete Course Navigation

Foundation (Ch 1-4)

Analysis (Ch 5-8)

- Ch 5: Economic Analysis

- Ch 6: Industry Analysis

- Ch 7: Company Analysis - Business

- Ch 8: Company Analysis - Financial

Advanced (Ch 9-13)

Annexures (Ch 14-16)

6.1 Role of industry analysis in fundamental analysis

Economic analysis helps us understand whether business, in general, is likely to grow in the foreseeable future or decline. Industry analysis helps in understanding how each industry would be impacted under the current economic conditions.

In Industry analysis, analysts also try to understand how the various players in the market (industry) are likely to react and how that may affect the prospect of the industry.

Key Role of Industry Analysis in Investment Research Framework:

- Bridge between macro and micro analysis: Links economic conditions to company-specific factors

- Competitive positioning: Helps assess relative strength of companies within their operating environment

- Risk assessment: Identifies industry-specific risks that may not be apparent at company level

- Valuation context: Provides industry benchmarks for valuation multiples and performance metrics

- Investment opportunity identification: Reveals sectors with favorable structural trends

The various questions that have to be addressed in industry analysis include the following:

- What is the industry in which the company operates? - Industry definition and boundaries

- How much does it get impacted on account of cyclical trends in the economy? - Cyclical sensitivity assessment

- What is the potential industry size? - Market sizing and growth potential

- How has the industry been performing in the past and what were the drivers behind the performance? - Historical analysis and trend identification

- What is the level of competition in the industry? How does it affect the pricing power of the various players? - Competitive dynamics and profitability drivers

- What are the various secular trends that affect the industry, and are they causing any value migration? - Long-term structural changes

- Are there any regulatory headwinds or tail winds affecting the industry? - Regulatory environment assessment

6.2 Defining the industry

The very first step in an industry analysis is to define the industry in which the company operates. Industry definition is not always an easy task. While there are several standard industry classification systems, such as National Industry Classification (NIC) system in India, the Global Industry Classification Standard (GICS), or North American Industry Classification System (NAICS) in US, they may not necessarily capture the substance of the industry.

Key Challenges in Industry Definition:

- Classification system limitations: Standard systems may not capture true business dynamics

- Multi-industry operations: Companies operating across multiple industries create classification difficulties

- Technology convergence: Technological advancement blurs traditional industry boundaries

- Substitute product competition: Competition from unexpected sources not captured in traditional classifications

- Value chain complexity: Deciding whether to focus on narrow segments or broader industry groups

Example - Car Manufacturing Classification: NIC has a single classification for manufacture of passenger cars. Thus, every car manufacturer including entry level compact car manufacturers and high-end luxury car manufacturers fall under the same industry classification. However, since the dynamics of the luxury car manufacturer is very different from entry level passenger car segment, analysts may view them as different industries. The challenge especially increases when a company competes in many industries to earn its income.

Detailed Example: PVR Limited - Industry Definition Complexity

Let us take the example of PVR Limited. On one hand, PVR Cinemas competes with satellite channels and Over the Top (OTT) platforms, such as Netflix and Hotstar, to attract audience. On the other hand, the cinema industry also competes with live theatres, live performances, and sporting leagues.

Industry Definition Decision Framework:

| Definition Approach | Classification | Advantages | Disadvantages |

|---|---|---|---|

| Narrow Definition | Cinema Exhibitors | Focused competitor analysis | May miss substitute threats |

| Medium Definition | Out of Home Entertainment | Captures leisure spending competition | Too broad for specific insights |

| Broad Definition | Media & Entertainment | Comprehensive competitive view | Loses industry-specific dynamics |

Thus, if an analyst applies a narrow industry definition and classifies the company as part of cinema exhibitors, it creates a risk of overlooking other competitors. But if one were to give broader definition, then challenge is to identify whether to classify the company as part of entertainment media industry or should it be classified as part of Out of Home (OOH) entertainment industry. This may force the analyst to classify it as part of a much broader media and entertainment industry. But that would create another challenge as each segment within this broader group have their own idiosyncrasies and not strictly comparable.

Example - Camera Manufacturing Evolution: Couple of decades ago, cameras were a standalone product. However, with the emergence of mobile phones with built-in cameras, a lot of entry level digital cameras started losing their sales to these phones. Today, with emergence of high technology mobile phones, even mid-tier cameras are facing competition from mobile phones. If cameras are defined as a standalone industry, then an analyst may end up ignoring this huge competition from mobile phones.

Best Practice for Industry Definition: An analyst should carefully consider the various factors that drive the business and should classify it as part of the industry group which have such common driving factors. Thus, if an analyst believes that PVR Limited's business is driven by people's propensity to spend time outside their home, it may be appropriate to classify it as part of out of home entertainment industry. On the other hand, if the business is largely driven by people's propensity to consume movie content, then it may be appropriate to classify it as part of entertainment media.

GICS Classification System

GICS which is widely used in financial sector for global investors on the other hand is a four-tiered, hierarchical industry classification system where the four tiers are: Sectors, Industry Groups, Industries and Sub-Industries divided into 11 sectors, 25 industry groups, 74 industries and 163 sub-industries. An example for grouping for Energy sector is shown below for illustration purposes:

| Sector | Industry Group | Industry | Sub-Industry |

|---|---|---|---|

| Energy | Energy | Energy Equipment & Services | Oil & Gas Drilling |

| Oil & Gas Equipment & Services | |||

| Integrated Oil & Gas | |||

| Oil & Gas Exploration & Production | |||

| Oil, Gas & Consumable Fuels | Oil & Gas Refining & Marketing | ||

| Oil & Gas Storage & Transportation |

Source – MSCI, March 2023

6.3 Understanding industry cyclicality

Economic cycles affect all businesses. However, they affect some businesses more than others. Understanding cyclical nature is crucial for investment timing and risk assessment. Based on the cyclical nature, industries can be classified into three categories:

Defensive Industries

Characteristics: Low income elasticity products/services

Economic Impact: Minimal impact from economic cycles

Revenue Pattern: Stable demand regardless of economic conditions

Examples: Food, agricultural inputs, healthcare, utilities

Investment Appeal: Portfolio stability during recessions

Semi-cyclical Industries

Characteristics: Moderate sensitivity to economic cycles

Economic Impact: Growth in expansion, decline in recession

Revenue Pattern: Base level demand provides floor during downturns

Examples: Consumer durables, automotive

Investment Appeal: Balanced risk-return during economic cycles

Deep Cyclical Industries

Characteristics: Extreme sensitivity to economic/commodity cycles

Economic Impact: Massive volatility with economic conditions

Revenue Pattern: Sharp declines in recession, explosive growth in recovery

Examples: Capital goods, steel, mining, construction

Investment Appeal: High risk, high return potential

Investment Implications of Industry Cyclicality:

- Defensive Industries: Suitable for conservative portfolios; outperform during economic uncertainty

- Semi-cyclical Industries: Provide balanced exposure; require careful timing

- Deep Cyclical Industries: High alpha potential; require exceptional timing skills and risk tolerance

6.4 Market sizing and trend analysis

Industries that are underpenetrated have high growth potential as there is more headroom for growth. However, as industries mature, the new growth avenues decline and the overall growth rates, thus, come down. Therefore, while studying industry, it is important to analyze the potential size of the market and current size of the market.

Key Challenges in Market Sizing:

- Unorganized sector data: Difficult to capture informal/unorganized players

- Private company information: Limited availability of private company data

- Assumption dependency: Market potential calculations require multiple assumptions

- Data reliability: Varying quality and consistency of available data sources

- Dynamic market boundaries: Rapidly changing competitive landscapes

However, measuring the current market size is difficult especially if there are many unorganized players or private companies whose information is not available in public domain. Further, quantifying the potential size of the market also involves making lot of assumptions, which can go wrong.

Therefore, studying the past trends can supplement our analysis and help us understand how the industry has been growing and what are the factors that are affecting growth. Such studies also help us understand the underlying secular trends.

Comprehensive Market Sizing Methodologies

Top-down Approach

In a top-down approach, we measure the size of the market or industry starting from macro-economic factors and arrive up to the industry level.

Methodology Steps:

- Total Addressable Market (TAM): Start with macro-economic indicators

- Serviceable Addressable Market (SAM): Apply geographic and demographic filters

- Serviceable Obtainable Market (SOM): Consider competitive and operational constraints

Example - Healthcare Therapy Market:

- Identify total patients requiring the therapy (epidemiological data)

- Determine treatment penetration rates (diagnosed vs undiagnosed)

- Ascertain average expenditure per patient (pricing research)

- Calculate: Patients × Penetration Rate × Average Spend = Market Size

Bottom-up Approach

In bottom-up approach, we quantify the market by looking at individual companies and aggregating their data to arrive at the industry size.

Methodology Steps:

- Company-level data collection: Gather revenue/volume data from all major players

- Market share estimation: Estimate shares of organized vs unorganized sectors

- Extrapolation techniques: Use sampling to estimate total market

- Cross-validation: Compare with top-down estimates for consistency

Example - Healthcare Therapy Market (Bottom-up):

Look at revenue of all hospitals providing this therapy, identify proportion of revenue from this specific therapy, aggregate across all providers, and adjust for unorganized sector participation.

Comparison: Top-down vs Bottom-up Market Sizing

| Aspect | Top-down Approach | Bottom-up Approach |

|---|---|---|

| Data Requirements | Macro-economic indicators, demographic data | Company-specific financial data |

| Accuracy | Broad estimates, assumption-heavy | More precise, data-driven |

| Time Investment | Relatively quick | Time-intensive data collection |

| Best Use Cases | New markets, preliminary analysis | Established markets, detailed analysis |

| Key Limitations | May miss market realities | Data availability constraints |

Best Practice: As mentioned above, market sizing may involve making certain assumptions, as all the required information may not be available. Analysts should triangulate findings using both approaches and clearly document all assumptions for transparency.

6.5 Secular trends, value migration and business life cycle

As discussed earlier, secular trends are long term trends that cause displacement in production or consumption of goods and services. Understanding these trends is crucial for identifying investment opportunities and avoiding value traps.

Comprehensive Factors Driving Secular Trends

1. Technological advancement

New technology can cause disruption in many ways. It can bring in new methodology in production of goods. It can provide alternative to an existing product or can create new consumption pattern.

Examples of Technology-Driven Secular Trends:

- Energy Sector: Horizontal drilling technology enabled exploration of shale gas, resulting in significant decline in long term average price of hydrocarbons

- Photography Industry: Digital cameras made film rolls obsolete; mobile cameras made entry level digital cameras obsolete

- Transportation: Improvement in battery technology is enabling increased use of electric vehicles compared to fossil fuel driven vehicles

- Artificial Intelligence: Automation affecting manufacturing, services, and knowledge work

- Renewable Energy: Solar and wind technology cost reductions disrupting traditional energy

2. Change in income levels

As an economy grows, the disposable income of population is likely to increase. This can cause change in category of goods and services being consumed. People start consuming premium products compared to cheaper alternatives.

Income-Driven Secular Trends:

- Premium food and beverage consumption in emerging markets

- Shift from basic healthcare to wellness and preventive care

- Growth in discretionary spending categories (travel, entertainment)

- Premiumization in consumer durables and automobiles

3. Demographic changes

The composition of a country's population in terms of age, gender and ethnicity may undergo change over a period. This may cause changes in the consumption pattern within the country.

Demographic-Driven Examples:

- Japan: Ageing population has resulted in decrease in per capita consumption of beer

- India: Young demographic driving digital adoption and consumption

- China: One-child policy creating unique consumption patterns

- Global: Urbanization driving infrastructure and services demand

4. Change in culture, and tastes and preferences

Cultural changes are a constant. Most often, they are gradual. However, sometimes changes can also be sudden driven by revolution, insurgencies, or a societal response to a pandemic.

Cultural Change Examples:

- Westernization: Increasing influence of western culture in Asian societies created higher demand for western clothing

- Health Consciousness: Growing awareness driving organic food and fitness industries

- Environmental Awareness: Sustainability concerns affecting consumption patterns

- Digital Lifestyle: Social media and digital platforms changing media consumption

5. Changes in regulation or government policy

Change in regulations, or government actions may also create secular trends in industry.

Policy-Driven Changes:

- GST Implementation: Created efficiencies in logistic industry, reducing demand for new commercial vehicles

- Environmental Regulations: Driving clean energy adoption and affecting traditional industries

- Financial Regulations: Changing banking and fintech landscapes

- Trade Policies: Affecting global supply chains and manufacturing locations

In addition to the above, many other factors may also serve as a catalyst for a secular trend.

When a new secular trend emerges, it causes value migration between industries or between players. And often it also creates an inflection point in the business cycle of one or more affected industries.

6.5.1 Value Migration - Comprehensive Framework

In simple terms, value migration happens when a phenomenon creates long term advantage for one or more entities at the cost of other entities. Thus, the entity that gains witnesses an increase in its shareholder value, while the other entity loses.

Such a shift can happen across geographies, across industries, across the value chain and to a lesser extent between competitors within the industry.

Types of Value Migration

1. Geographic migration

Geographic migration of value happens when a secular trend helps a country or geography as compared to other.

Examples:

- Shale Gas Revolution: Horizontal drilling and shale gas discovery shifted value to US based oil exploration at the cost of other oil producing countries

- Globalization: Helped low cost manufacturers such as China rapidly grow economy compared to high cost destinations

- Technology Hubs: Silicon Valley benefiting from tech concentration effects

- Manufacturing Migration: Production shifting from high-cost to low-cost countries

2. Cross industry migration

Cross industry migration happens when one industry gains at the cost of another.

Examples:

- Digital Photography: Advent of digital cameras resulted in massive decline of film rolls industry and saw big companies like Kodak having to shut down

- Streaming Services: Netflix and OTT platforms gaining at expense of traditional TV and DVD rental

- E-commerce: Online retail gaining market share from traditional brick-and-mortar stores

- Electric Vehicles: EV industry growth affecting traditional automotive and oil industries

3. Migration across value chain

Some phenomenon can result in industries at the down end of value chain gain at the cost of those at the upper end or vice versa.

Example: High competition intensity in the Indian telecommunication space resulted in significant fall in price of mobile services, which in turn led to significant decline in shareholder value for telecom companies. However, this resulted in increased consumption of digital products and thus more traction for digital content providers.

4. Migration across companies in the same industry

Certain disruption may create new competitive advantage for one company or may remove a competitive advantage enjoyed by an existing player.

Example: Before advent of 2G technology, Research in Motion (Blackberry) enjoyed significant competitive advantage among corporate mobile users. Its mobile devices were the most efficient in accessing emails and other internet services. However, with the advent of 2G Technology many new smartphone manufacturers emerged. They were able to provide similar service. This eventually led to decline in shareholder value for Blackberry while its competitors such as Apple saw the value increasing.

Investment Significance: Understanding and pre-empting value migration can help analysts identify suitable investment opportunities ahead of time and to exit from the losing businesses. This requires continuous monitoring of technological, regulatory, and social trends that could disrupt existing industry structures.

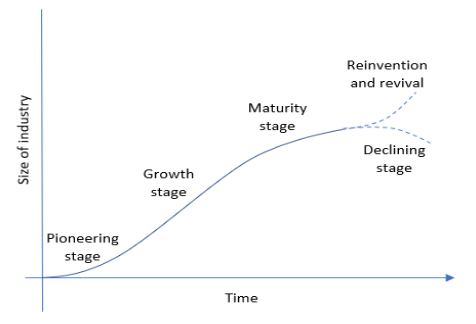

6.5.2 Business life cycle

Business life cycle refers to the various stages through which a business transitions through its journey from its emergence till its eventual decline.

Business Life Cycle Stages

Every industry typically goes through the following phases:

a) Pioneering stage

The industry is just taking shape. It is not widely adopted. The concept is still being proven or just been proven.

Characteristics: High uncertainty, limited players, experimental phase

b) Growth stage

The concept is found viable and many customers start adopting the new product. As more and more customers adopt the product, the industry witness steep growth.

Characteristics: Rapid expansion, new entrants, scaling challenges

c) Matured stage

The industry has existed for long and most customers who can use the product are already using it. Number of new (potential) customers are relatively less.

Characteristics: Stable demand, market saturation, efficiency focus

d) Declining stage

Change in customer preference or a new technology replaces the industry's product with a new product. At this juncture, the industry starts losing out to the alternatives.

Characteristics: Shrinking demand, consolidation, cost management

e) Reinvention and revival

Although it is very rare, it is possible that the goods or services produced by the industry finds a new use in a different application and starts a new cycle all over again.

Characteristics: Innovation-driven, new applications, transformation

Comprehensive Example - Call Taxis in India:

In the Indian context, call taxis can be looked at one example of an industry that has gone through all the phases over a period.

| Phase | Time Period | Key Characteristics | Market Dynamics |

|---|---|---|---|

| Pioneering | Late 1990s - Early 2000s | Phone-based booking, limited operators | Urban metros, premium positioning |

| Growth | 2000s - 2010 | Rapid expansion, increased penetration | Growing consumer income, urbanization |

| Maturity | 2010 - 2012 | Market saturation, competitive pricing | Established player base, stable demand |

| Decline | 2012 onwards | App-based aggregators disruption | Uber, Ola causing significant market share loss |

| Revival (Potential) | Future | Premium/luxury segment focus | Differentiated service offerings |

Every industry goes through the cycle and in turn causes significant displacement in the economy. The labor force working in one industry will have to reskill themselves and move to a new industry or find themselves out of workforce. Similarly, capacity will need to be redirected to a different use.

Important Considerations: Although secular trends can be traced to business lifecycles, there are other disruptors that can affect the secular trend. For example, horizontal drilling technology enabled exploration of shale gas which brought a long-term decline in crude oil prices without causing any displacement of the goods being consumed.

Analyzing and understanding secular trends help the analyst understand the long-term trajectory of the business. However, in order to understand the medium term and short-term trends, analyst will have to focus on cyclical trends.

6.6 Understanding the industry landscape

Industry landscaping involves studying all the players in the industry and their interaction with each other. This includes understanding competitors, customers, suppliers, regulators, and emerging technologies. It also involves studying the differentiating factors between various competitors and customer's preference.

Such a study will help the analyst understand how the industry may react to external market events.

Example: In industries with low competition intensity, companies are likely to be able to transfer any increase in input cost to their customers. Thus, their profit margin is likely to remain intact. On the other hand, if the competition intensity is high, it may create pricing pressure which will likely reduce the profits.

Industry landscaping needs to be very comprehensive. While analysts can use their own frameworks, there are certain established frameworks that can help understand the industry landscape. These include the following:

- Michael Porter's Five Force Model

- PESTLE analysis

- BCG Matrix

- SCP analysis

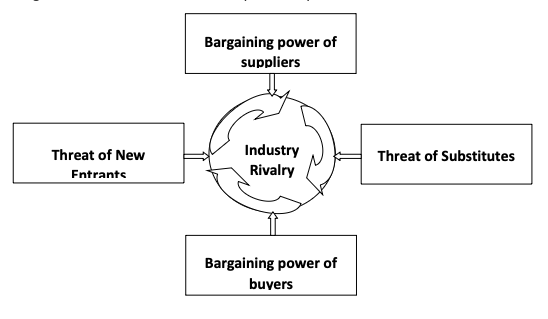

6.6.1 Michael Porter's Five Force Model for Industry Analysis

Analyzing any industry requires looking at it from various angles and finally reaching to a conclusion about its attractiveness as an investment proposition. Market participants use different methods to make this analysis. Among the many methods used for doing such an analysis is the popular Porter's 5 Forces model developed by Dr. Michael Porter in 1979.

As the name suggests, this model analyses any industry on the basis of five broad parameters or forces. These 5 forces are divided into 2 vertical and 3 horizontal ones, as listed below:

Horizontal Forces:

- Threat of Substitutes

- Threat of New Entrants

- Threat of Established Rivals

Vertical Forces:

- Bargaining Power of Suppliers

- Bargaining Power of Customers

Porter's Five Forces Model

Some industries have structure wherein these forces make it very difficult for the businesses to earn significant profits for the owners. For example, either or all or a combination of some of these forces in industries like aviation, telecom, retail, textile, sugar, power, etc. end up keeping profits low for companies in these sectors. Such sectors are termed as unattractive ones by the model from owners' perspective. On the other hand, industries like Education, FMCG, Healthcare and IT enjoy huge margins over long periods of time as the forces are not so strong there. Such sectors are termed as attractive by the model for shareholders.

Two of Warren Buffet's quotes in the context of industry structure are pertinent here:

- "When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact."

- "Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks."

Mr. Buffet, through these two quotes, is clearly indicating that if economics of business is bad, a great management may not be able to bring anything substantial and an investor would be better off shifting his investments to different industry.

Now, let us look at each of these five forces of Dr. Porter's model in detail:

6.6.1.1 Industry Rivalry

An industry where rivalry is high, like the aviation and telecom space, the end result will be lower pricing power and lower incomes for the industry participants. Innovation in products and customer service and engagement initiatives become essential in such an industry. A strong competitor with deep pockets can easily adopt the tactics such as continuously dumping products/services at prices lower than the cost to drive others out of the industry. Not everyone can sustain losses for long period.

Intensity of rivalry can be understood from following simple industry characteristics. It would be high if:

- Many companies exist in the business segment

- Similar products/services being offered by participants with little or no differentiation

- Every industry participant tries to attract customers with similar strategies – lower prices or longer credits

- Switching cost for customers from one product/service to another is low or nil

If industry rivalry is strong, businesses in the industry will go through frequent phases of low revenues and profitability. The telecom industry in India is a case to point where a number of players in each telecom circle try to garner market share by offering competitive plans. The high pre-paid component in the revenue of all telecom players means that the price sensitive subscribers would easily migrate to lower priced offerings of competitors.

It is relevant to quote Mr. Charlie Munger, partner at Berkshire Hathaway here: "If only basis of competition in an industry is pricing, it is a self-defeating business."

So, how can a company, in a competition intensive industry still deliver good returns to its shareholders?

Answer lies in aggressive innovation internally as well as externally. Better and efficient operations resulting in lesser working capital requirement, faster turnaround times, lesser cost of capital are some of the things which the company has to do internally. On the external side, launching differentiating products, creating and nurturing strong brands, positioning its products/ services uniquely are what the company can do to break-out of the clutter.

Example: Micromax, a cellular device company in India, managed to garner a 10% market share in just three years of launch by focusing on special features at competitive prices.

6.6.1.2 Threat of Substitutes

Industries go through significant changes from time to time. Telegram does not exist anymore as Short Messaging Service (SMS) emerged as cheaper and easier alternative with significant accessibility. Cement pipes industry lost its relevance to steel and plastic pipes. Typewriters got substituted by computers totally. IPods, mobiles etc. have rendered radio and two-in-ones a thing of the past.

The most famous example: Digital photography completely destroyed the film-based model followed by Kodak. While first digital camera was invented by Kodak engineers, to protect their existing business, the company did not move to that. As innovations happen, existing products become irrelevant. This is called threat of substitutes. The ability of an industry and company to foresee changes and to adapt to them early, will define their success. Unfortunately, Kodak did not see the threat, and subsequently filed for bankruptcy.

Some industries are not able to face the threat of substitutes and fail, while others reinvent themselves to stay relevant. Also, some industries do not have threat of substitutes at all. For example, power, healthcare, education etc. There could be different modes of servicing customers at different times but these products/services will never be out of business.

Threat of substitutes can be understood from following two simple industry characteristics. It would be high if:

- Substitutes offer equal or better experience to customers – quality, price, ease etc.

- Switching cost for customers from one product/service to another is low or nil

Sometimes, substitutes may take long time to replace the existing businesses. For example, solar products, while are cheaper at operating level, need capex to begin with and that becomes deterrent for customers. So is the case with LED lights. As technology evolves and new products become cheaper, more and more customers shift to them posing higher threat to the existence of traditional businesses.

6.6.1.3 Bargaining Power of Buyers

Buyers can exert a lot of pressure and dictate prices, if there are a large number of sellers with similar products/services. On the contrary, they may not be such a big influencer in case there are few sellers for a product/service. In nutshell, it is the function of number of buyers and sellers and differentiation in their products/services, which may determine buyers' bargaining power in an industry. The size and profile of the buyer, for example, the government as a buyer of the product or service, can influence the bargaining power they have.

Buyers' bargaining power can be understood from following simple industry characteristics. It would be high if:

- Competitive intensity in the industry is strong (continuous pricing pressure would exist on industry participants).

- Products/Services are standardized with little or no differentiation.

- Close substitutes of the products/services exist and switching cost for customers is low or nil.

6.6.1.4 Bargaining Power of Suppliers

A consumer will rarely bargain over the fees charged by hospitals or schools? But the same consumer will bargain with the vegetable or fruits vender all the time. In the first case, the bargaining power of suppliers is absolute and in the second case, bargaining power of suppliers is nil (until he/she is the only vendor and close substitute is pretty far).

The sugar industry, especially in the Indian context, is totally dependent upon the price which is decided by the government after considering the views of the sugarcane farmers. So, the input cost of the raw material depends upon the price which the suppliers demand. In this case, suppliers have a strong bargaining power. Similarly, supplies of the essential commodity, crude oil is virtually controlled by a few Organizations of the Petroleum Exporting Countries (OPEC) through adjustment of the outputs to maintain the price levels, they desire. In a sense, we may say OPEC has pricing power on oil.

Suppliers' bargaining power can be understood from following simple industry characteristics. It would be high if:

- The number of suppliers is limited and buyers are many

- Suppliers supply some critical inputs to buyers

- Competitive intensity in the industry is low with differentiation in products and services.

- Products/services do not have threat of substitutes

- Switching cost for the customers is high

6.6.1.5 Barriers to entry (Threat of new entrants)

An industry which does not face the threat of new competitors coming in would be an attractive industry for investors/owners. There could be several barriers to entry for new entrants in a business - licensing, required competence/skills (IT products), capital (oil and gas), distribution reach (banking and finance), brand loyalty of customers with the existing participants (toothpaste, coffee markets) etc. etc.

This is what Warren Buffet calls as 'the moat'; he says "In business, I look for economic castles protected by unbreachable 'moats'." This essentially means he looks for businesses with high entry barriers. Such businesses will have pricing power viz. can sell the products at a premium without fear of losing customers.

Entry barriers in an industry can be understood from following simple industry characteristics. They would be high if:

- There are lots of licensing required in the business

- Patents and copyrights prevent new entrants

- Huge investments in specialized assets pose a challenge

- Strong Brands, strong distribution network, specialized execution capabilities, customers loyalty with existing products/services exist in the business

🏭 Analyze Industries with Porter's Five Forces Framework

You've just learned Porter's Five Forces model. Now apply this framework to real sectors using our professional industry analysis tools!

🎯 Sector Competitive Analysis

Apply Porter's Five Forces to live sectors:

- Industry Rivalry assessment

- Threat of Substitutes evaluation

- Buyer/Supplier Power analysis

- Entry Barriers identification

📊 Sector Performance Dashboard

Track real industry metrics mentioned in NISM:

- Sector-wise performance rankings

- Industry P/E ratios comparison

- Market Share dynamics

- Growth Trends analysis

Warren Buffett's Approach: Use these tools to find companies with strong "economic moats" as taught in NISM!

Attractive Industry from Shareholders' Perspective

Based on the above discussion, attractive Industry from shareholders' perspective is one that has one or more the following salient features that create a profitable atmosphere for the business:

- Low competition

- High barriers to entry

- Weak suppliers' bargaining power

- Weak buyers' bargaining power

- Few substitutes

If an industry is having these features, it would have strong pricing power and high profit margins and attract investors.

Example - Education Industry in India:

Education is an industry in India where there is ample demand (and continuously increasing) and very little bargaining power of the students (buyers of the service). The industry is by and large protected from recession. Starting an educational institute requires multiple permissions (high entry barriers) and quality institutions are a few (low competition). Teaching staff is hired at salaries decided by the management of the institute (weak suppliers' bargaining power). Competing courses though may be available, but do not generate enough confidence amongst students (few substitutes). Thus, education industry can be said to be an example of an attractive industry.

6.6.2 Political, Economic, Socio-cultural, Technological, Legal and Environmental (PESTLE) Analysis

PESTLE Analysis stands for Political, Economic, Socio-cultural, Technological, Legal and Environmental Analysis. Some models also extend this to include Ethics and Demographics, thus modifying the acronym to STEEPLED. This analysis is done more from the perspective of a business which is looking to setup unit offshore and analysing several countries to choose from. This model primarily analyses the external environmental factors that will act as influencers for a business.

To do business in any country, a business must know each of the above factors very well and how changes in any/either of these would impact business. Let us see each one of these individually in brief here.

Political Factors

Countries can have a variety of political structures. Communist countries would have social objectives above anything else while capitalist ones would not necessarily have all responsibilities of a welfare state. Further, capitalists also exhibit differences amongst themselves in terms of their approach to the social welfare schemes.

Stability in legislation and policy, minimal corruption, bureaucracy, communal tensions and violence coupled with maximum freedom of press, ease of doing business and quick turnaround time are some of the factors which investors would look at in a country. Healthy public finances and a consistent fiscal policy furthering investment in infrastructure are some other important parameters for investors.

Economic Factors

The economic parameters of a country such as GDP growth and its contributors, inflation and interest rates, composition of imports and exports, balance of payment and exchange rate stability, stable monetary and fiscal situation, well developed financial markets, taxation and others, will define its attractiveness as an investment destination.

Whether a country depends upon exports or internal consumption, whether this internal consumption is driven by imports or domestic manufacturing, whether the country has high inflation and hence a falling currency etc. are some of the first questions which an investor will think before investing in any country. Country's dependence on other countries in terms of important natural resources such as oil, monitory policies of the Central Banker, Balance of payment positions and forex reserves etc. are very important for an investor to get a comfort level about a country's economic situation. India has seen the worst and the best phases of economies in the last three decades.

Socio-Cultural Factors

The social and cultural aspects of the population of the country, such as the demographic profile in terms of age, education and skills, health, social values, lifestyle factors, all affect the choices that people make in what they buy and consume. Cultures affect businesses in multiple ways.

With young population in India, India offers different opportunities and challenges in comparison to say Japan with aging population. With the change in culture, there is a change in the economic activity as well. For example, given nuclear families and working spouses in metro cities in India, there has been an increase in demand for day cares facilities, packaged foods and hotel chains/restaurants. Competitive pressures at the young generation are also resulting in life style diseases such as diabetes, sugar, hyper tension etc. This offers opportunity set for several new businesses in the country.

Technological Factors

No dimension of life can ever be imagined today without technological support. Technology is playing crucial role in taking businesses and society to the next level. Development of a scientific temper amongst students leads to an ever technologically evolving society. Countries pushing R&D activities are bound to be at the forefront of technology. Availability of technology savvy population and institutions driving technology based initiatives and infrastructure help a country attract investors.

Legal Factors

Legal architecture of the country and ability of legal system to support and protect businesses is what businesses look for in a country. Consistency of legal aspects and no arbitrary changes give comfort to the businesses and investors both.

In India, recently the Vodafone retrospective tax case and also the cancellation of telecom licenses and mining licenses etc. have been examples of discomfort to the investing community.

Transparency in the legal environment and enforcement of laws are things which investors would favour.

Environmental Factors

Developing nations are generally bound to emit environment harming gases in the atmosphere. A country's awareness of environmental issues and the policies relating to pollution control, waste disposal, mining and protection of natural flora and fauna, rehabilitation of displaced local residents, are all thorny issues, which if not clearly spelt out unambiguously can lead to operational and legal issues in the future and ultimately loss of time, money and resource for a business. Investors look for clear polices of government on these issues.

As the government pushes for India to become a manufacturing hub, environmental issues are creeping up and these are acting as one of the deterrents for investors ready to enter India.

Important Note: Not all the factors referred to above affect all companies equally. Evaluating the impact of each factor and its criticality for the business is an important step to follow.

6.6.3 Boston Consulting Group (BCG) Analysis

While models such as Porter's and PESTLE are used to analyse the industries and economies, the BCG Analysis, developed by the Boston Consulting Group, looks at different segments of a business unit at portfolio basis through the lenses of market growth and cash generation.

BCG created a matrix based on sensitivity of growth and cash generation. As per the matrix, business segments can be classified as:

Stars

These are segments in a business where market is growing rapidly and company is having a large market share. This segment generates increasing cash for the business with the passage of time.

Cera Sanitaryware could be a good example of "star" with large market share, continuous growth and significant cash generation.

Cash Cows

These are segments which require low cash infusion for investment to maintain market shares because of low growth prospects but at the same time steadily generate cash for the company from the established market share.

Navneet Publications, which is into the business of books and notebooks, could be a good example of "cash cow". The industry grows at a predictable and steady rate each year. With strong brand name, well penetrated distribution channel, ready market, and strong balance sheet, all that the company needs to do is change the content every time some syllabus changes and reap the benefits in the form of steady cash flows. Colgate is another example of the cash cow.

Question Marks

Business segments in a fast growing market, but having low market share. The right strategies and investments can help the market share of the business grow, but they also run the risk of consuming cash in the process of increasing market share and in the end turning out to be not enough cash generating.

Tata Nano can be considered as an example of a question mark, which did not succeed; whereas, Bajaj Pulsar may be considered as an example of a question mark product which succeeded.

Dogs

Business segments, which have slow growth rates and intensive competitive dynamics which lead to low generation of cash are categorized as Dogs.

Strategy: Typically divested or managed for cash flow in declining markets.

BCG matrix provides interesting sense of the businesses/segments in terms of their attractiveness for the investors.

6.6.4 Structure Conduct Performance (SCP) Analysis

Another method of analysing industries is to look at the industry structure (monopoly, oligopoly), its conduct (commoditized or specialized, seasonal or round the year, cyclical or non-cyclical etc.) and finally its performance (RoE, RoIC, WACC, etc.). Structure, Conduct, Performance (SCP) analysis approaches the industry evaluation exactly with this categorization.

SCP analysis may be seen as extension of Porter's model where probably first two points structure and conduct were captured. Under SCP model, one also goes into the financial dimension of industry from analysis perspective. Basic elements of SCP analysis are captured below in brief:

Structure analysis

Industry structure refers to the competitive intensity in the industry (number of players), concentration of business in industry, relationship among the various players, market size, its growth rate, etc. In this section, analysts study:

- How many players exist in the industry;

- Is there domination of few players in the industry;

- How is business scattered between organized and unorganized players;

- Are there any threats from substitute products;

- How are equations between suppliers and buyers; and

- Is there backward/forward integration already in existence or a possibility in future.

Thus, very broadly coverage of analysts in this section overlaps with what we study as part of Porter's 5 Forces model and the SWOT Analysis model.

Conduct analysis

The structure of the industry, as described above, will define the conduct of the businesses on aspects such as pricing and product innovation. Each industry will have its peculiar behaviour. Umbrellas and raincoats would be seasonal businesses and FMCG and Pharma would be round-the-year ones. High interest rates may deter people from purchasing real estate and 4 wheelers, but 2-wheelers may not be impacted that much. Mining business may be commoditized but FMCG and white goods may be sold purely based on power of brands.

So, while looking for an industry's conduct, analysts have to study several factors such as:

- Is business cyclical in nature

- If business is cyclical, what are the factors affecting the business – commodity prices, interest rates, currency prices or some other global factors

- Is it a highly specialized business which requires skilled labour or it is a low skill based industry

- For skilled based business, is there enough talent available

- How customers choose the products/services

- How will technological changes affect this business

- Is business heavily dependent on government policies

Performance analysis

Based on structure and conduct of the industry, industry would generate financials for the investors/owners. Businesses with High return on capital/equity are the ones which create wealth for shareholders/owners in the long run. While analysing performance of an industry, analysts will look at several numerical ratios, which are dealt with in great detail in the unit on quantitative analysis.

6.7 Key Industry Drivers and Industry KPIs

When studying an industry to identify trends or while preparing an industry landscape, it is always important to focus on the key performance indicator (KPIs) for the industries.

The key performance indicator varies industry to industry and a metric that is suitable to analyse one industry may not be suitable for other industries.

Example: A metric such as revenue per employee is likely to be very useful in analysing a service provider such as a BPO —as the industry is labour driven and their billing is generally based on the head count assigned on a contract. However, the same metric is far less valuable for manufacturing industries, which are capital intensive.

Most often, analysts are guided by the companies in the industry in terms of identifying the KPIs. Reading annual report and the management discussions of a company can certainly help analysts understand what the industry players consider as KPIs for the relevant firms.

In addition, an analyst can be guided by two other factors:

- Unit of pricing

- Key constraining factors

6.7.1 Unit of pricing

Unit of pricing essentially refers to what a company considers as unit while pricing a product. It is far simpler in the case of manufacturing industries as the unit of pricing is the number of goods sold. However, it can be very challenging in the case of service sector.

In the case of a café like Star Bucks, it may appear that the unit of pricing is the quantity of beverage sold. However, in substance, their pricing is more likely to be driven by the consideration of how much they expect to earn from one patron rather than based on quantity of beverage sold.

6.7.2 Key constraining factors

Another important factor to consider while deciding on the KPIs is the key constraining factors for the industry. At times, these constraints may vary within an industry. Further, these constraints may also gradually change over a period of time as the industry evolves.

Broadly speaking, the constraints can be broken into three categories:

- Demand side constraints

- Supply side constraints

- Regulatory constraints

Since a company's performance is dependent on how it handles these constraints, analysts should look at KPIs that reflect these constraints.

If an industry has limited market size (driven by limitations in number of target customers) then industry penetration rate will be a key factor to look at. On the other hand, if an industry is constrained by capacity constraints, then capacity utilisation rate will be an important metric to track. If regulatory constraints exist, then it might be prudent to track metrics followed by regulators.

6.7.3 KPIs for select industries

Airlines and other transportation and logistics

In this sector, the pricing is driven by quantity of passengers / cargo carried and the distance it is carried. In terms of constraints, their ability to provide service significantly depend on the amount of capacity they hold.

Important KPIs:

- Passenger/cargo kilo meter (km) - Bundled metric: passengers/cargo × distance travelled

- Price per passenger/cargo km - Revenue realization metric

- Capacity and utilisation rate / occupancy rate - Efficiency measures

- Load factor - Percentage of available capacity utilized

- Yield management - Revenue optimization metrics

Automobiles and capital goods

In this sector, the unit of pricing is typically the quantity of goods sold and one of the key internal constraining factors for sales is their capacity.

Important KPIs:

- Volume and volume growth - Units sold and growth rates

- Average realisations and their growth - Price per unit trends

- Capacity and capacity utilisation rate - Production efficiency

- Market share - Competitive positioning

- Order book - Future revenue visibility

Commercial bank and NBFC

For the banks, the unit of pricing is the value of loan and the price is denoted as interest rates. Lending money and recovering the same back with a healthy interest rate that is well above its cost of funds is an important KPI. In terms of constraints, their ability to lend depends on the amount of deposits and the amount of the regulatory capital they hold and the mandated liquid assets they need to hold. On the external front, the business is affected by the overall flow of liquidity in the market.

Important KPIs:

- Net interest margin - Profitability measure

- Capital adequacy ratios - Regulatory compliance and risk management

- NPA ratio - Asset quality indicator

- Growth rates in deposits and loans - Business expansion metrics

- Cash reserve ratio and statutory liquidity reserve ratio - Regulatory requirements

- CASA ratio - Low-cost funding indicator

- Return on Assets (ROA) and Return on Equity (ROE) - Efficiency measures

Note: Since the cost of funding for banks depend heavily on central bank policy rates, it is also extremely important to track that.

Consumer goods

In the case of consumer goods including consumer staples and consumer discretionary, the unit of pricing is generally the quantity of goods sold.

Important KPIs:

- Volume and its growth - Unit sales performance

- Average price and its growth - Price realization trends

- Market share - Competitive position

- Brand equity metrics - Consumer preference indicators

- Distribution reach - Market penetration

Note: In consumer durables, capacity can become constraint especially during the period of high growth. Hence, it may be appropriate to track capacity and utilisation rate as well.

IT services/ BPO/ KPO

In this sector, the pricing is typically based on the number of headcounts who are assigned per project per month (often referred as full time equivalent or FTE per month). Since it is a labour driven industry, one of their key constraints is the availability of work force. Although labour force for the sector is available in abundance in India, during period of high growth it can become a constraint. Further, since the sector is largely export oriented, their realisations are heavily impacted by the foreign currency fluctuation. Further, some of the companies in the industry are heavily reliant on a handful of customers, which, one hand gives a steady stream of revenue while on the other creates high customer concentration ratio.

Important KPIs:

- Average no. of FTEs billed - Utilization measure

- Average revenue per FTE - Productivity indicator

- Bench strength (spare capacity) and attrition rates - Resource management

- Constant currency growth rates - True business growth excluding forex impact

- Customer concentration ratio and number of "million dollar" customers - Revenue diversification

- Visa dependency ratio - Operational risk indicator

- Digital revenue percentage - Technology transformation indicator

Media

The media industry includes: (i) print medium, (ii) Television and radio, and (iii) online medium. Revenue for the media industry comes from two sources: (i) payments by users and (ii) advertisement revenue. However, majority of their revenue is earned through advertisement.

In print media, the unit of pricing is based on the amount of real estate space occupied in the paper while in television and radio, the unit of pricing is the amount of airtime of the advertisement. Since there is real limitation in terms of the amount of airtime or real estate space that can be allocated to advertisement, their ability to grow largely depends on attracting larger audience so that they can charge higher price from the advertisers. This, in turn, depends on their ability to acquire good quality content at reasonable price.

In online media, the unit of pricing is directly based on the number of views / clicks per advertisement.

Important KPIs:

- Readership / viewership (TRPs) / number of site visitors - Audience metrics

- Average ad realisation per unit - Monetization efficiency

- Content acquisition cost - Investment in programming

- Subscription revenue growth - Direct revenue streams

- Digital transformation metrics - Online engagement indicators

Retail

Organised retailers sell variety of products. Each of these individual products will have different units of pricing. Further, since the business is "trading" in nature, they can quickly shift the products they retail based on market demands. Therefore, the unit of pricing is far less relevant. However, in terms of constraints, their business growth heavily depends on expanding their store network in localities where they can generate healthy sales.

Important KPIs:

- No. of stores - Physical expansion metric

- Same stores' sales growth - Organic growth indicator

- Revenue per square foot - Space productivity

- Inventory turnover - Working capital efficiency

- Online vs offline sales mix - Channel performance

Telecommunication / Internet service providers

In India, till a few years ago, telecommunication providers charged customers based on the number of calls, messages and data that were used. Over the past few years, this model has eventually changed, and more and more subscribers are getting charged a fixed monthly rental. However, regardless of the billing model, from an analytical perspective, a subscriber is considered as the unit of pricing and companies try to increase their subscriber base while trying to upsell their services to existing subscribers.

In terms of constraints, the biggest constraint for the industry is the limited market size as the number of subscribers is limited by the population in the geography they serve. At individual service provider level, they also must ensure that they win over competition to acquire and retain a customer.

Important KPIs:

- Average revenue per user (ARPU) - Revenue per subscriber

- Subscriber churn rate - Customer retention

- Cost of subscriber acquisition - Customer acquisition efficiency

- Market share - Competitive position

- Network coverage and quality metrics - Service quality indicators

- Data usage per subscriber - Service consumption patterns

6.8 Regulatory environment/framework

Industry analysis cannot be complete without adequate knowledge of the rules of the game. Even small changes in regulatory framework can have big impact on the businesses.

Examples of Regulatory Impact:

- FDI in Multi-brand Retail: Discussions around backend infrastructure investment requirements, vendor sourcing mandates

- Environmental Policies: Mine closures affecting businesses drastically

- Telecom License Cancellations: Major business disruptions in telecommunications

- Companies Act Amendments: Changed entire business landscape in India

- Data Protection Laws: Impact on digital businesses and data processing companies

- Banking Regulations: Capital adequacy norms affecting lending capabilities

Key Regulatory Considerations for Industry Analysis:

- Entry barriers: Licensing requirements, approval processes

- Operational constraints: Compliance costs, operational restrictions

- Pricing regulation: Price controls, subsidy mechanisms

- Competition regulation: Anti-trust laws, market concentration limits

- Environmental compliance: Pollution control, sustainability requirements

- Labor regulations: Employment laws, worker protection norms

Therefore, analysts should pay enough attention to the regulatory aspects of businesses.

6.9 Taxation

Taxes are tools that a government uses to earn income which can be used to meet its expenses. However, governments also use taxes as a tool to encourage or discourage certain businesses.

Examples of Tax Policy Impact:

- Kerala Fat Tax (2017): 14.5% additional tax on junk foods to discourage junk food industry

- GST Structure in India: Multiple slabs - essential products have no/lower GST, luxury products have higher GST rates

- Research & Development Incentives: Tax benefits for R&D expenditure promoting innovation

- Green Energy Incentives: Tax breaks for renewable energy investments

Broadly, taxes charged by government can be classified into two categories:

- Direct taxes

- Indirect taxes

6.9.1 Direct Taxes

Direct taxes refer to taxes where the incidence of the tax and liability for the tax are on the same person. In other words, the person who has to bear the tax is also the one who is obliged to pay the tax to the government.

The most common form of direct tax is the income tax. Every individual and business has to pay a particular rate of tax on the profits they earn. Tax laws prescribe how and when income and expenses should be recognized. Although most often these are driven by nature of income and expense, in many cases these are also driven by considerations on the business practice that government wants to encourage or discourage.

Examples of Tax Policy Tools:

- R&D Promotion: Companies allowed to claim 1.5 times actual expenditure on scientific research as expense

- Discouraging Delays: Interest to banks deductible only when actually paid (not when accrued)

These adjustments often result in difference between the profits shown for external reporting purpose and for tax purpose.

Since government use direct tax also as a tool for promoting or discouraging certain activities, tracking the developments is very critical to understand their impact on the industry's growth.

Components of Corporate Income Taxes in India

Corporate income taxes, in India, have four components:

- Income tax

- MAT (Minimum Alternate Tax)

- Surcharge

- Cess

| Tax Component | Rate | Base | Purpose |

|---|---|---|---|

| Income Tax | 25-30% | Taxable Profit | Primary corporate tax |

| MAT | 18.5% | Book Profit | Minimum tax ensure |

| Surcharge | 0-12% | Income Tax/MAT | Additional central revenue |

| Cess | 4% | Tax + Surcharge | Specific purpose funding |

Income tax: Indian companies are required to pay 30% (25% in case total turnover was below Rs 400 crores in a financial year) of their taxable profit as income tax to the government. However, the act allows companies to choose alternative schemes of taxation under which they can pay a reduced tax rate if they forego certain benefits (in terms of expense deduction) available in the Income Tax Act. Such rates vary from 15% to 25% depending upon when the company was established and what scheme they opt.

Minimum Alternate Tax (MAT): If the income tax payable by the company on its profits is less than 18.5% of the book profits, then the company will have to pay 18.5% of book profits to the government. However, any excess tax paid in such form can be availed as MAT credit to set-off future tax obligation (to the extent it exceeds MAT in the relevant year).

Surcharge: Surcharge is a tax on tax. In terms of income tax, the central government shares the revenue with the state governments in which the companies are located. However, in terms of surcharge the entire tax revenue goes to the central government funds and it is not shared with the state governments. These are charged at a rate on the income tax/MAT paid and may be altered every year. For assessment year 2020-21, which pertains to financial year 2019-20, the rate of surcharge is 12% of taxes payable if the profit is above Rs.10 crores. The same will be levied at 7% if the profit is between Rs.1 crore to Rs.10 crores and nil if profits are below Rs.1 crore.

Cess: It is an additional levy that is charged on the taxes plus surcharge. Cess is meant to be used for specific purpose for which it is levied. For example, an education cess can only be used by the government towards education related expenditure. For assessment year 2020-21, the government levies a total cess of 4% that is meant for health and education.

6.9.2 Indirect taxes

Indirect taxes are those taxes where the person bearing the tax is different from the person liable to collect such tax and transfer to the government. Goods and Service Tax (GST) is one example of an indirect tax. The tax is levied on the seller of the goods. However, the seller collects the money from the customer and deposits it into the account of the government. Therefore, it is the end consumer who bears the tax.

India has various indirect taxes. However, in order to combine these taxes, government brought in GST and removed other taxes. However, some products (fossil fuels and liquor) and activities (imports) are still covered under the old system.

Types of Indirect Taxes

Goods and service tax: Goods and service tax is a tax that is charged at the time of sale of goods or services. These are calculated as a percentage of the invoice value and sellers charge this to the customer. Sellers then remit this amount to the government. In order to avoid double taxation, sellers are allowed tax credit (i.e., deduct) the GST they paid to their suppliers and they only have to remit the balance to the government.

Most goods and services are charged GST at 18%. However, the GST rates vary from 0% to 28% for different categories of goods and services.

Excise duty: Excise duty is tax on production. With the introduction of GST, excise duty has been removed for most of the goods. However, excise duty is still applied on liquor, petrol and diesel as these products do not come under GST.

Value Added Tax (VAT): Value added tax is levied on sale of products. These are charged by the state governments. Similar to excise duty, these taxes are currently applicable only for liquor, petrol and diesel.

Customs duty: Customs duty is a tax that is levied on imported products. The rate of customs duty varies based on the product that is imported.

6.9.3 Other taxes

Road tax: Road tax is paid by the purchasers of new automobiles. These are lifetime taxes paid upfront. This tax increases the acquisition cost of automobiles and thus impacts automobile sales, and in turn, other downstream industries such as auto-ancillaries, and general insurance firms offering vehicle insurance, etc.

Stamp duty: Stamp duty is payable whenever any document needs to be registered. These are largely required at the time of purchase or sale of asset. Since this is an upfront cost, it increases the cost of acquisition of asset (for the buyer) or realisable value of assets (for the seller). Change in stamp duty affects the real estate industry and investment management firms including stock broking firms and asset management companies.

Security transaction tax (STT): Security transaction tax is paid at the time of sale of securities. Since it reduces the realisable value of security sales, it discourages short-term trading. Thus, this affects stock traders and in turn stock broking firms.

6.10 Sources of information for industry analysis

There are several sources of information on industry. Reliable data sources are crucial for accurate industry analysis. Some of them are stated below:

Primary Sources (Direct Industry Data)

- Annual Reports of companies in the Industry – 'Management Discussion and Analysis' section provides detailed industry insights

- Company investor presentations and conference calls – Management commentary on industry trends

- Industry associations/Trade Bodies publications – Sector-specific research and statistics

- Relevant ministry websites/publications – Government policy and regulatory updates

- Central Bank publications – Monetary policy and economic sector analysis

Secondary Sources (Research and Analysis)

- Industry reports from research houses – Credit rating agencies, investment banks, consulting firms

- Industry journals and trade publications – Specialized sector-focused content

- Business media reports – News analysis and investigative reporting

- Academic research papers – In-depth analytical studies

- International organization reports – World Bank, IMF, OECD industry studies

Statistical and Database Sources

- Central Statistical Office (CSO) data – National Industrial Classification and production statistics

- Sector-specific regulatory body data – SEBI, RBI, TRAI, CERC, etc.

- Stock exchange databases – Listed company financial data and filings

- International databases – Bloomberg, Thomson Reuters, FactSet

- Government economic surveys – Annual economic survey and budget documents

Criteria for Evaluating Source Reliability:

- Data accuracy and methodology: Clear explanation of data collection and processing methods

- Update frequency: Regular and timely data updates

- Source credibility: Reputation and track record of the data provider

- Transparency: Disclosure of assumptions, limitations, and potential biases

- Consistency: Data consistency across time periods and with other reliable sources

- Relevance: Alignment with specific industry analysis requirements

Sample Questions for Self-Assessment

1. The tyre industry in a country comprised of three organised players and several unorganised players. A sample survey revealed that around 20% of total sales came from unorganised sector. The three major companies reported revenue of Rs 6,000 crore, Rs 8,000 crore and Rs 10,000 crore, respectively, for the year 2019. Which of the following is closest to the fair estimate of overall size of tyre market in that country for the year 2019?

a. Rs 48,000 crore

b. Rs 24,000 crore

c. Rs 30,000 crore

d. Rs 36,000 crore

Calculation: Total organized = Rs 24,000 crore (6000+8000+10000). If organized = 80%, then total market = 24000/0.8 = Rs 30,000 crore

2. An industry where rivalry is high, the end result will be _____ pricing power and ______ incomes for the industry participants.

a. Lower; higher

b. Lower; lower

c. Higher; higher

d. Higher; lower

3. Who can exert a lot of pressure and dictate prices, if there are a large number of sellers with similar products/services?

a. Sellers

b. Consumers

c. Producers

d. None of the above

4. Which of the following is considered as an economic factor in PESTLE analysis?

a. Forex reserves

b. Monetary policies of the RBI

c. Country's dependence on other countries in terms of important natural resources

d. All of the given options

5. What does Industry structure in Structure Conduct Performance (SCP) analysis refer to?

a. Industry Growth rate

b. Relationship among the various players in the industry

c. Market size

d. All of the given options

Answer Key: 1-c, 2-b, 3-b, 4-d, 5-d

These questions test your understanding of market sizing methodologies, Porter's Five Forces, and various industry analysis frameworks covered in this chapter.

Chapter Summary

This chapter provides a comprehensive framework for industry analysis, covering definition challenges, cyclicality assessment, market sizing methodologies, secular trends analysis, and various analytical frameworks. Understanding these concepts is essential for effective fundamental analysis and investment decision-making in the context of NISM Research Analyst Certification.

End of Chapter 6 - Industry Analysis