Multimedia Learning Hub

Master financial ratio analysis through video, audio deep dive, comprehensive overview, and interactive knowledge testing

Complete Learning Path

This comprehensive guide teaches you to analyze any stock using calculated ratios and the DuPont framework. You'll learn to distinguish between companies earning genuine returns and those artificially inflating their ROE through dangerous levels of debt.

What You'll Learn:

- The Zombie Test: How to identify companies that are borrowing time, not building value

- Solvency Analysis: Interest Coverage, Debt-to-Equity, and survival metrics

- Profitability Paradox: Why EBITDA can mislead and Net Profit reveals the truth

- Efficiency Metrics: Asset turnover and the velocity of money concept

- DuPont Decomposition: Breaking ROE into Margin x Turnover x Leverage

- The Leverage Trap: How debt creates illusions of great returns

- Quality Compounder Profile: What sustainable, low-risk growth looks like

Real Companies Analyzed:

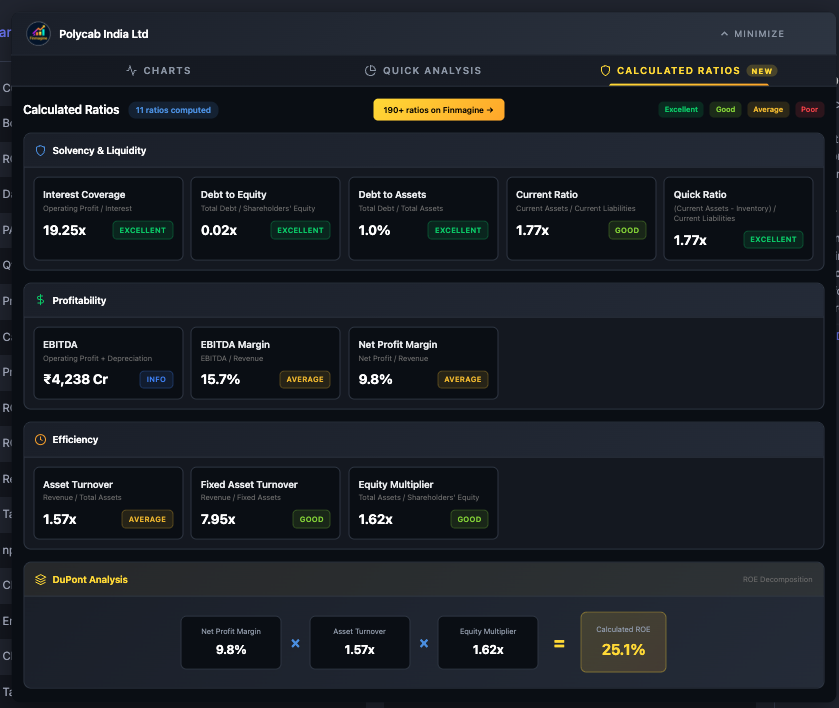

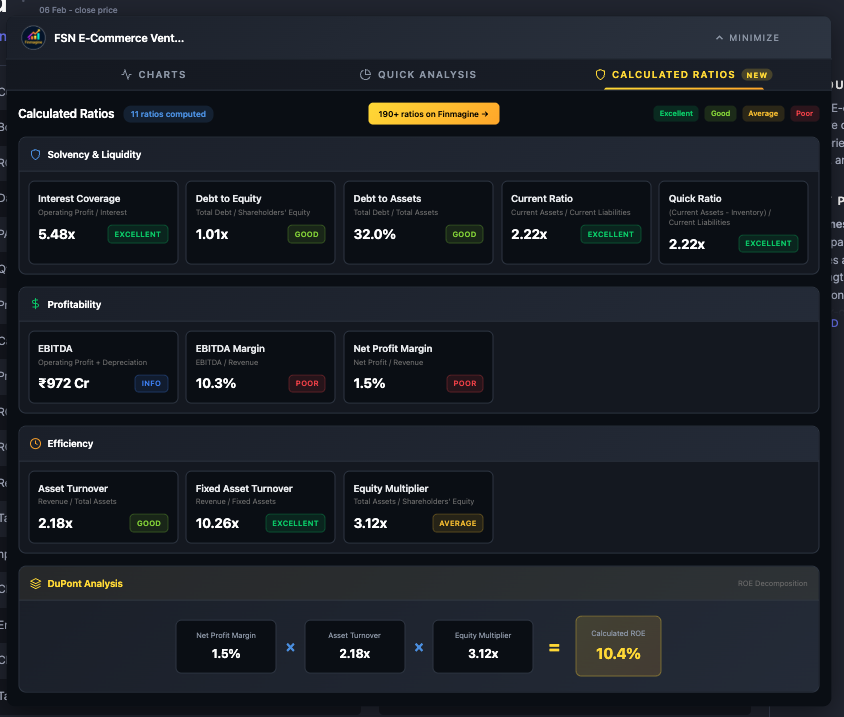

- Polycab: The quality compounder with 25% ROE on low leverage

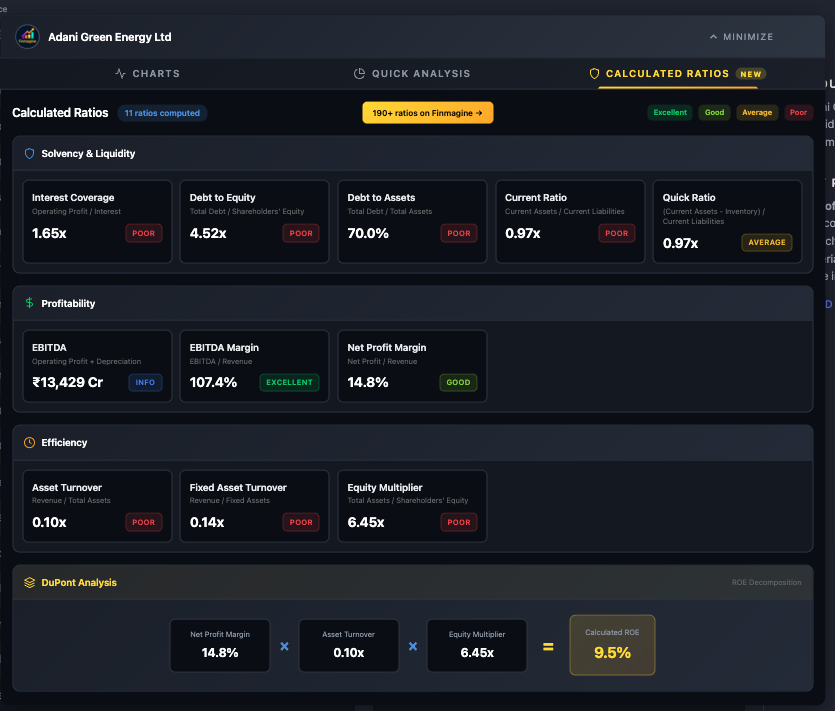

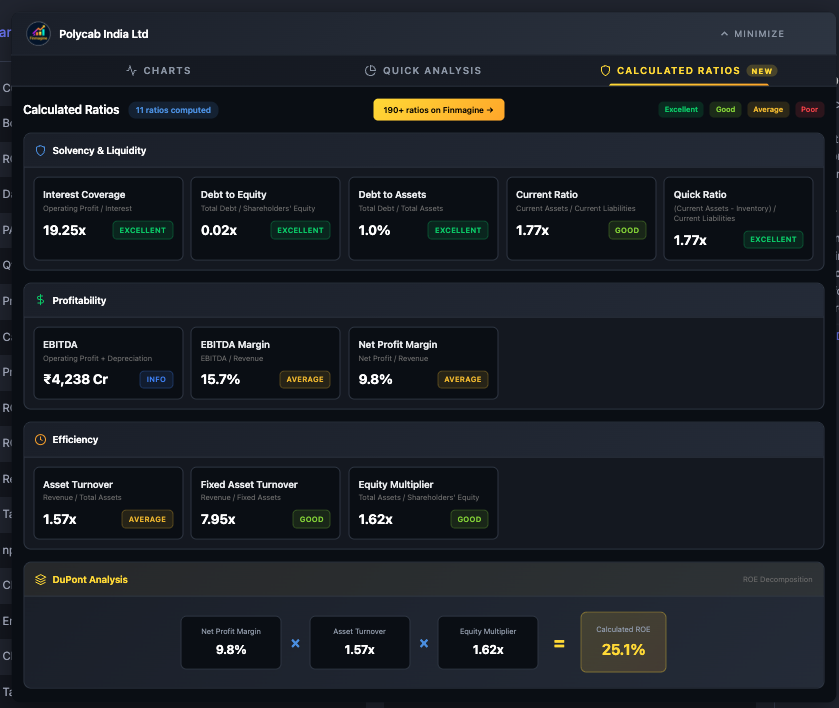

- Adani Green: High debt, 4.52x D/E, leveraged growth profile

- IndiGo: 38% ROE driven by massive 15x equity multiplier

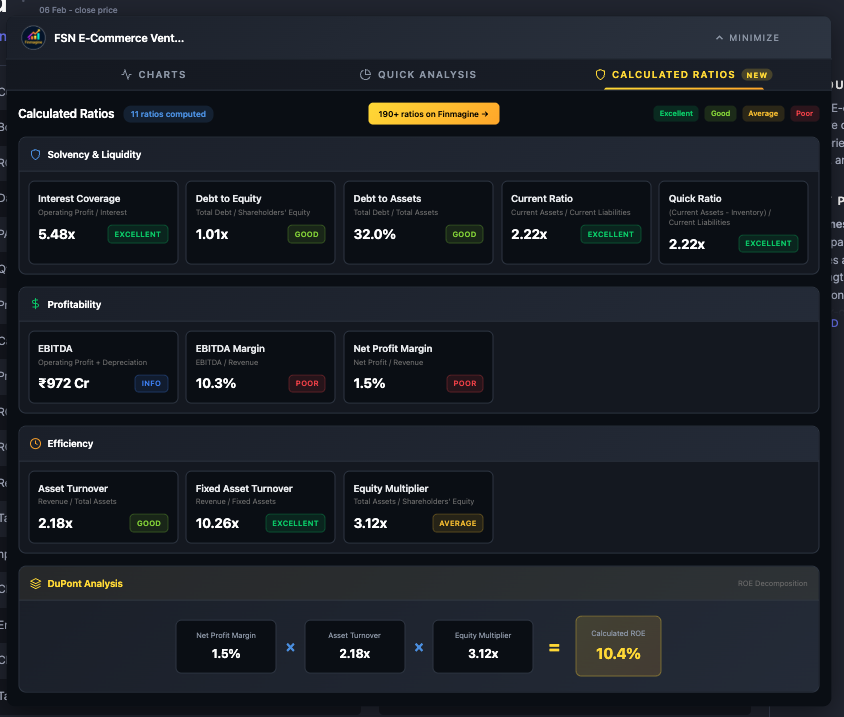

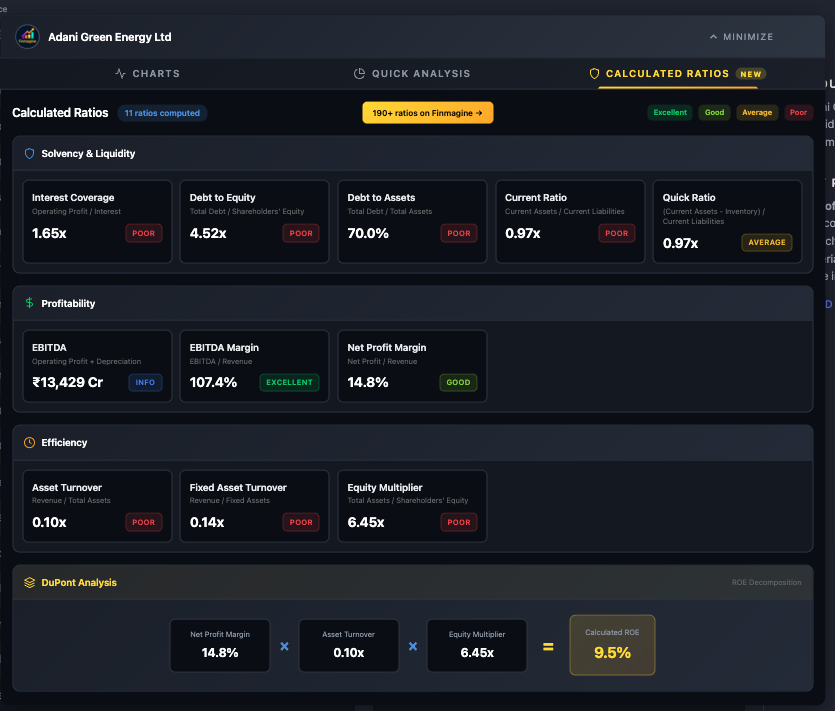

- Nykaa: Low margins but high turnover - efficient operator

- Vedanta: 51% ROE with risky leverage and liquidity concerns

- Bajaj Finserv: Why financial companies break the normal rules

Key Skills You'll Master:

- Calculate and interpret 11+ financial ratios from raw statements

- Decompose ROE to understand what's really driving returns

- Identify leveraged growth vs. quality compounding

- Apply sector-appropriate benchmarks (manufacturing vs. banking)

- Build a 5-point health check for any stock

High ROE Is a Trap: How Debt Creates the Illusion of Great Stocks

Watch this complete breakdown of why high ROE can be dangerous and how to use DuPont Analysis to find quality compounders.

What you'll learn: Why high ROE can be dangerous, how debt artificially inflates returns, the 3 drivers of ROE explained simply, and a practical checklist to identify distress vs opportunity.

Complete video with real Indian market examples: Polycab, Adani Green, IndiGo, Nykaa, Vedanta

Audio Deep Dive: The Zombie vs Compounder Analysis

Listen to this comprehensive 30+ minute exploration of calculated ratios, featuring detailed company comparisons and real-world examples.

Duration: Full deep dive | Format: Conversational analysis

Covers: Interest Coverage, Debt-to-Equity, EBITDA vs Net Profit, Asset Turnover, DuPont Analysis, and the complete framework for identifying quality stocks

Test Your Ratio Knowledge

Click any flashcard to reveal the answer. Use the search box to find specific topics.

The X-Ray Goggles for Your Portfolio

Picture this: It's late at night, you're researching a stock, and you see a company with a 38% Return on Equity. Your heart races. That's an incredible number! Better than Apple. Better than Google. You reach for the "Buy" button.

Stop right there.

What if I told you that stellar ROE might be nothing more than a financial illusion? A magic trick hiding a mountain of risk? Today, we're putting on our X-ray goggles and looking past the surface numbers to understand what's really driving a company's returns.

We're going to use the Calculated Ratios feature from the Finmagine Chart Builder to separate healthy companies from financial zombies. This isn't pre-baked analysis someone else did—these are ratios derived straight from raw financial statements. The P&L. The Balance Sheet. Pure, unadulterated numbers.

By the end of this guide, you'll never look at ROE the same way again.

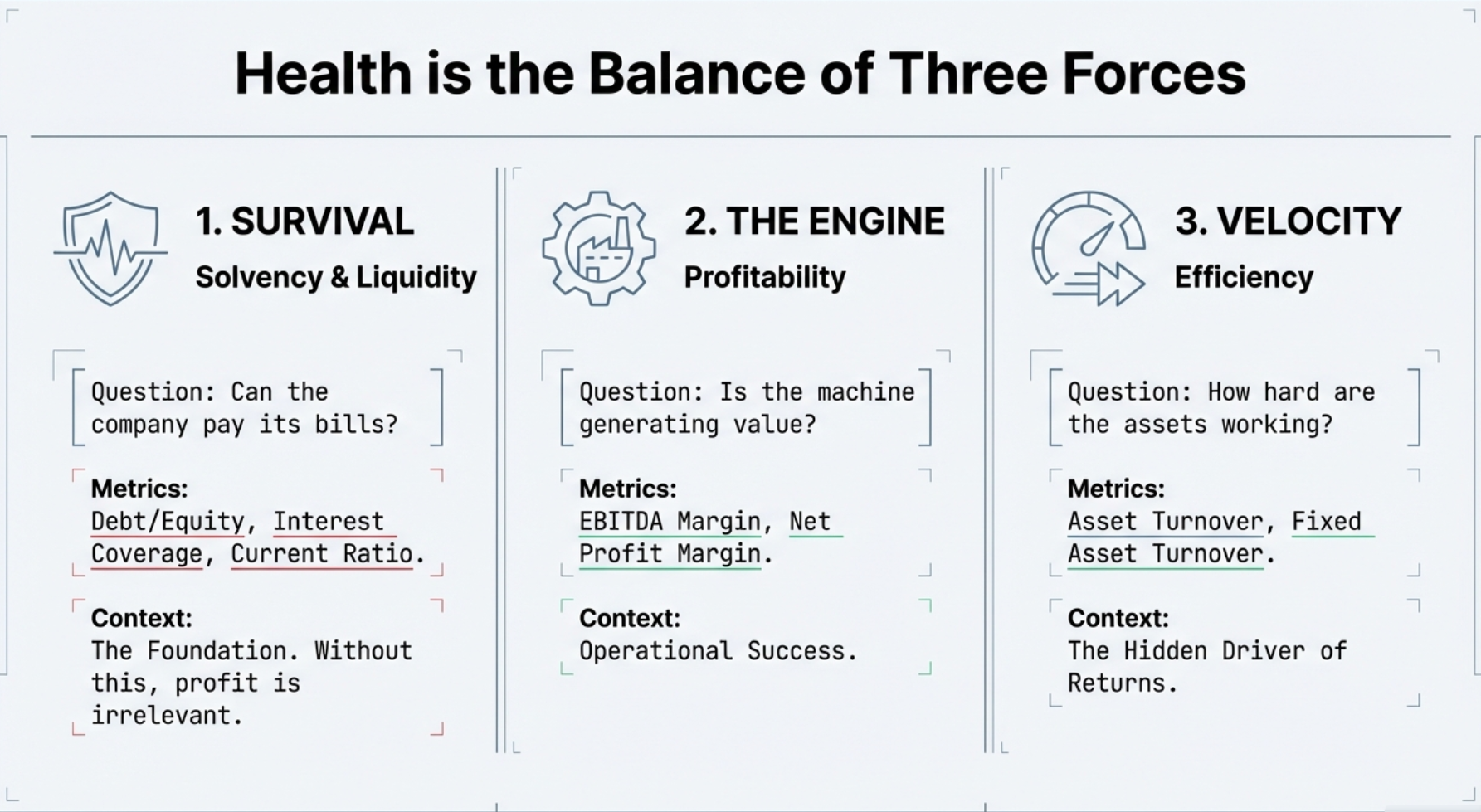

Survival vs Success: The Solvency Check

Before we even think about profits, we need to check for financial cracks in the foundation. People mix up performance and health constantly. They see soaring revenues and assume the company must be healthy.

The Restaurant Analogy

Think of it this way:

- Profitability = Performance. How fast you can run a race.

- Solvency = Health. Whether you're bleeding to death while running.

You can be the fastest runner in the world. You could have huge revenue growth. But if you have a severed artery, you aren't finishing the race.

Test #1: Interest Coverage Ratio

The first question we ask: Can they pay the bills?

| Formula | What It Measures | Danger Zone |

|---|---|---|

| Operating Profit / Interest Expense | Ability to pay interest on debt | Below 2.0x |

When you see a ratio below 1.0x, the company is in survival mode. They either burn cash reserves, sell assets (like selling furniture to pay the mortgage), or worse—borrow more money just to pay interest on old debt. That's a death spiral.

Test #2: Debt to Equity Ratio

This tells us who really owns the company—the shareholders or the bank?

| Rating | D/E Ratio | Interpretation |

|---|---|---|

| Excellent | ≤ 1.0x | Conservative, equity-funded |

| Good | 1.0 - 1.5x | Moderate leverage |

| Average | 1.5 - 2.5x | High leverage, monitor closely |

| Poor | > 2.5x | Excessive debt burden |

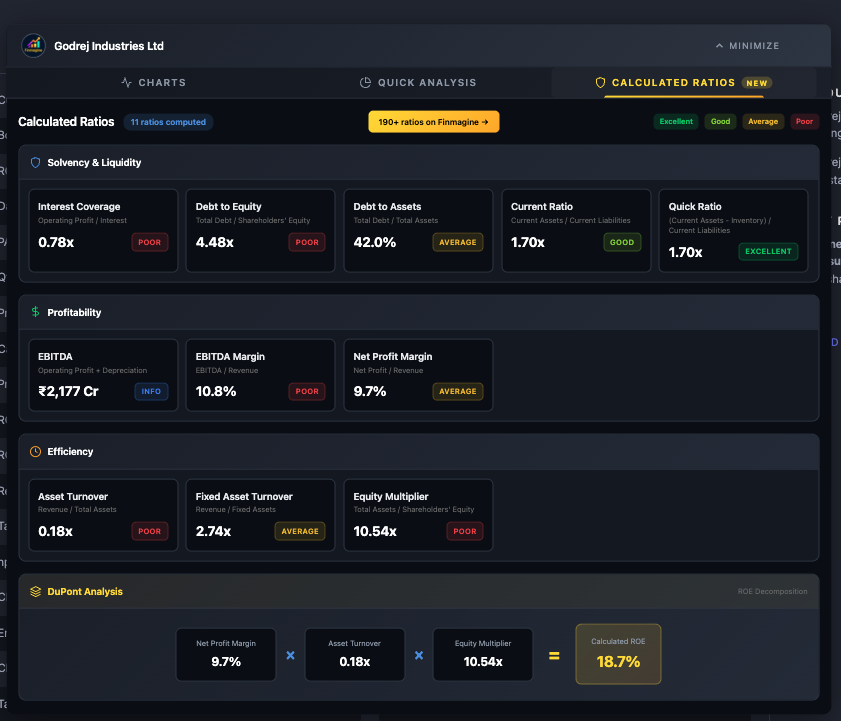

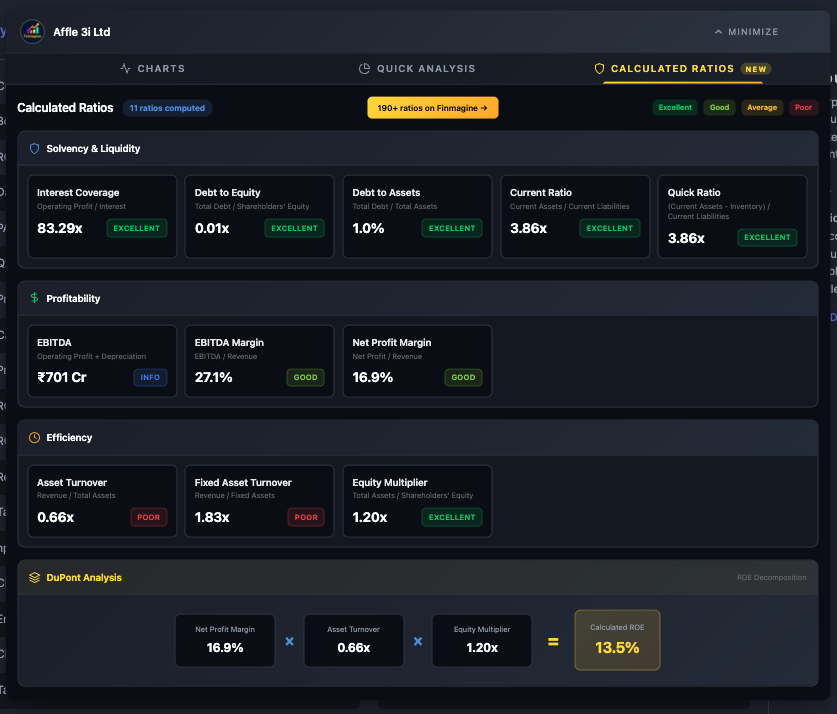

The Contrast: Affle vs Adani Green

Affle (Digital Advertising): D/E of 0.01x. Effectively debt-free. The shareholders own 99.9% of the company. Interest coverage of 83x. They could suffer a dot-com style crash and still pay lenders without breaking a sweat.

Adani Green (Energy): D/E of 4.52x. For every dollar shareholders invested, there's $4.52 of debt sitting on top. The bank owns 4.5x more of the capital structure than shareholders do.

The Profitability Paradox: EBITDA vs Net Profit

This is where newbie investors get tripped up. They look at the wrong profit number and get excited.

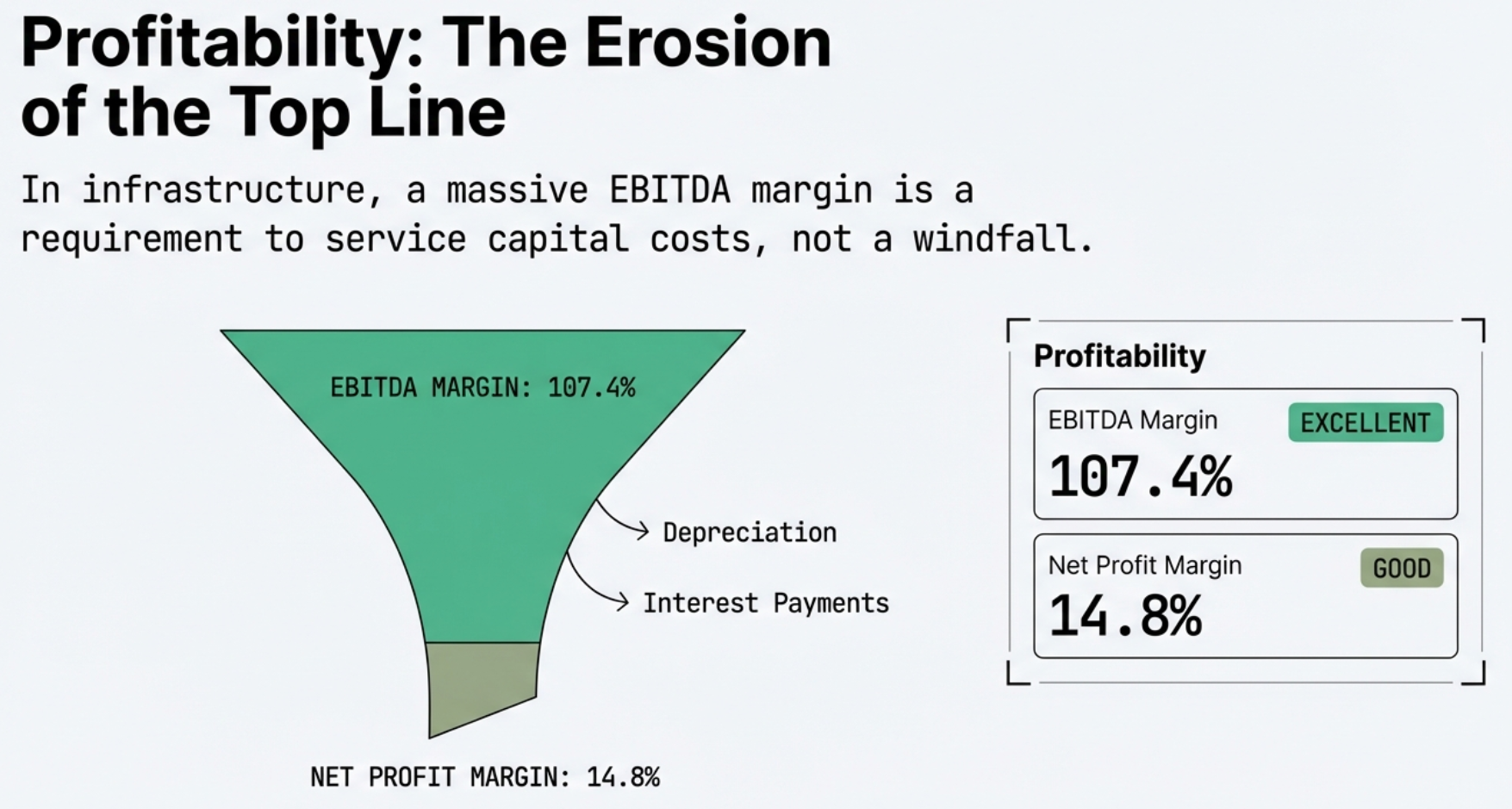

The Adani Green Mystery

Adani Green's dashboard shows an EBITDA margin of 107.4%—rated "Excellent." How can a margin exceed 100%? Did they create money from thin air?

It's likely an accounting quirk related to how certain subsidies or regulatory credits are recognized. But here's what really matters: scroll down to Net Profit Margin and it collapses to just 14.8%.

- Depreciation: Solar panels and wind farms lose value every year

- Interest: That 4.52x debt requires massive interest payments

This is why you cannot just look at EBITDA, especially in capital-intensive sectors. EBITDA ignores the very real cost of debt and aging assets.

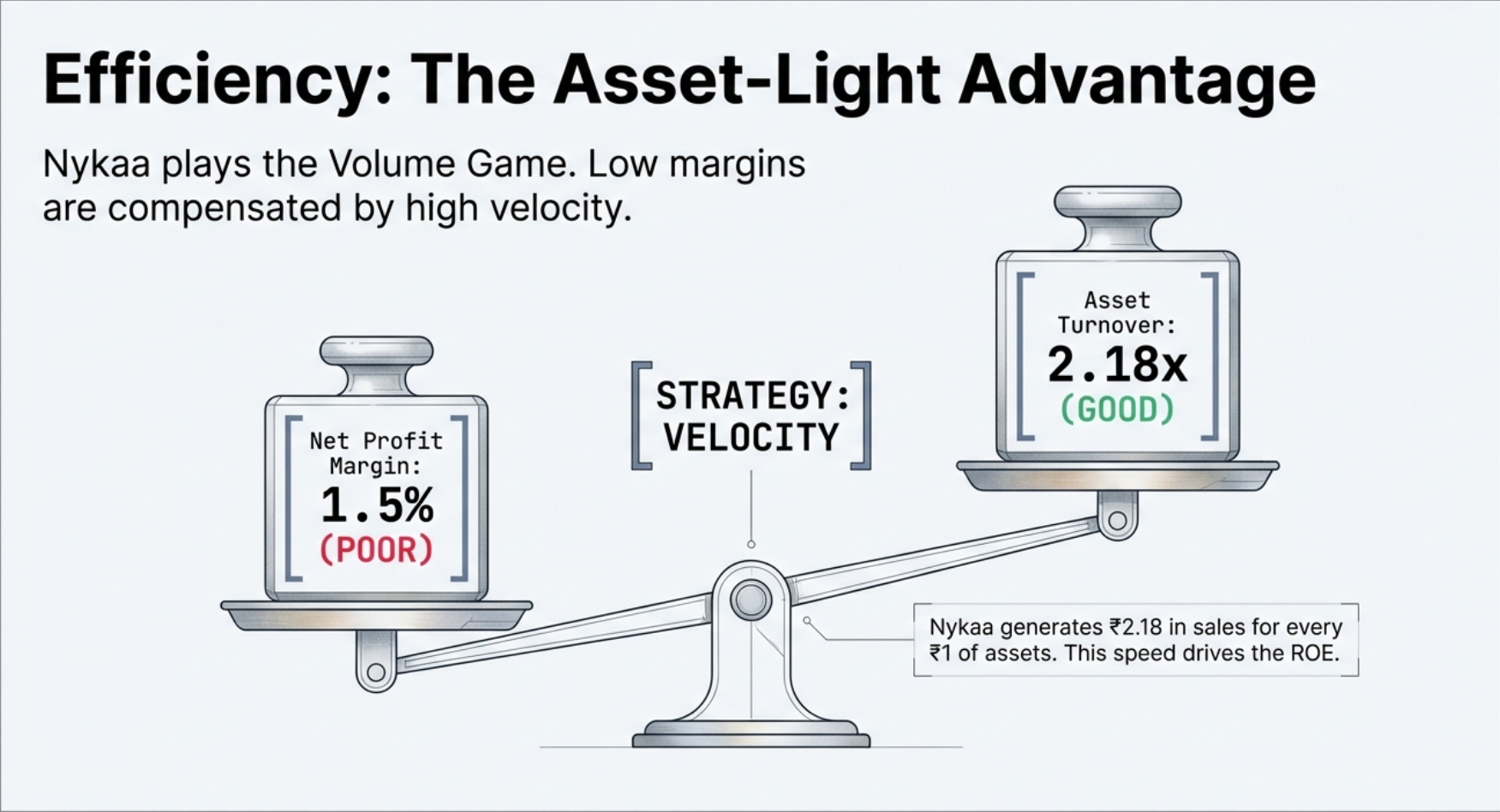

The Nykaa Puzzle

Now flip the script. Nykaa's net profit margin is 1.5%—rated "Poor." Sell a lipstick for Rs.1000, keep just Rs.15. Why bother?

Because context is king. Nykaa isn't a luxury brand making money on markup. They're a retailer making money on velocity. This leads us to efficiency ratios...

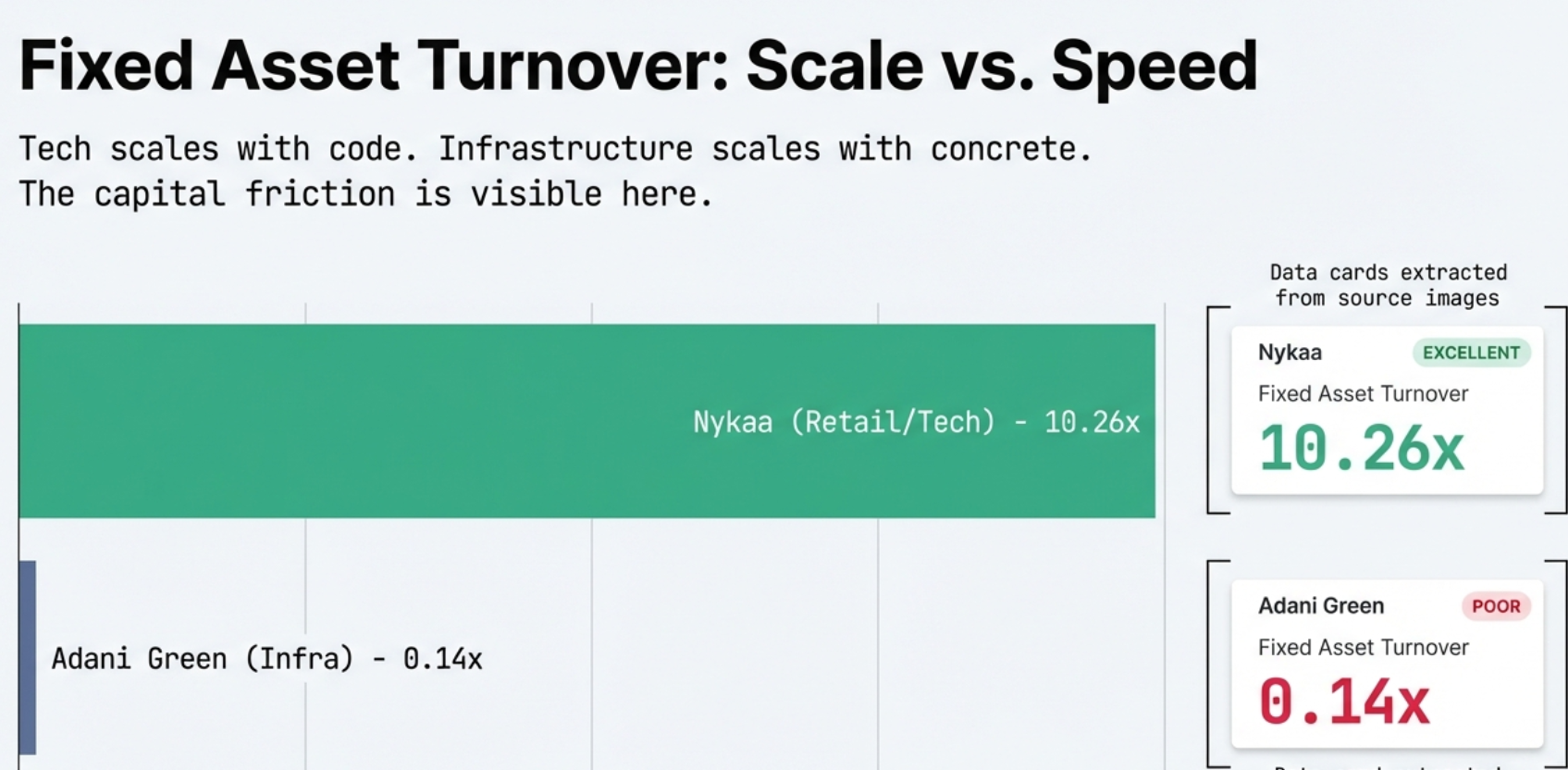

The Velocity of Money: Efficiency Ratios

This is my favorite category because it reveals the strategy of a business.

The Restaurant Analogy (Part 2)

There are two ways to run a profitable restaurant:

- Fancy Steakhouse: Sell Rs.5000 steaks to one customer per night. High margin, low turnover.

- Fast Food Joint: Sell Rs.50 burgers to 200 customers per hour. Low margin, high turnover.

Nykaa is the fast food joint of retail. Their asset turnover is 2.18x—for every rupee of assets, they generate Rs.2.18 in sales annually.

Asset Turnover Comparison

| Company | Asset Turnover | Business Model |

|---|---|---|

| Nykaa | 2.18x | High volume, low margin retailer |

| Polycab | 1.57x | Efficient manufacturer |

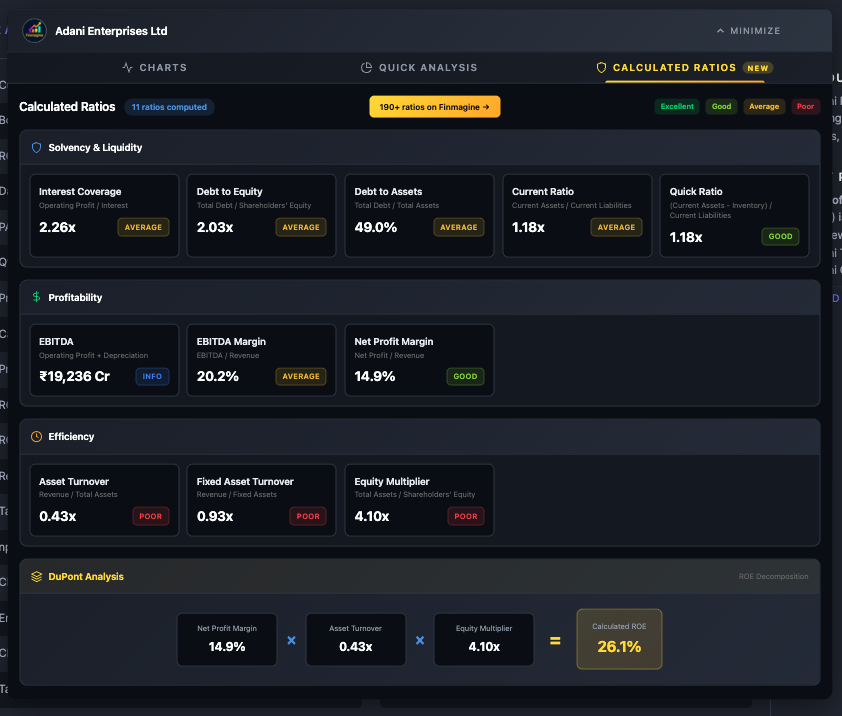

| Adani Enterprises | 0.43x | Diversified conglomerate |

| Adani Green | 0.10x | Capital-intensive infrastructure |

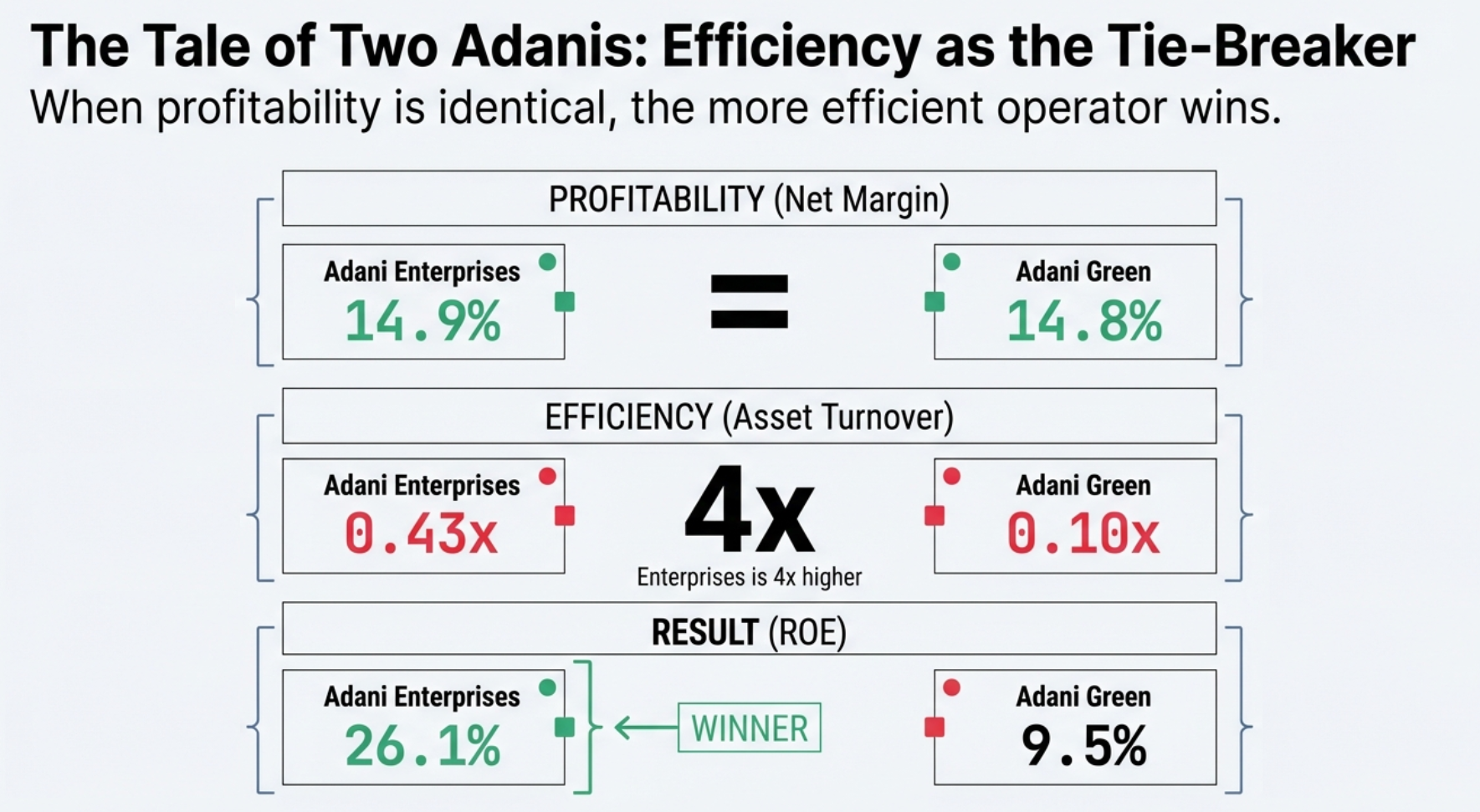

Why Adani Enterprises Beats Adani Green (Despite Similar Margins)

Here's a mystery from the data: Both companies have nearly identical net profit margins (~15%). But Adani Enterprises has 26.1% ROE while Adani Green has only 9.5% ROE.

The answer? Turnover. Adani Enterprises has 4x higher asset turnover. They're "sweating their assets" harder—getting more juice from the squeeze.

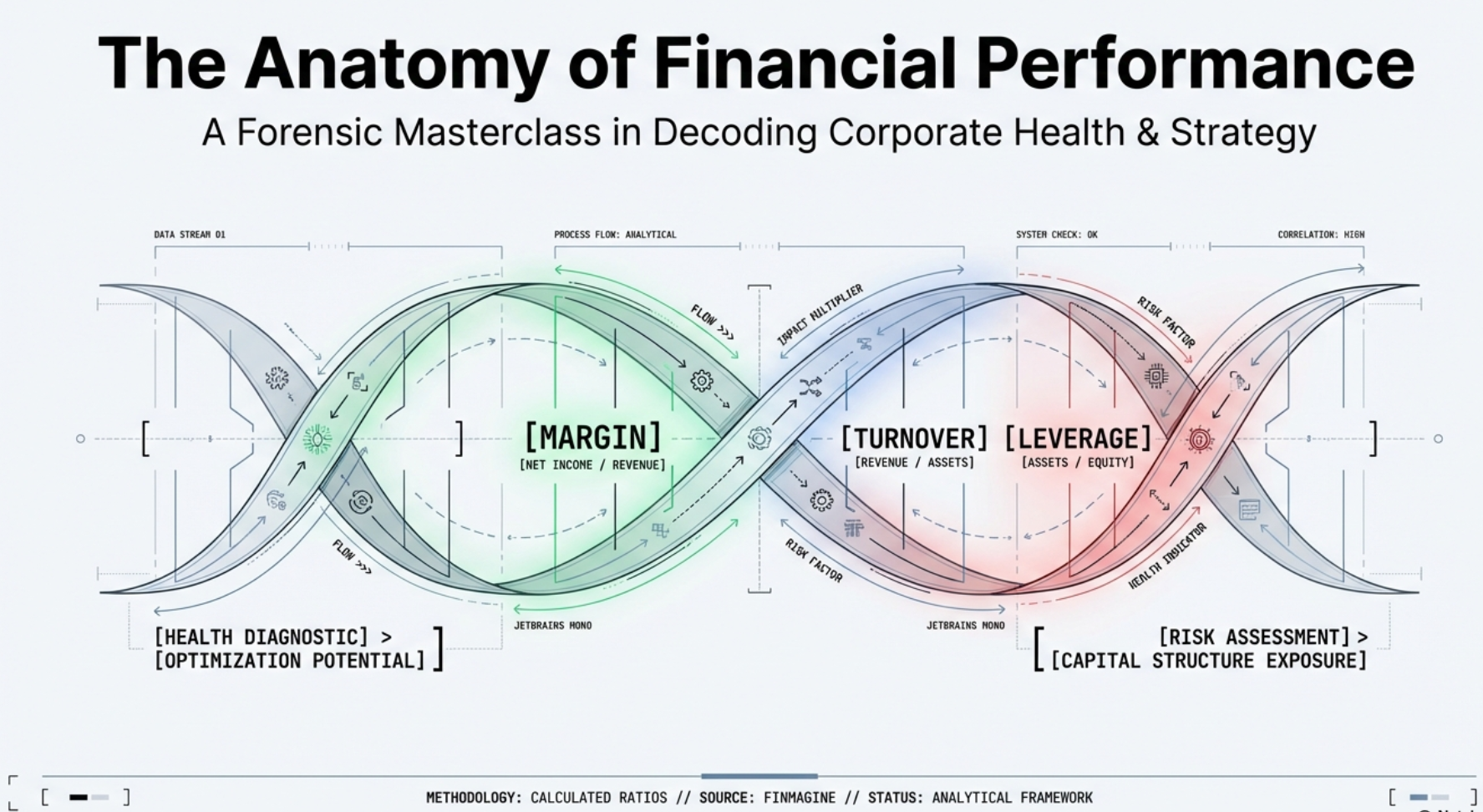

The Master Framework: DuPont Analysis

Now we put it all together. DuPont Analysis takes Return on Equity and breaks it into three drivers:

The Formula

ROE = Net Profit Margin × Asset Turnover × Equity Multiplier

Profitability × Efficiency × Leverage

This lets us perform a DNA test on returns. We can see how a company gets its ROE. Is it from genuine operational skill (muscle)? Or just financial steroids (debt)?

Company Profiles

| Profile | Margin | Turnover | Leverage | Risk Level |

|---|---|---|---|---|

| Quality Compounder | High | Moderate | Low | Low Risk |

| Efficient Operator | Moderate | High | Moderate | Medium Risk |

| Leveraged Growth | Low | Low | High | High Risk |

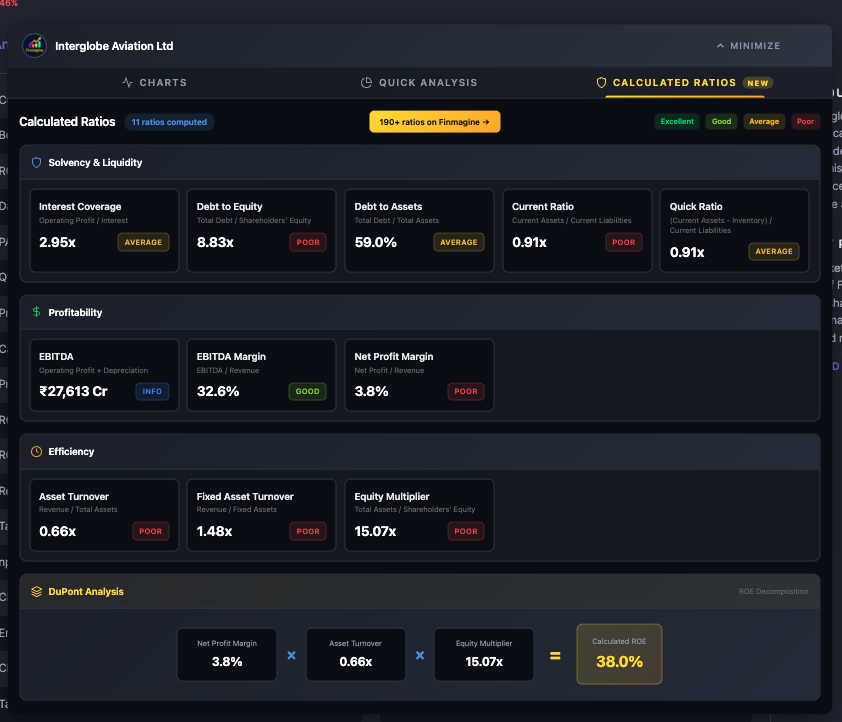

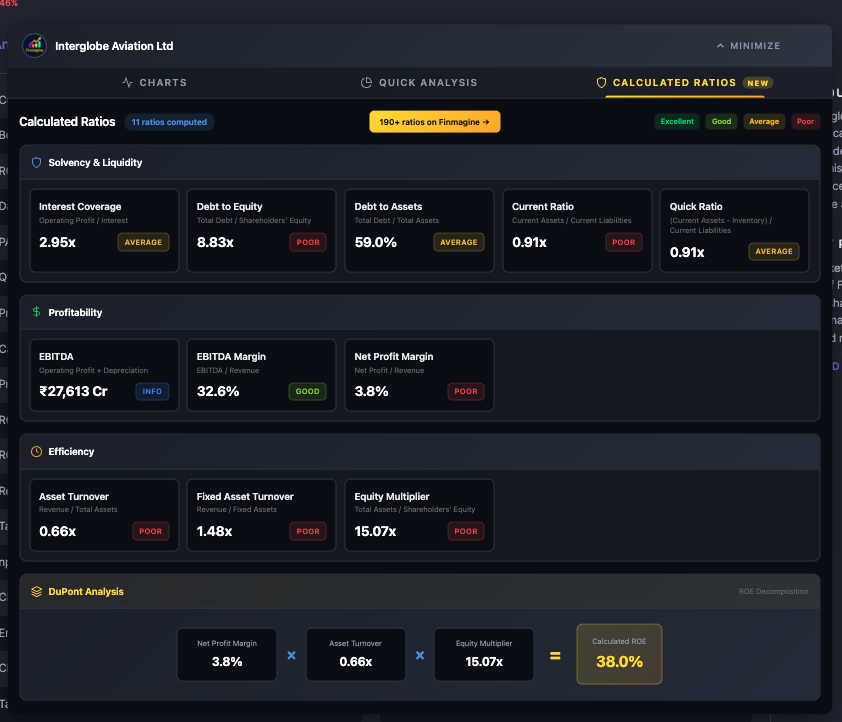

Case Study: IndiGo Airlines (The Steroid Strategy)

IndiGo's ROE is 38%. That beats Apple. That beats Google. Should you buy immediately?

Let's decompose it:

- Net Profit Margin: 3.8% (Poor—airlines are tough)

- Asset Turnover: 0.66x (Poor—planes are expensive and sit idle)

- Equity Multiplier: 15.07x (Massive!)

Leverage cuts both ways. If that thin 3.8% margin drops to zero (pandemic, oil spike), those losses get multiplied 15x. You can wipe out shareholder equity in a single bad quarter.

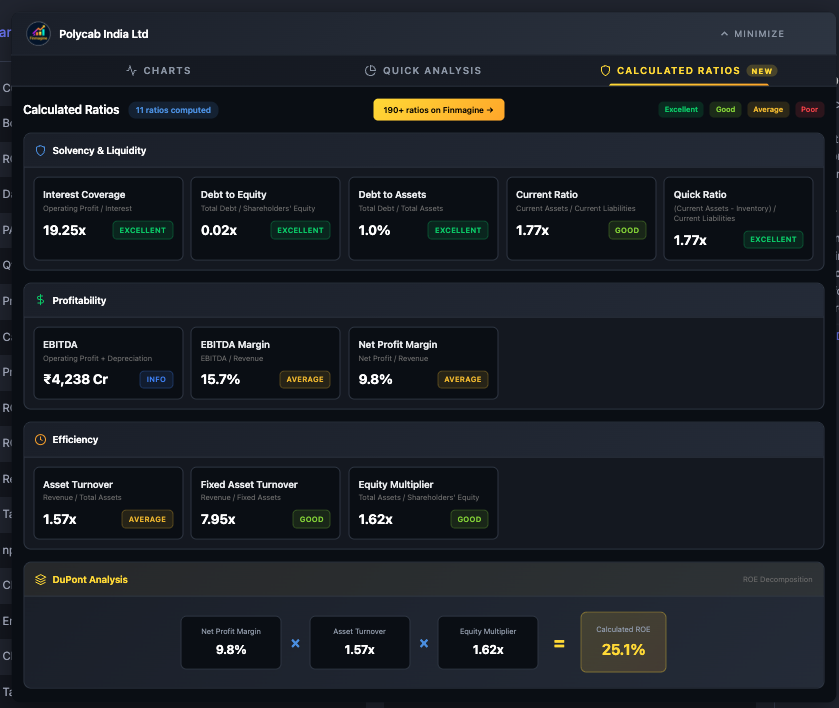

Case Study: Polycab (The Quality Compounder)

Now look at Polycab. ROE of 25.1%. Not as flashy as IndiGo's 38%, but let's decompose:

- Net Profit Margin: 9.8% (Good)

- Asset Turnover: 1.57x (Good)

- Equity Multiplier: 1.62x (Excellent—very low leverage)

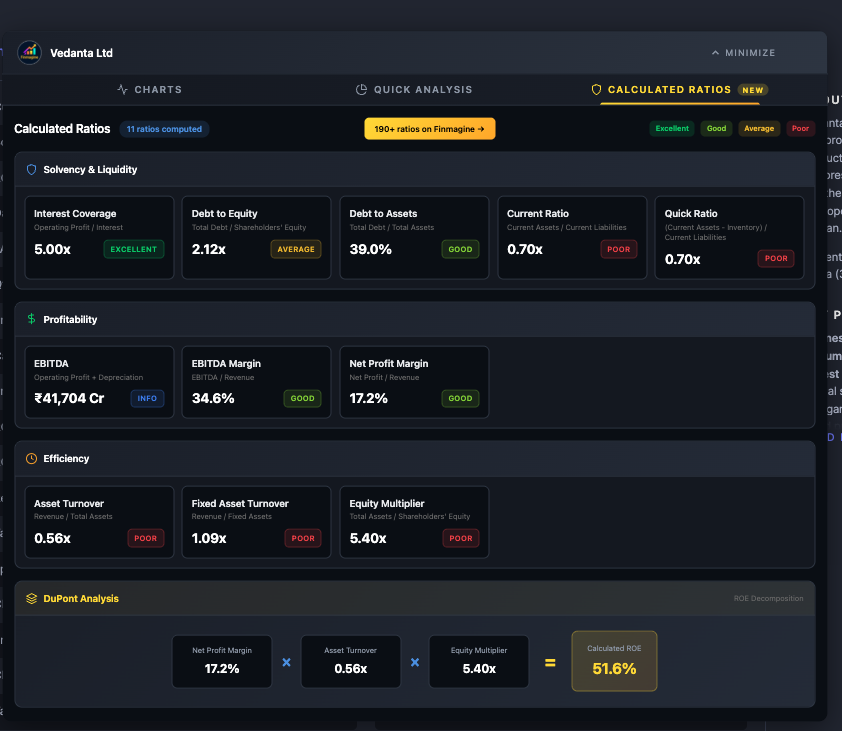

Case Study: Vedanta (High Risk, High Reward)

Vedanta has an eye-watering 51.6% ROE. They're combining two levers:

- Good margins (17.2%—mining is profitable when commodities are high)

- High leverage (5.4x equity multiplier)

But notice the current ratio: 0.70x. Their short-term liabilities exceed short-term assets. They might have trouble paying bills next month.

Vedanta is a classic high-risk, high-reward play. You might get 51% returns—or they might face a sudden cash crunch.

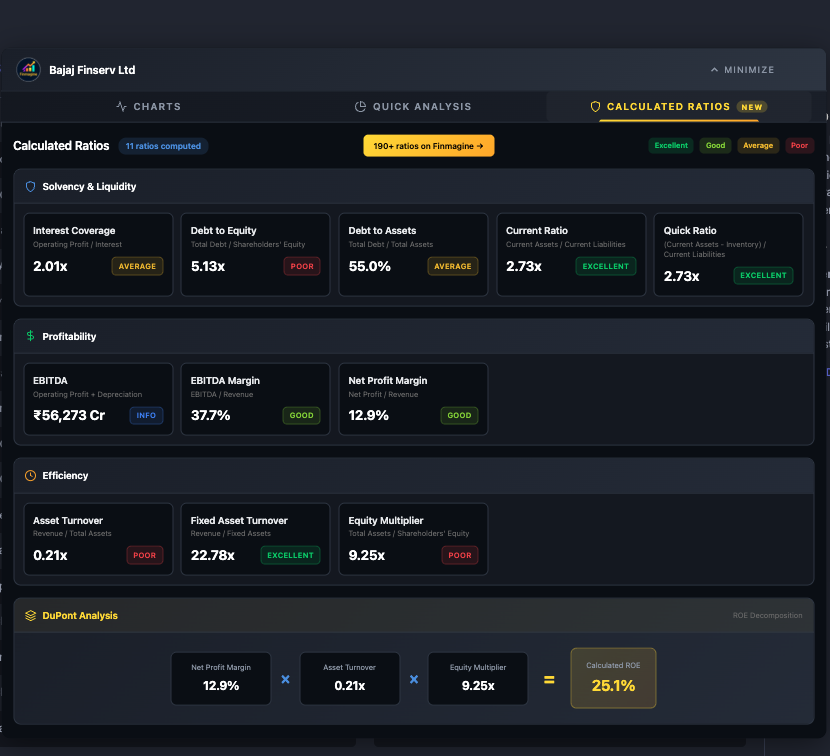

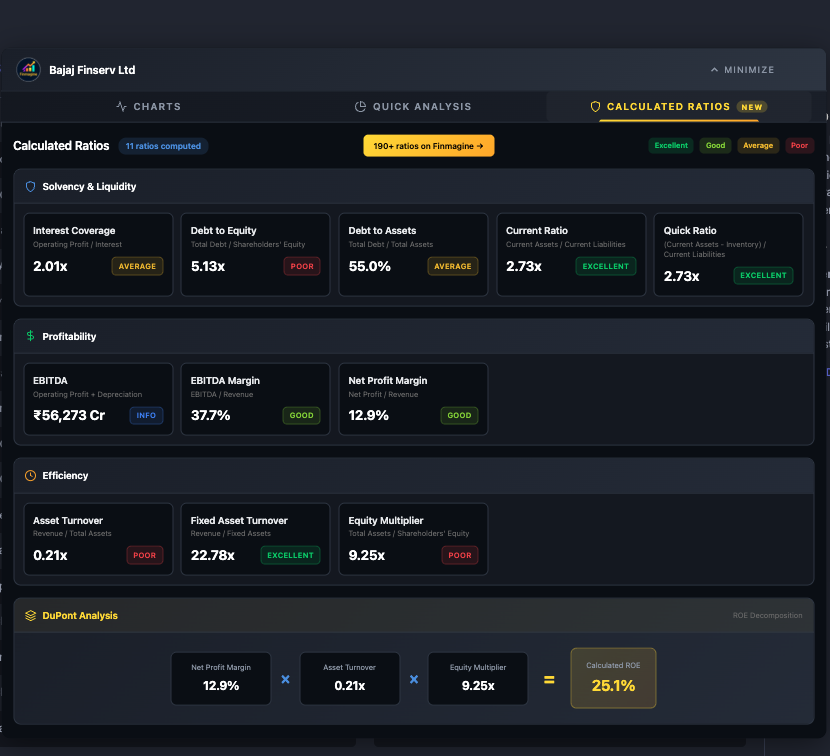

The Exception: Analyzing Financial Companies

Bajaj Finserv's dashboard looks like a crime scene. Debt/Equity of 5.13x. Asset turnover of 0.21x. Equity multiplier of 9.25x. All rated "Poor."

Should you run away? No. You cannot analyze a bank like you analyze a factory.

Why Banks Are Different

Think about what a bank does. What's their raw material?

Other people's money.

When you deposit money in a savings account, that's a liability on the bank's balance sheet. They owe it back to you. For a bank, your deposits = their debt.

They then lend that money to borrowers, which becomes their assets.

The entire business model runs on a spread: borrow at 5%, lend at 8%, profit 3%. To make decent returns on that thin spread, banks need high leverage and high volume.

Your 5-Point Health Check

Before you buy any stock, run through this checklist:

| # | Check | What to Look For | Red Flag |

|---|---|---|---|

| 1 | Interest Coverage | ≥ 3.0x (comfortable) | < 2.0x |

| 2 | Debt to Equity | ≤ 1.5x (manageable) | > 2.5x |

| 3 | Current Ratio | ≥ 1.5x (liquid) | < 1.0x |

| 4 | Net Profit Margin | ≥ 10% (profitable) | < 5% |

| 5 | Equity Multiplier | ≤ 2.5x (sustainable) | > 4.0x |

The DuPont Question

When you see a high ROE (over 20%), don't celebrate. Investigate.

Ask: Did they earn it or did they buy it?

- Earned: High margins + good turnover + low leverage = Quality

- Bought: Low margins + low turnover + high leverage = Risk

Stop Chasing Numbers. Start Reading Stories.

The stock price tells you what people think a company is worth today. It's sentiment. These ratios tell you how the machine actually works. The price is perception. The ratios are reality.

New investors chase the highest number on the page. Experienced investors chase the highest quality number.

So the next time you see a headline saying "Company X reports record profits" or "Company Y has the highest ROE in its sector," don't just nod along. Ask the DuPont question:

Did they earn it through operational excellence?

Or did they just buy it with a mountain of debt?

Open the Calculated Ratios tab on your portfolio companies. Put on your X-ray goggles. You might find some zombies hiding in plain sight—and some hidden quality compounders too.

Try It Yourself: Using the Calculated Ratios Tab

Now that you understand the theory, let's put it into practice. The Finmagine Chart Builder Chrome extension includes a Calculated Ratios tab that performs all this analysis automatically for any company on Screener.in.

Step-by-Step: Analyzing Any Company

The overlay panel will appear on the right side of the page

You'll see three tabs: Charts | Quick Analysis | Calculated Ratios

Polycab's Calculated Ratios showing a quality compounder profile

Understanding the Interface

The Calculated Ratios tab organizes 11+ financial ratios into clear categories:

| Category | Ratios Included | What It Tells You |

|---|---|---|

| Solvency | Interest Coverage, D/E, D/A, Current Ratio, Quick Ratio | Can the company pay its debts? |

| Profitability | EBITDA, EBITDA Margin, Net Profit Margin | How much does it earn per rupee of sales? |

| Efficiency | Asset Turnover, Fixed Asset Turnover | How well does it use its assets? |

| Leverage | Equity Multiplier | How much debt amplifies returns? |

| DuPont Analysis | Visual ROE breakdown | WHERE is the ROE coming from? |

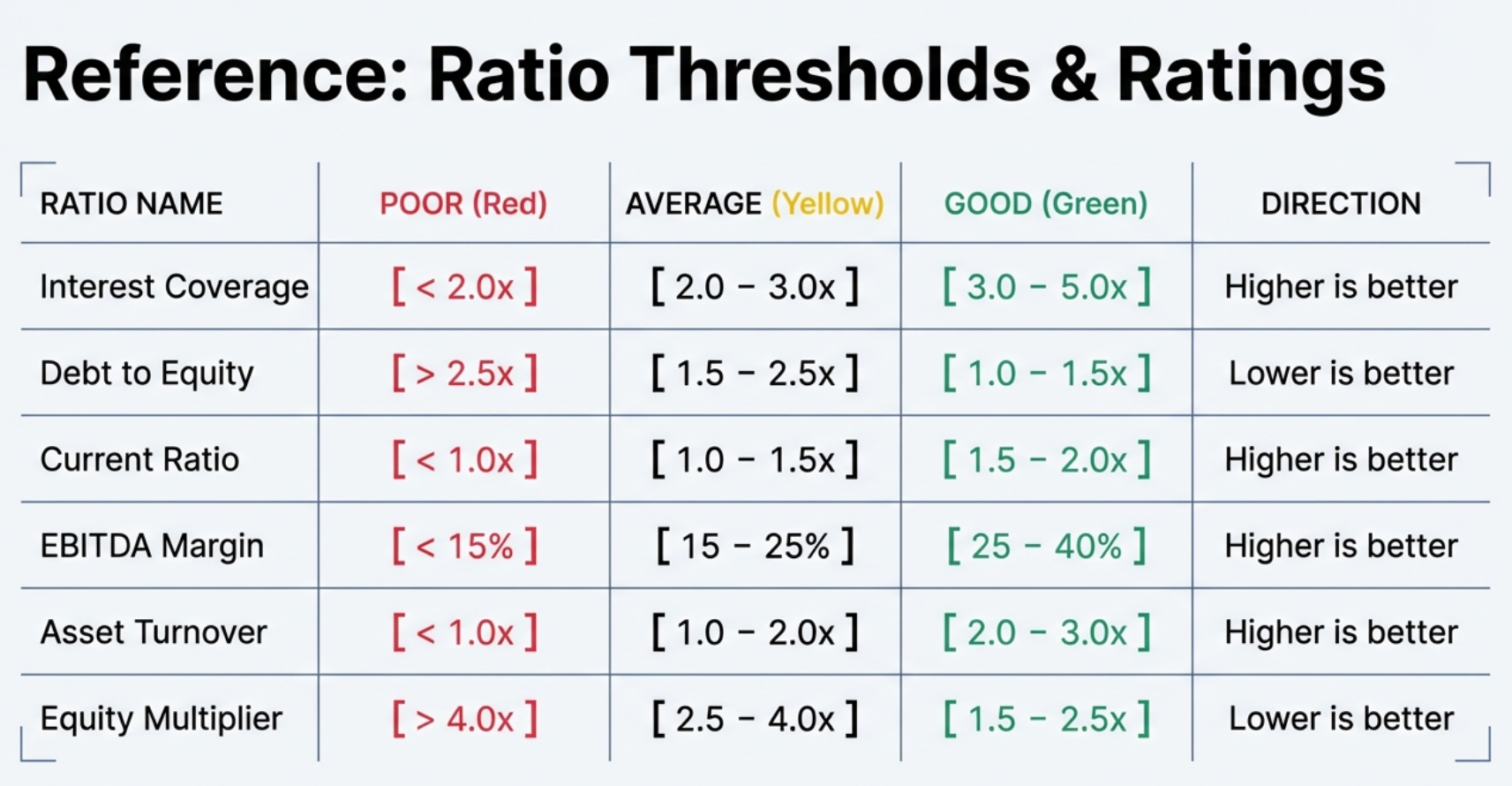

The Color-Coded Rating System

Every ratio displays a colored badge that instantly tells you the quality:

Top-tier performance

Above average

Acceptable, monitor closely

Warning sign

Reading the DuPont Analysis Section

At the bottom of the tab, you'll find the DuPont Analysis breakdown. This is your X-ray vision:

ROE = Net Profit Margin × Asset Turnover × Equity Multiplier

The tool calculates this live and shows you the contribution of each component

What to look for:

- Quality Compounder: High margin + moderate turnover + low equity multiplier (≤ 2.0x)

- Efficient Operator: Lower margin + high turnover + low leverage (retail, FMCG)

- Leveraged Growth: Low margin + low turnover + HIGH equity multiplier (> 3.0x) = Warning!

Compare: Quality vs Leveraged

Polycab: Quality Compounder

D/E: 0.02x | ROE driven by margins

Adani Green: Leveraged Growth

D/E: 4.52x | ROE inflated by debt

More Examples to Explore

Nykaa: Efficient Operator (low margin, high turnover)

IndiGo: Watch the leverage impact

Bajaj Finserv: Financial company (different rules)

Your Assignment

Pick 3-5 companies from your watchlist or portfolio. Open each one on Screener.in and check their Calculated Ratios tab. Ask yourself:

- What's the Debt-to-Equity ratio? Is it sustainable?

- What's driving the ROE in the DuPont breakdown?

- Is this a quality compounder, efficient operator, or leveraged growth?

- Are there any red (Poor) ratings I should investigate?

You might be surprised by what you find. Some "star performers" in your portfolio might turn out to be zombies borrowing time. And some boring-looking companies might actually be hidden gems built on solid foundations.

Explore the Complete Chart Builder Hub

Discover all Chart Builder resources — tutorials, Google Finance integration, case studies, and more. Transform Screener.in & Google Finance data into professional charts.

Visit Chart Builder Hub →