Complete AI Advisor Deep Dive

Architecture, 5 templates, sector-aware intelligence, 21-parameter methodology, and 56 flashcards

Your Personal AI Research Desk on Screener.in

Free Chrome extension that extracts financial data from Screener.in, runs sector-aware analysis across 18 industries, and generates institutional-grade research prompts for Custom GPT. Five templates. Health scoring. DuPont ROE. Deep Research that reads actual concall transcripts and annual reports. All running privately in your browser.

Download Free Extension View Deep Dive

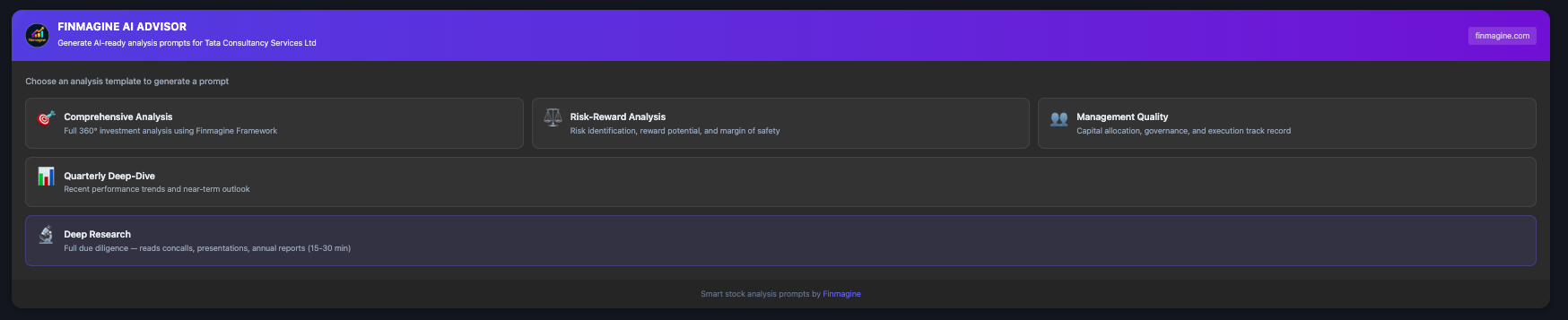

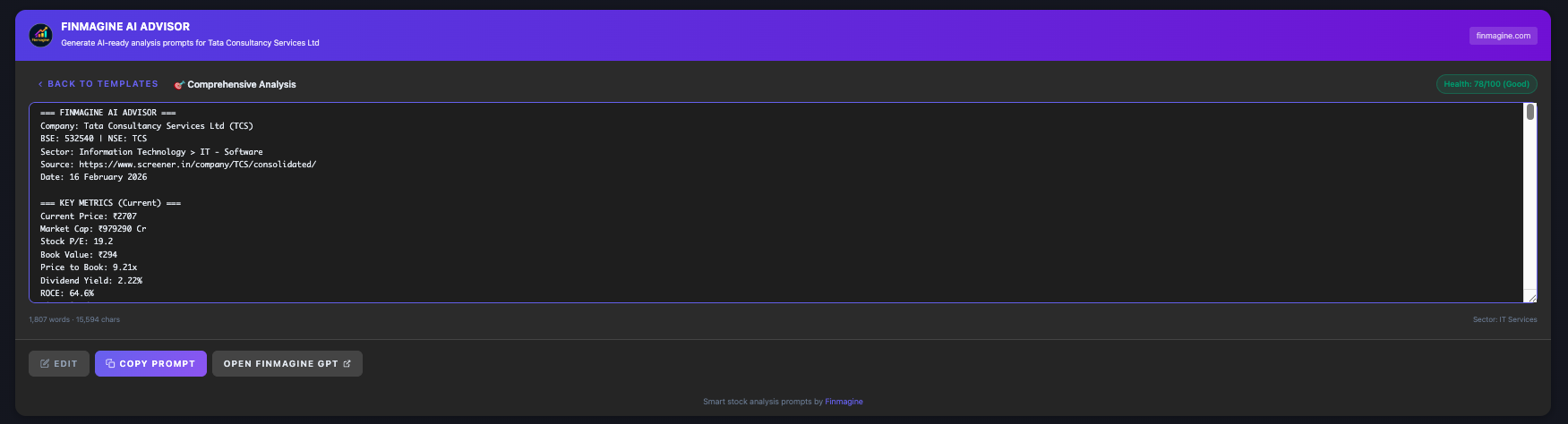

This is what you'll see when you install the extension and visit any Screener.in company page:

The AI Advisor panel appears automatically below the chart section on every Screener.in company page — five template cards ready to generate research prompts

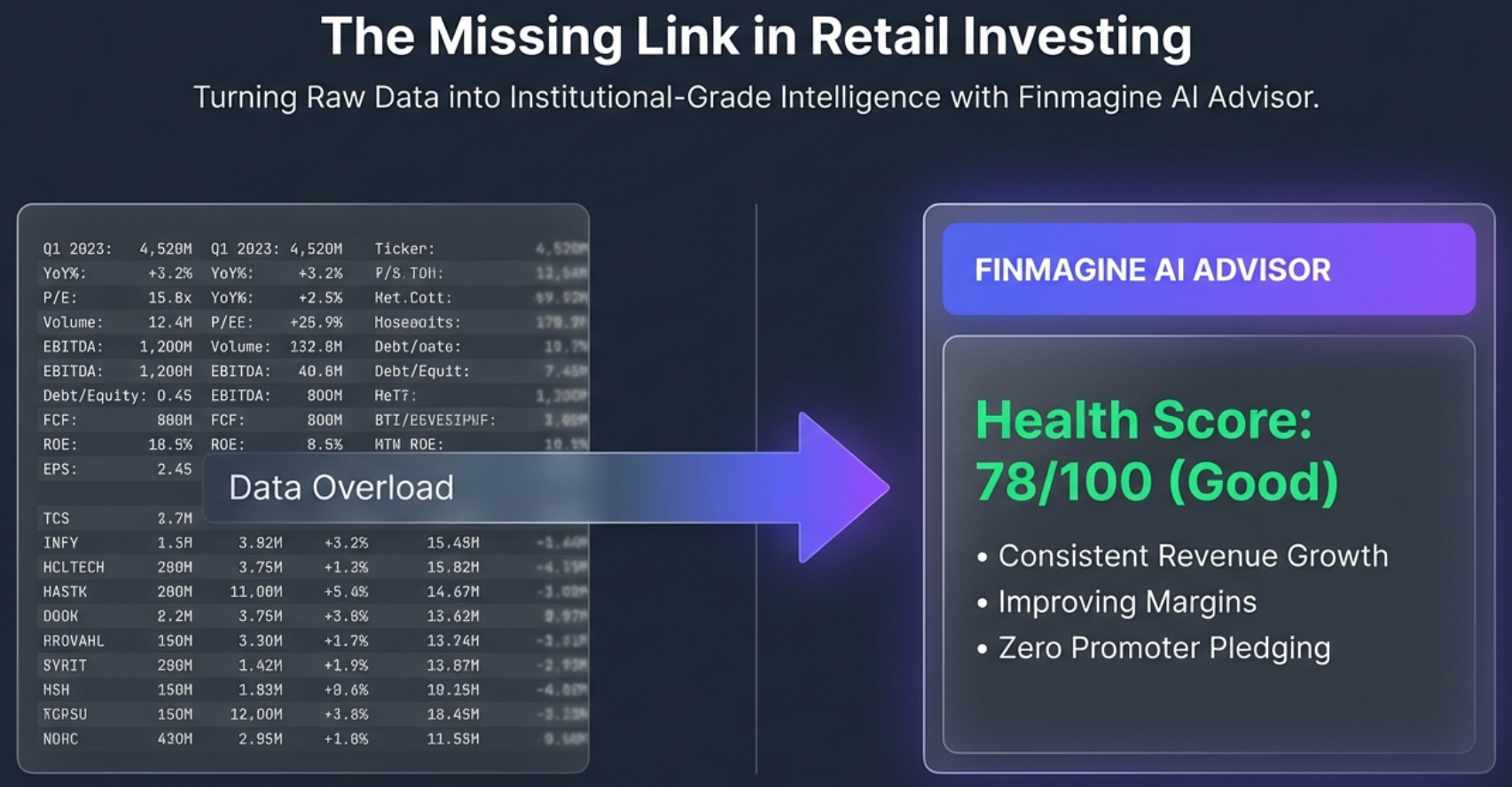

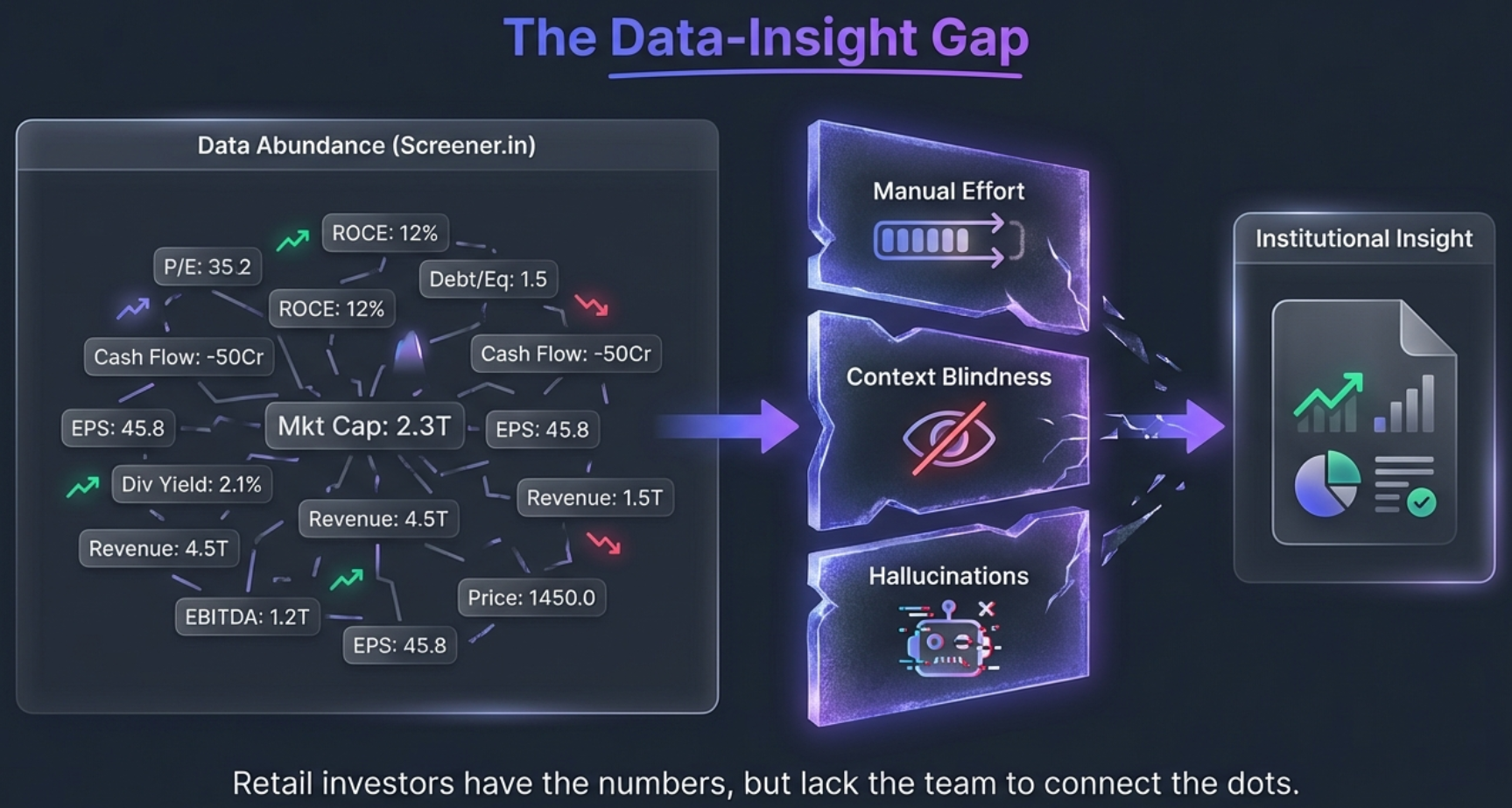

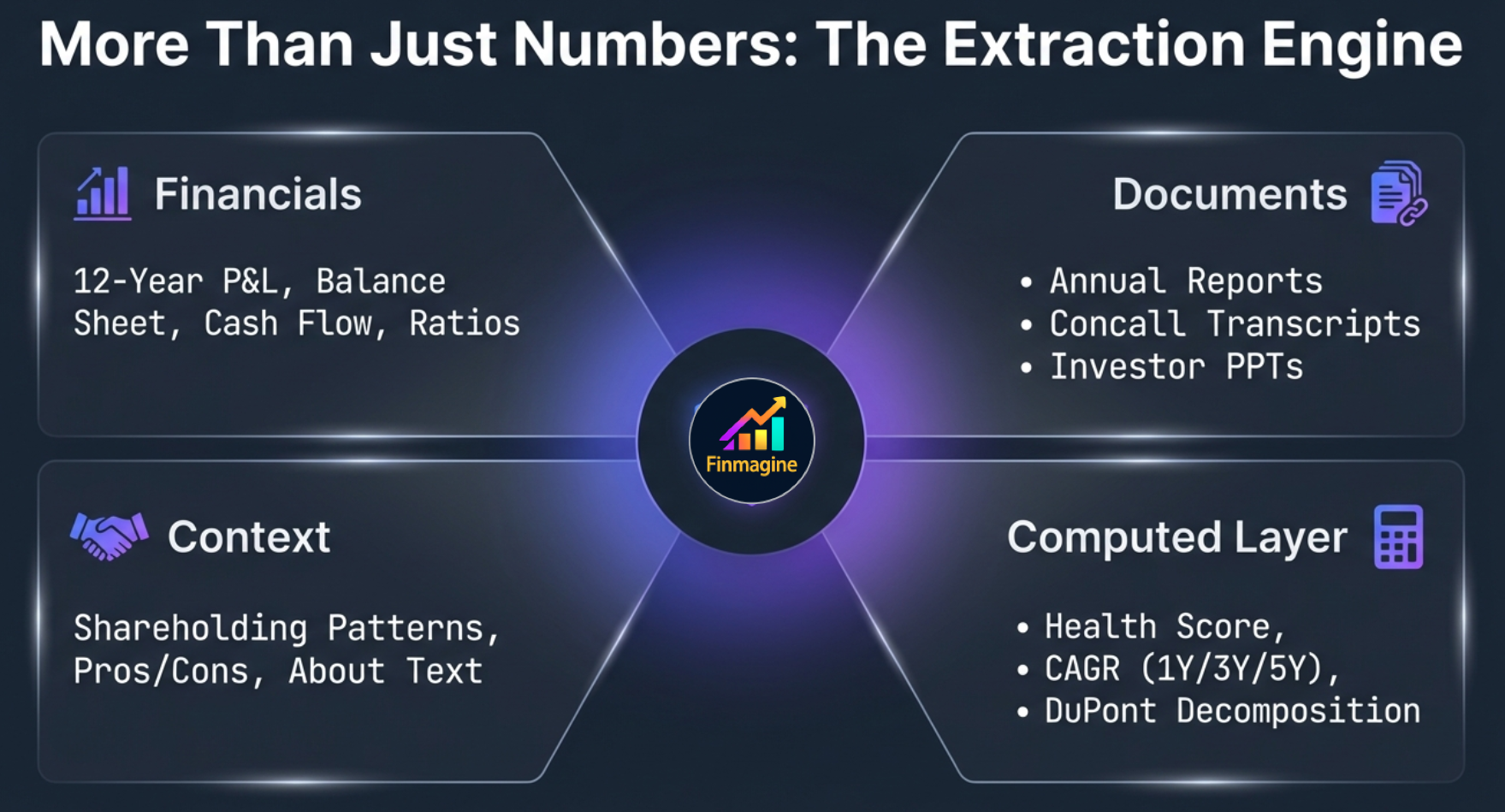

Screener.in gives you the data. But turning 12 years of financial tables into a coherent investment thesis still requires the kind of structured analytical thinking that institutions have systematized. The AI Advisor bridges this gap — extracting everything on the page, running sector-aware analysis, and generating research prompts that a Custom GPT transforms into institutional-grade output.

18 industry profiles with customized thresholds. Banks use P/B, not P/E. Metals use EV/EBITDA. Negative cash flow is normal for lending. The extension knows the difference.

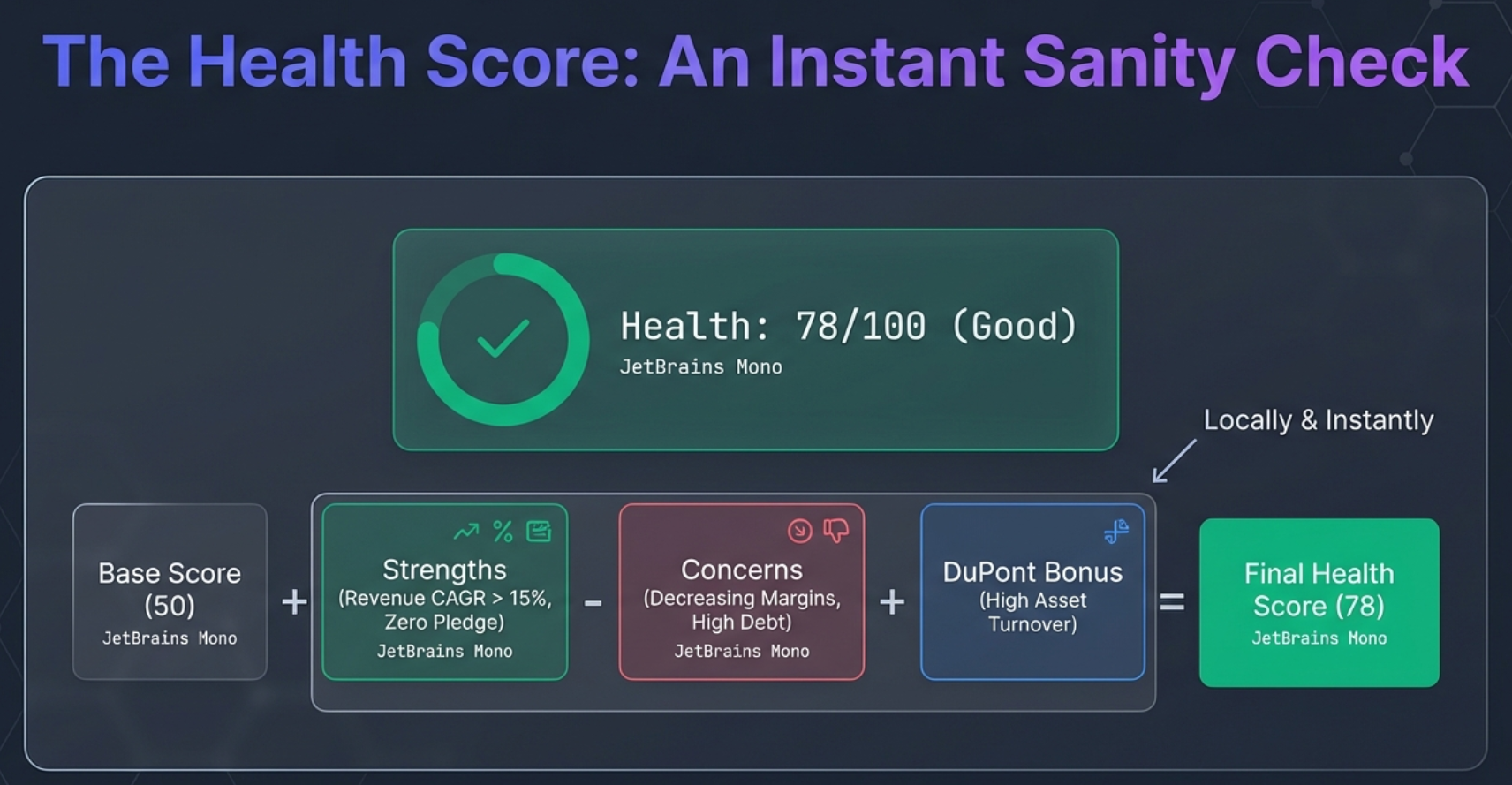

Health Score (0-100), CAGR calculations at 4 horizons, DuPont ROE decomposition, valuation verdicts, strengths and concerns — all computed before GPT even gets involved.

The featured template instructs GPT to browse actual BSE PDFs — concall transcripts, annual reports, investor presentations — for 9-part forensic due diligence.

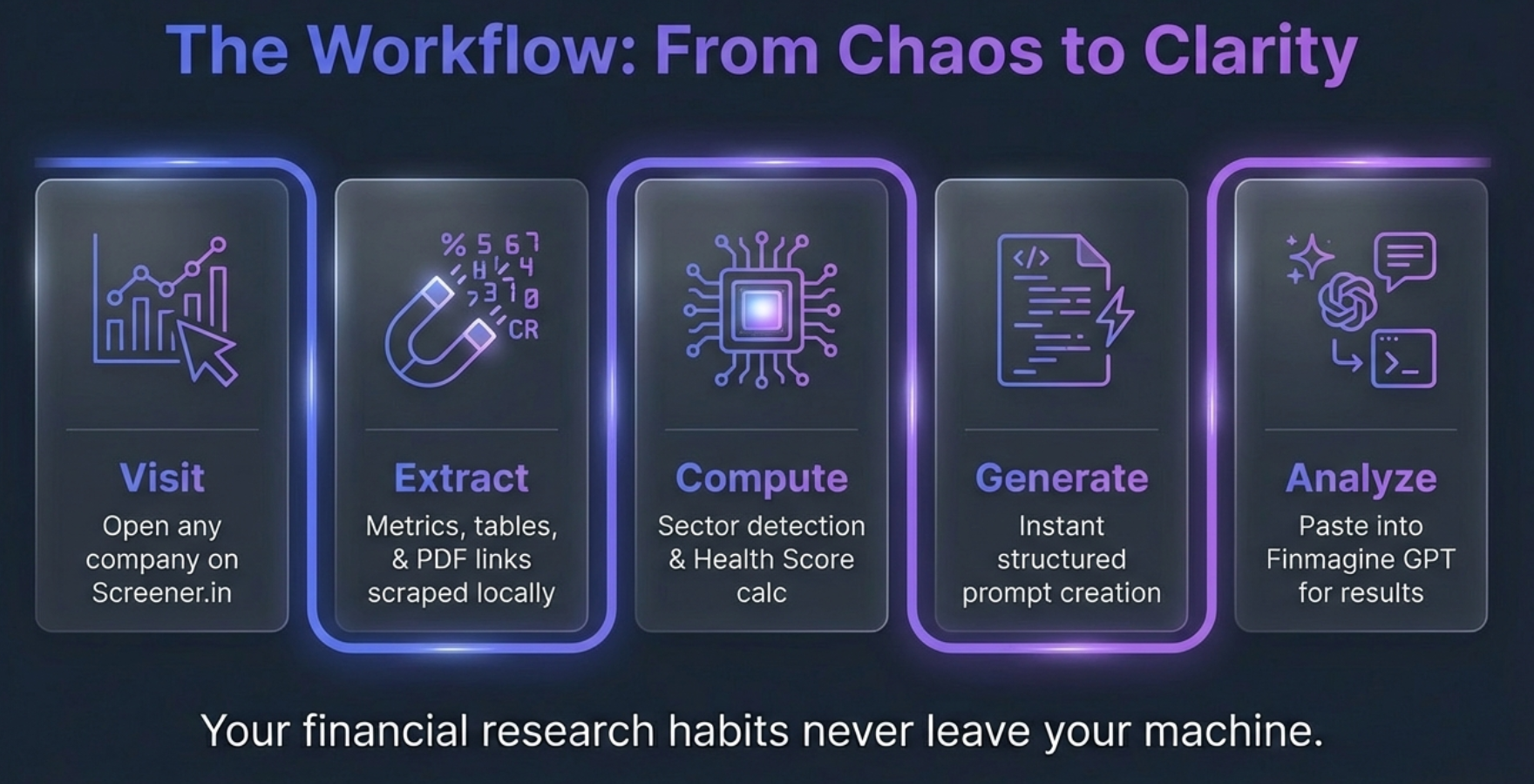

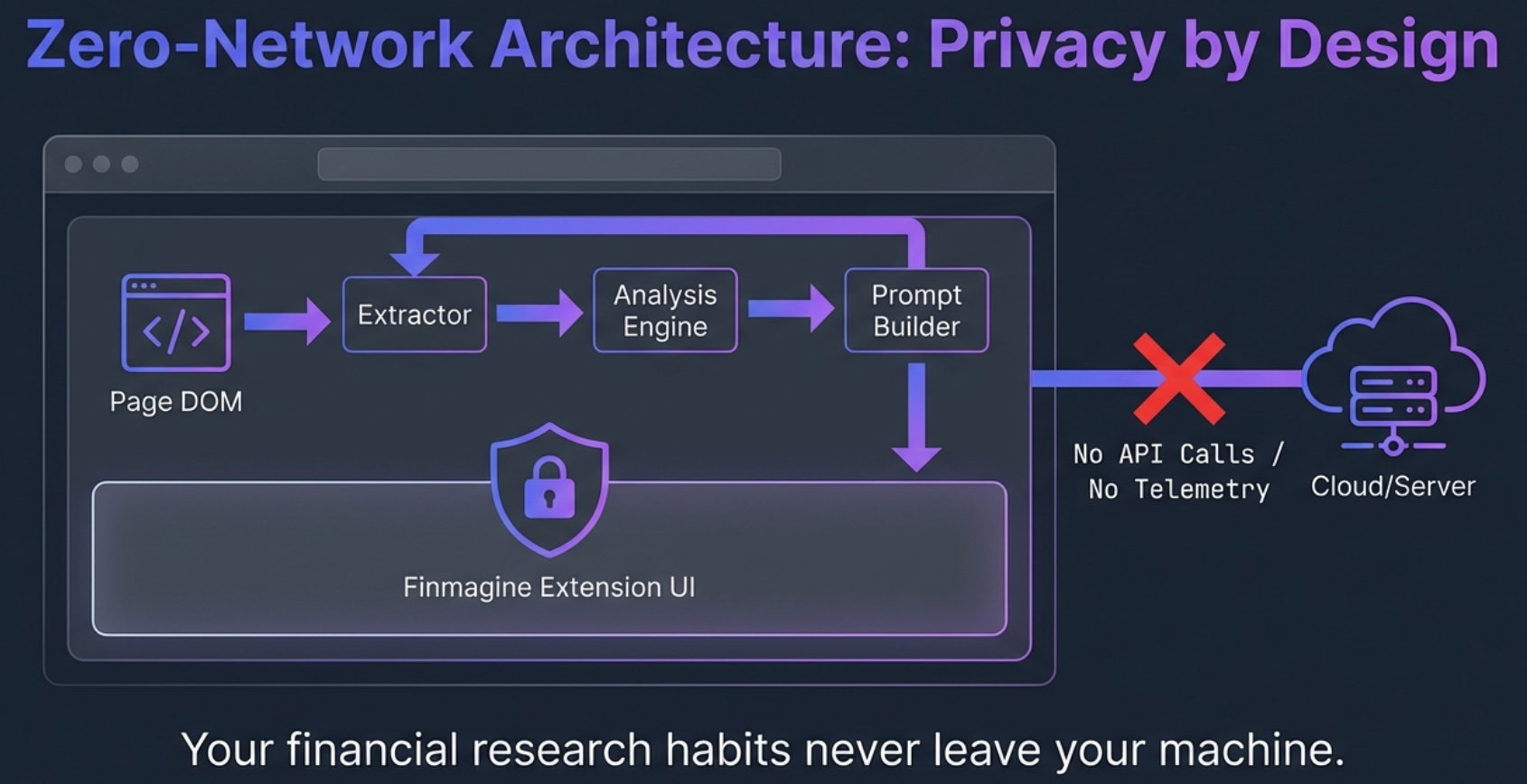

100% client-side processing. No network calls, no analytics, no tracking, no telemetry. Your financial research habits never leave your browser.

Key metrics, 6 financial tables, shareholding patterns, document URLs, pros/cons, sector classification — all extracted on page load in milliseconds.

No subscriptions, no trials, no hidden costs. Institutional-grade analysis workflow completely free for every Indian stock investor.

From raw Screener.in data to AI-ready research prompt in seconds:

Go to any company on Screener.in (e.g., TCS, HDFC Bank, Polycab). The extension activates automatically and extracts all visible data — key metrics, financial tables, shareholding patterns, document links, pros/cons, and sector classification.

Pick from 5 specialized templates depending on your question. Need a complete thesis? Comprehensive Analysis. Worried about risks? Risk-Reward. Want forensic due diligence? Deep Research. The analysis engine runs on first click, computing health scores, CAGRs, and DuPont decomposition.

Copy the generated prompt (edit it first if you want to add custom instructions), open the Finmagine Custom GPT, and paste. The GPT — pre-loaded with Finmagine's Five-Parameter scoring methodology — produces institutional-grade research in minutes.

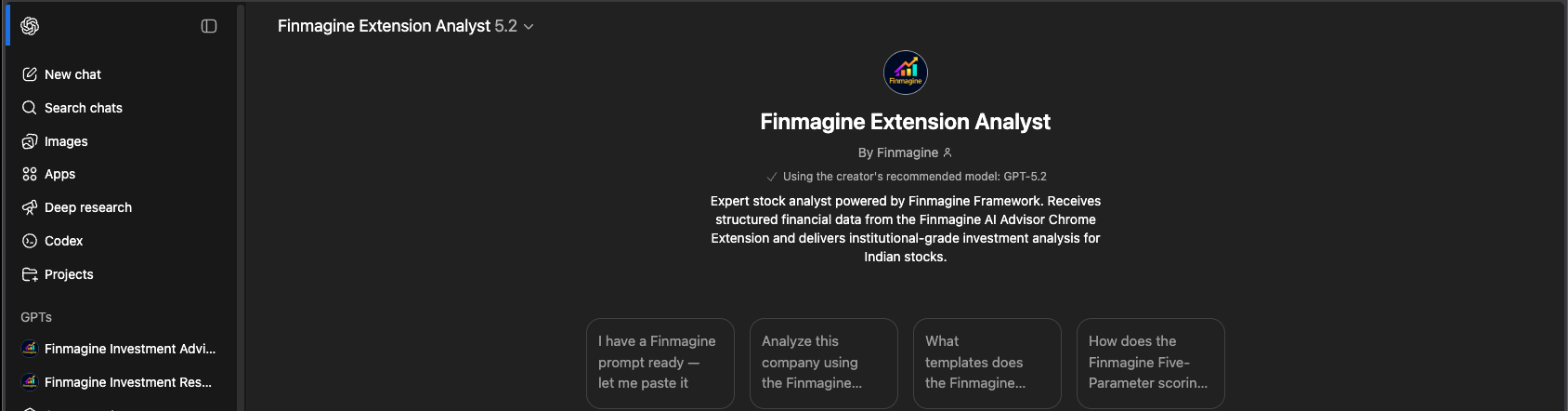

The Finmagine Extension Analyst — a purpose-built Custom GPT running on GPT-5.2 with the Five-Parameter scoring methodology baked into its knowledge base

Each template is a different lens to examine a company through. Pick the one that matches your current question:

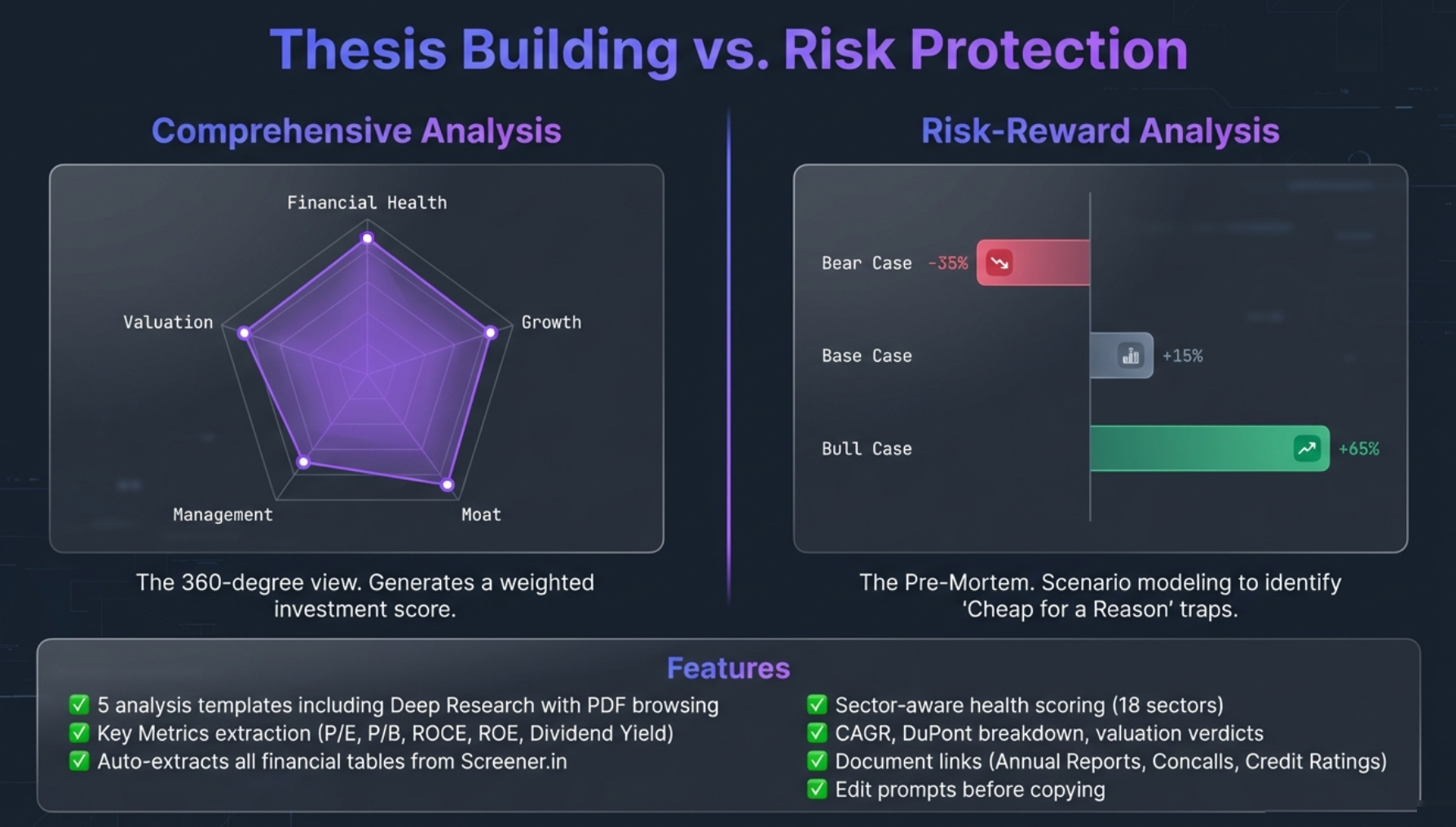

Full 360-degree investment thesis using the Five-Parameter Weighted Scoring Framework. Financial Health, Growth, Competitive Position, Management Quality, and Valuation — each scored 2-10 with a weighted composite.

GPT time: 2-3 min | Best for: First look, thesis building

Identify material risks across 5 dimensions and model probability-weighted Bull/Base/Bear return scenarios. Includes "Cheap for a Reason" detection and margin of safety assessment.

GPT time: 2-3 min | Best for: Pre-buy assessment, value trap detection

12-quarter Promise vs. Delivery tracking, capital allocation efficiency, governance assessment, and the Management Integrity Matrix. Catches "Metric Shopping" red flags.

GPT time: 3-5 min | Best for: Leadership evaluation, family-run companies

Sequential quarterly trend analysis, earnings quality checks, margin trajectory, and forward guidance extraction. Answers: Is quarterly momentum supporting or diverging from the annual story?

GPT time: 2-3 min | Best for: Post-earnings check, monitoring holdings

The GPT goes beyond the prompt data — it browses and reads actual BSE PDFs including concall transcripts, investor presentations, and annual reports. Produces a 9-part forensic analysis: Sector Context, Financial Forensics, PPT Analysis (12 quarters), Concall Transcript Analysis (12 quarters), Annual Report Forensics, Management Integrity Scorecard, News & Competition, Growth Triggers, and Final Verdict.

GPT time: 15-30 min | Best for: Full due diligence before significant investment

Generic stock screeners apply the same rules to every company. The AI Advisor has 18 distinct sector profiles, each with its own relevant metrics, disabled metrics, and customized thresholds. When the extension detects the company's sector from the Peer Comparison breadcrumb, everything downstream adjusts automatically.

| Sector | Primary Valuation | Special Handling |

|---|---|---|

| Banking | Price-to-Book (P/B) | NIM, GNPA, CASA; skip D/E; negative CFO is normal |

| NBFC | Price-to-Book (P/B) | NIM, GNPA, ROA; D/E threshold raised to 7.0 |

| IT Services | P/E Ratio | Attrition, TCV deal wins; skip D/E, Current Ratio |

| Pharma | P/E Ratio | R&D pipeline, ANDA filings, FDA risk, gross margin |

| Metals & Mining | EV/EBITDA | Cyclical handling; P/E unreliable |

| Infrastructure | EV/EBITDA | Interest coverage, order book-to-revenue |

| FMCG | P/E Ratio | Volume vs. price-led growth, brand premium |

| Real Estate | P/E + NAV | Pre-sales, collections; revenue lags activity |

Plus 10 more sectors: Telecom, Utilities, Chemicals, Auto, Capital Goods, Textiles, Consumer Durables, Insurance, Healthcare, and a General fallback.

Before GPT even sees the data, the extension's analysis engine computes insights that don't exist on the Screener.in page:

Starts at 50 (neutral). Adds bonus points for strong revenue/profit CAGR, high ROE/ROCE, positive cash flow, debt-free status, and sector-specific metrics. Deducts for each concern identified. Color-coded badge: Excellent, Good, Average, Below Average, Poor.

Revenue, Profit, and EPS growth rates at 1-year, 3-year, 5-year, and 10-year horizons. No manual calculation needed — the extension pulls start and end values from the tables automatically.

ROE = Net Profit Margin × Asset Turnover × Equity Multiplier. Reveals whether returns are driven by genuine profitability, operational efficiency, or financial leverage. A 25% ROE from leverage is very different from one from margins.

Sector-aware valuation assessment using the right metric for each industry — P/E for IT, P/B for banks, EV/EBITDA for metals. Compares current multiples against 5-year median and peer benchmarks.

Automated identification across growth, profitability, leverage, cash flow, and shareholding dimensions. Each finding feeds into the health score and is included in the prompt for GPT context.

Up to 12 quarters of concall transcripts (with separate Transcript, PPT, and Recording links), annual reports, credit ratings, and announcements — all URLs extracted and ready for Deep Research.

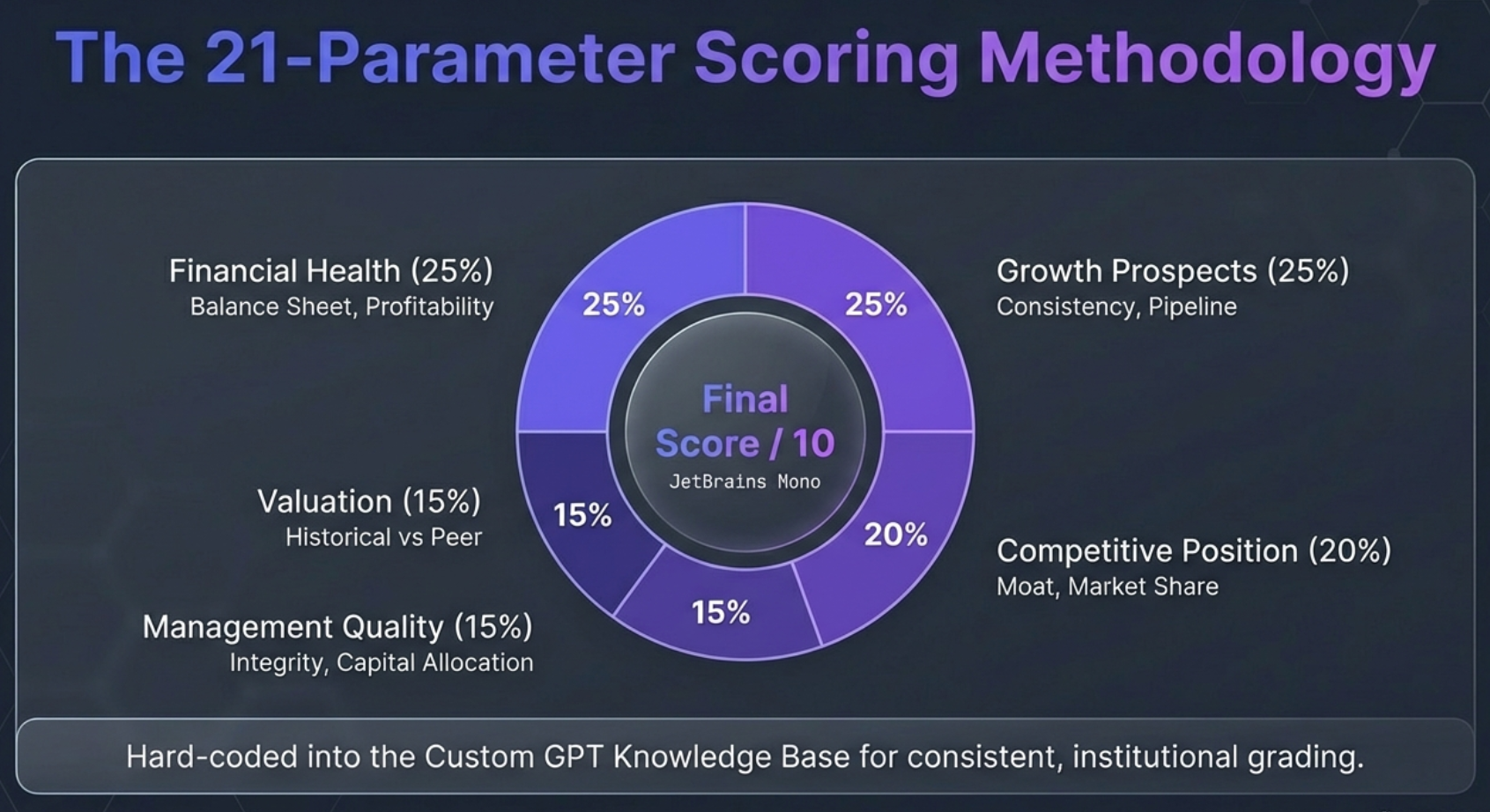

The Custom GPT doesn't produce ad-hoc analysis. It follows the Finmagine Five-Parameter Weighted Scoring Framework — hard-coded into its knowledge base for consistent, institutional-grade output. This framework evolved from Finmagine's Ranking Methodology, the same battle-tested system used to evaluate 71+ companies across the platform:

| Parameter | Weight | What It Measures |

|---|---|---|

| Financial Health | 25% | Balance sheet strength, profitability metrics, cash flow generation |

| Growth Prospects | 25% | Historical CAGR consistency, future potential (TAM), business scalability |

| Competitive Position | 20% | Market share leadership, economic moats, industry structure |

| Management Quality | 15% | Leadership track record, capital allocation, corporate governance |

| Valuation | 15% | Current multiples, historical context, peer comparison |

Valuation is deliberately weighted at only 15%. The framework prioritizes business quality (Financial Health + Growth + Competitive Position = 70%) over the price you're paying. A great company at a fair price will compound wealth over time. A mediocre company at a cheap price is often cheap for a reason.

Each parameter is scored 2-10. The weighted composite determines the verdict: 8.0-10.0 Exceptional, 7.0-7.9 Strong, 6.0-6.9 Above Average, 5.0-5.9 Average, Below 5.0 Below Average. Every analysis concludes with an investment classification (Core Portfolio Compounder, Tactical Opportunity, or Watchlist) and position sizing guidance.

P/E, P/B, Price, Market Cap, ROCE, ROE, Dividend Yield, Debt/Equity, Book Value, 52-week High/Low, and more from the top ratios section.

6 complete tables: Annual P&L (12 years), Balance Sheet, Cash Flow, Ratios, Shareholding Pattern, and Quarterly P&L (11 quarters).

About section, Pros & Cons, Sector & Industry classification from Peer Comparison breadcrumb, BSE/NSE codes.

Annual Reports, Concall Transcripts (12 quarters with separate Transcript/PPT/Recording links), Credit Ratings, Announcements.

Replace hours of manual due diligence with a structured, repeatable, sector-aware research workflow. Run Comprehensive Analysis on your shortlist, Deep Research on your top picks.

Use the extension as a rapid first-pass filter. The health score and pre-computed CAGRs save time. The structured prompt ensures consistent analytical coverage across your universe.

Learn institutional-grade analysis methodology by seeing it applied to real companies. The Five-Parameter Framework, DuPont decomposition, and sector-aware thinking are core curriculum concepts brought to life.

Generate structured research as a starting point for stock write-ups. The Management Quality template provides unique "Promise vs. Delivery" content that readers love.

The information edge is gone — everyone sees the same Screener.in data. The analytical edge is collapsing — the AI Advisor automates what institutions do with dedicated teams. The behavioral edge remains — and that's the one edge AI can't replace.

AI gives you intelligence. Discipline builds wealth.

Everything you need to master the AI Advisor extension:

The definitive tutorial covering the architecture, all 5 templates, sector-aware intelligence, health scoring, DuPont ROE, the 21-parameter methodology, and real company examples (TCS, HDFC Bank, Polycab). Includes video guide, audio deep dive, and 56 interactive flashcards.

Complete transparency on data handling. See our zero-collection guarantee and understand exactly how the extension processes data locally in your browser.

We don't collect, store, or transmit ANY of your data. The extension operates entirely locally within your browser. No tracking, no analytics, no external API calls.

Yes! 100% free with no trials, subscriptions, or hidden costs. We built this to democratize institutional-grade research for every Indian investor.

The AI Advisor doesn't just chat — it extracts all financial data from the Screener.in page, runs sector-aware analysis with 18 industry profiles, computes health scores and DuPont decomposition, and assembles everything into a structured prompt optimized for the Finmagine Custom GPT. The GPT has the Five-Parameter scoring methodology baked into its knowledge base. You can't get this quality by just asking ChatGPT "analyze TCS."

It's a specialized ChatGPT instance pre-loaded with Finmagine's 21-parameter analysis methodology, sector-specific valuation frameworks, and institutional-grade scoring rubrics. The extension generates the data; the GPT applies the methodology. Together, they produce research that rivals institutional output.

Yes. The prompt includes real BSE filing URLs for concall transcripts, investor presentations, and annual reports. When you paste it into the Custom GPT (which has web browsing capability), it opens and reads those documents as part of its 9-part forensic analysis. This takes 15-30 minutes because thoroughness requires time.

Currently, the extension is optimized exclusively for Screener.in company pages. It activates only on screener.in/company/* URLs.

No registration required. Install and start using immediately.

Chrome and all Chromium-based browsers (Edge, Brave, Opera).

Yes. The Edit button toggles the prompt between read-only and editable mode. Add custom instructions, focus areas, or specific questions before pasting into GPT.

Install the extension. Visit a company page. Generate institutional-grade research in minutes.

Download Free Extension Read the Deep DiveNo credit card required • No registration • 100% Free Forever