🎓 Multimedia Learning Hub

Master the Manual FD Compounding Strategy through video, audio, comprehensive learning overview, and interactive flashcards

📚 Complete Learning Path

This comprehensive strategy reveals how to transform your passive Fixed Deposits into active wealth-building engines. You'll discover the manual monthly compounding protocol that forces 12 compounding events per year (vs the bank's 4), master the booster strategy that supercharges growth, and learn the 30th Rule to manage multiple FDs without chaos.

🎯 What You'll Master:

- The Default Trap: Why cumulative FDs leave money on the table with quarterly compounding

- The Float Problem: How banks profit from holding your interest in limbo

- Monthly Payout Selection: The critical toggle switch that enables the entire strategy

- Interest-on-Interest Loop: Creating ₹35, then ₹68, then ₹103 in cascading returns

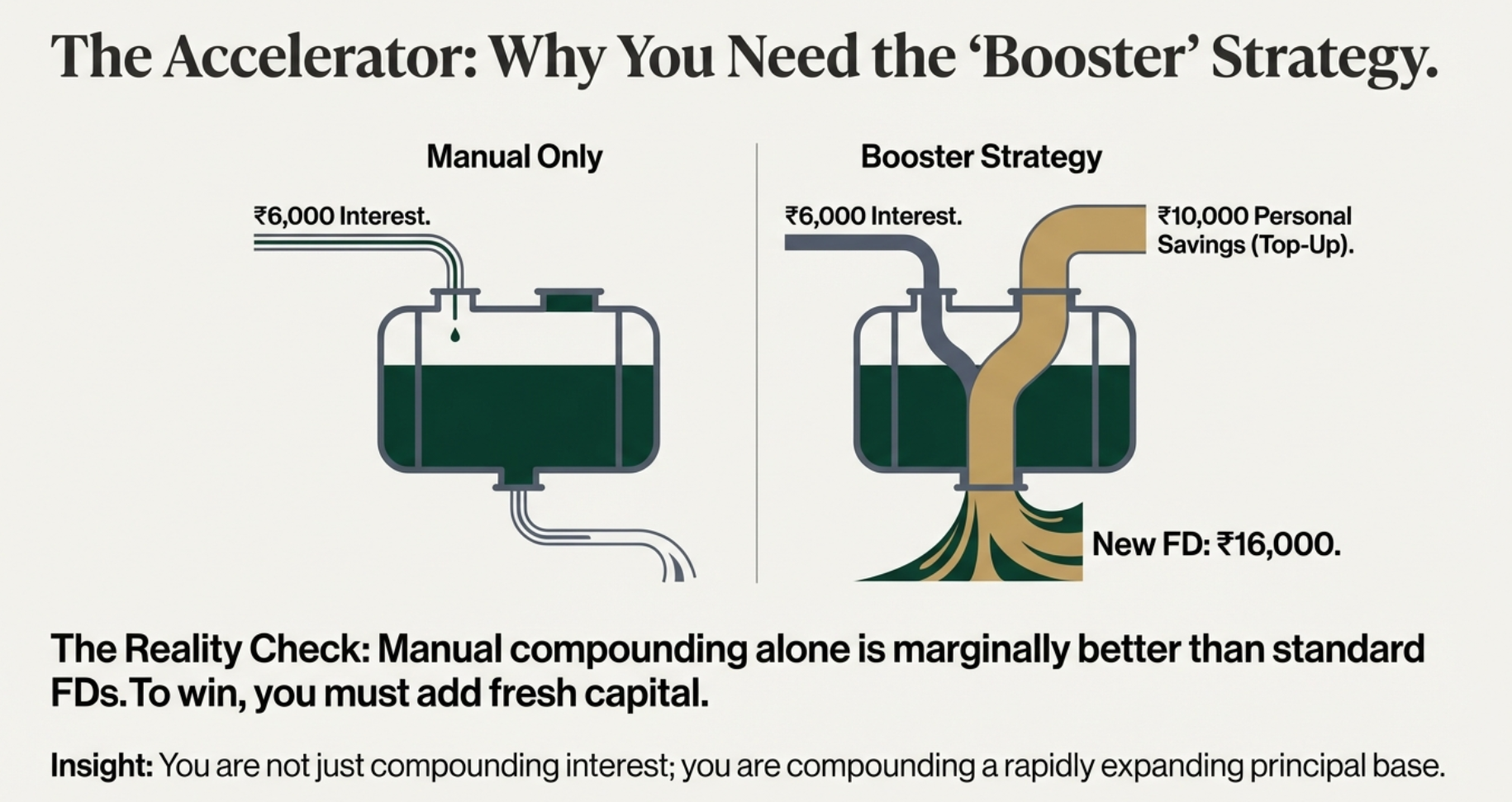

- The Booster Strategy: Adding ₹10,000 monthly savings to turn ₹70K into ₹1.9 Lakh+

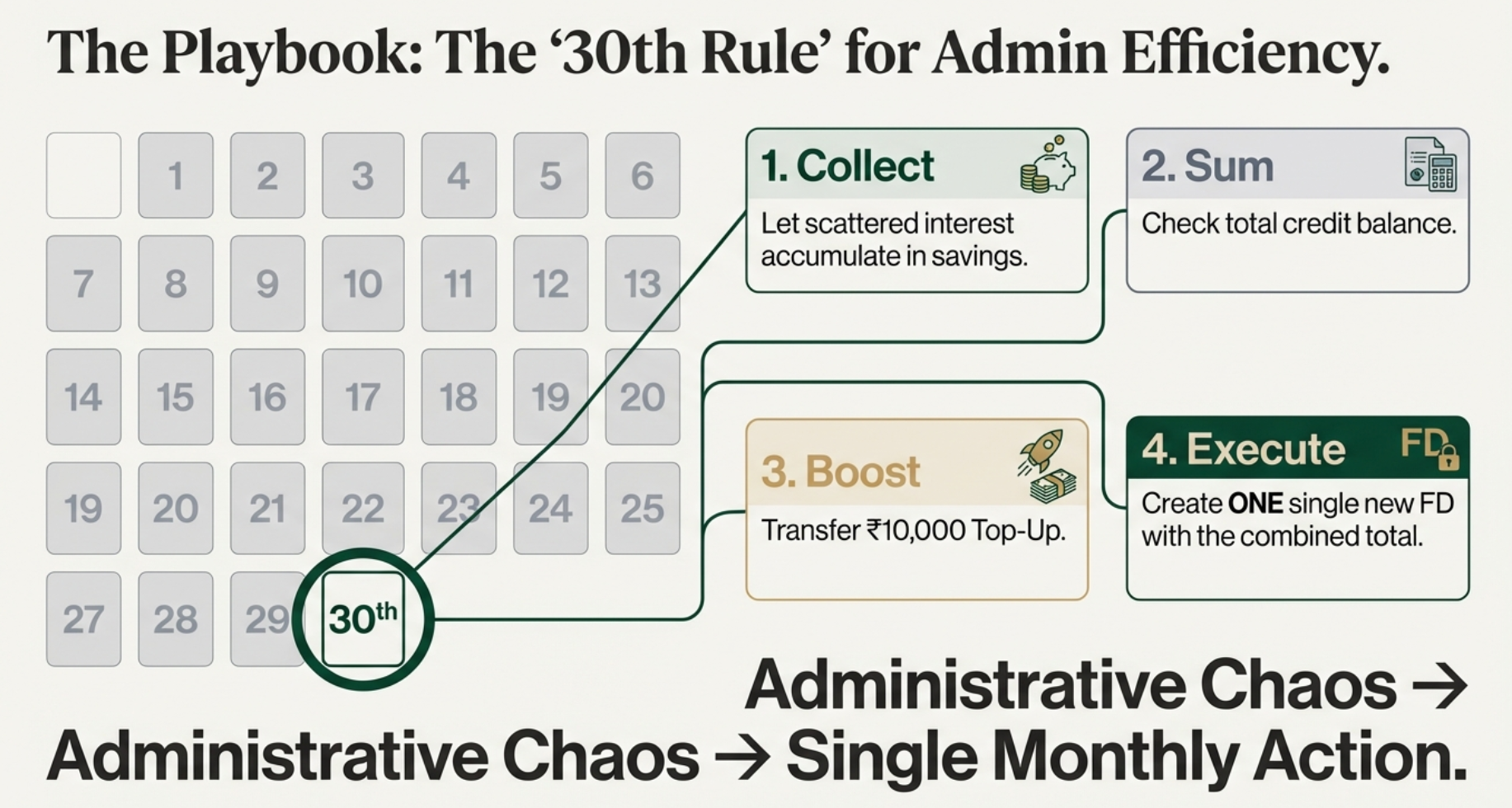

- The 30th Rule: Managing 12+ FDs with a single 15-minute monthly ritual

- TDS Management: Handling 10% tax deduction and claiming refunds (if income < ₹12L)

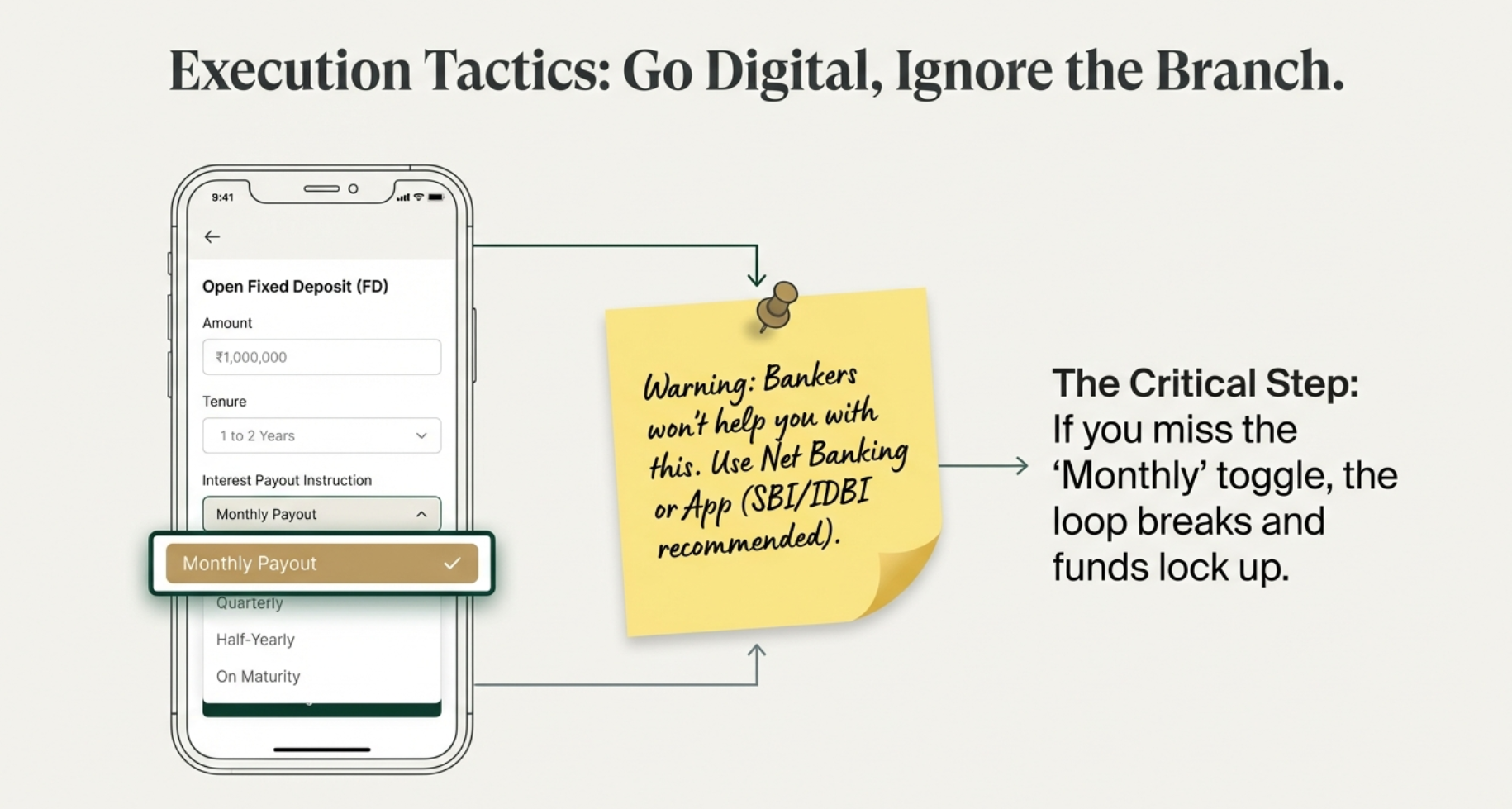

- Banking App Setup: SBI/IDBI digital execution without visiting branches

- Real Projections: ₹10L at 7% - month-by-month growth breakdown

- FD vs RD vs Debt Funds: When this strategy outperforms alternatives

💡 Key Insights:

- Standard FDs compound quarterly (4x/year) - This strategy forces monthly (12x/year)

- Interest-only reinvestment adds ~₹420/year - marginal improvement

- Booster strategy (₹10K/month top-up) creates 2.7x larger asset base

- The magic isn't just the rate - it's disciplined capital injection into compounding

- 10% TDS reduces reinvestment but booster compensates the drag

- Flexibility beats rigidity: Manual > RD for variable income savers

📖 Learning Recommendations:

- Start with the video guide to see the strategy explained visually

- Listen to the audio deep dive for complete philosophical understanding

- Study all 12 visual diagrams from the FD Velocity Protocol

- Review the month-by-month projection table to understand growth trajectory

- Test your knowledge with 40 interactive flashcards covering all concepts

- Set up your first monthly payout FD using the execution checklist

📺 Complete breakdown of the Manual Compounding FD Strategy with real examples and banking app walkthrough

🎧 Deep dive conversation exploring the philosophy and mechanics of manual FD compounding

🎯 Test Your Knowledge

Click any flashcard to reveal the answer. Use the search box to find specific topics.

The Fixed Deposit Paradox

Let me ask you a simple question: Are your Fixed Deposits really working as hard as they could be?

For most of us, FDs are the financial equivalent of comfort food. Safe. Predictable. Boring. We set them, forget them, and collect the interest at maturity like clockwork. But here's the uncomfortable truth most banks won't tell you:

Your "safe" Fixed Deposit is slowly losing purchasing power.

So the mission for today is to plug that leak. We're going to explore a strategy that claims to turn this boring, passive vehicle into an active wealth-building engine.

The source material calls it the FD hack—specifically, a combination of manual monthly compounding and something they call the booster strategy.

🔒 The Manual Compounding Protocol

Most investors treat Fixed Deposits as 'park and forget' assets. This visual outlines a manual intervention strategy—The Active Wealth Engine—that converts a passive savings instrument into a monthly compounding machine. It moves from the bank's default quarterly schedule to a user-controlled monthly cycle.

The Default Trap: Why Cumulative FDs Leave Money on the Table

Let's start with the enemy—or at least the status quo—the lazy FD. The default setting. The one you get if you don't do anything.

When you walk into a bank today or log into your app and create an FD with ₹10 lakhs, what happens in 99% of cases?

⏰ Lost Opportunity Cost: The Cumulative Trap

The Status Quo (Standard FD):

- Banks compound quarterly (4 times/year)

- Your interest sits in the bank's ledger during "idle capital" months 1-3

- You earn nothing on that waiting money in February and March

- It's "dead money" waiting in the lobby for the quarter to end

The Manual Protocol:

- Forces a compounding event every 30 days (12 times/year)

- Continuous flow eliminates the lag and waiting period

- You take January interest and put it to work immediately in February

- Stealing time back from the bank - shortening the feedback loop

The Cumulative Option: How It Works

Unless you specifically intervene, you're signing up for the cumulative option (sometimes called the maturity option). Here's what happens:

- You give the bank your ₹10 lakh rupees

- They lock it away for a specific term (let's say one year)

- The bank calculates interest on that money

- Every three months, they add the interest to your pile in their own ledgers

- You don't see a dime of cash flow until the FD matures at the end of the year

It's a black box. You put money in, wait a year, and get a lump sum out. That's it.

The Float: Why Banks Love This

You have to look at this from the bank manager's perspective. It all comes down to a concept called the float.

When you tick that cumulative box, you are essentially giving the bank a free, interest-free loan on the interest they already owe you.

That is the fundamental business model of a bank. They want to hold onto cash for as long as possible. The cumulative option helps them do that perfectly.

Flipping the Switch: Monthly Payout vs. Cumulative

🔄 The Critical Toggle: Monthly Payout Selection

DEFAULT SETTING - Cumulative Option:

- Interest is locked until maturity

- Compounding is controlled by the bank's schedule

- You have zero control over when interest is realized

REQUIRED SETTING - Monthly Interest Payout:

- Cash is released to Savings Account every 30 days

- You take possession and decide what happens next immediately

- Example: Principal ₹10,00,000 at 7% → Output ~₹6,000/month (Liquid)

The active FD strategy is designed to flip this on its head. What's the fundamental shift?

The shift is one click. It's moving from cumulative to monthly interest payout.

So instead of the bank keeping the interest, you're telling them: "Send it to my savings account. Every month."

But Wait—Doesn't This Break Compounding?

This is the number one intuitive reaction. If I take the money out, isn't that bad for compounding? I thought the whole point was leaving it alone so it can grow—Einstein's eighth wonder of the world and all that.

If you take that cash and go buy a pair of sneakers or pay for a nice dinner, you have absolutely broken the machine. You've just turned an investment into pocket money.

But that's not what we're doing.

The difference is that this strategy is not about spending it. This is about taking possession of the cash so that YOU can decide what happens to it next—immediately.

The Mechanics: Creating the Interest-on-Interest Loop

🔄 The Compounding Chain Reaction

This diagram shows how the interest cascade builds momentum:

- Primary FD (₹10L) → Month 1 Payout: ₹6,000

- New FD #1 (₹6,000) → Month 2 Yield + Interest from FD #1 (₹35)

- New FD #2 (₹6,035) → Contains both main payout + previous interest

- Key Insight: You are earning interest on interest that—under a standard plan—wouldn't have been credited to you yet

The bank won't do this for you automatically. You can't just call them up and say, "Hey, can you compound my FD monthly for me?"

They don't generally offer that product. Why would they? It increases their administrative cost and, more importantly, it reduces their float.

So you have to do it manually. You have to become the engine of your own compounding.

The Monthly Ritual: Real Numbers

Let's get into the weeds with real calculations because this is where it becomes real.

We're sticking with the ₹10 lakh example at 7%:

- Annual Interest: ₹70,000 (simple math: ₹10,00,000 × 7% = ₹70,000)

- Monthly Breakdown: ₹70,000 ÷ 12 = ₹5,833 per month (let's round to ₹6,000 for conversational purposes)

Month 1

Ping. ₹6,000 rupees hits your savings account. You immediately log into your banking app and open a new FD for that ₹6,000 rupees. A tiny FD. A little baby FD. A soldier reporting for duty.

Now you have your big FD (the ₹10 lakh one) and your new baby FD (the ₹6,000 one).

Month 2

You get the big payout from your main ₹10 lakhs again—another ₹6,000. But you ALSO get interest from that tiny Month 1 FD.

Let's do the math: 7% on ₹6,000, but for one month, so divided by 12 = about ₹35 rupees.

Month 3

You get the main ₹6,000 again. You get ₹35 interest on the Month 1 FD. You get another ₹36 on the Month 2 FD. And here's the beautiful inception part: you get interest on the interest that the Month 1 FD earned last month. It's minuscule, but it's there.

The snowball is starting to roll.

🔬 The Micro-View: Month-by-Month Breakdown

This table shows the "interest on interest" progression:

- Month 1: Base Yield ₹5,833 + New Interest ₹0 = Total Reinvestment ₹5,833

- Month 2: Base Yield ₹5,833 + New Interest ₹34 = Total Reinvestment ₹5,867

- Month 3: Base Yield ₹5,833 + New Interest ₹68 = Total Reinvestment ₹5,901

- Month 4: Base Yield ₹5,833 + New Interest ₹103 = Total Reinvestment ₹5,936

By manually cycling, you create velocity. While the static gain is small (~₹420/year extra), this mechanism builds the infrastructure for the Booster Strategy.

The Brutal Honesty: Interest-Only Is Underwhelming

If you only do this—if you only reinvest the interest and you don't add any of your own money—the math is frankly underwhelming.

The source calculates that you end up with an extra ₹420 or so at the end of the year compared to just getting the simple interest payouts.

₹420 rupees for a whole year of clicking buttons once a month.

And here's the real kicker: If you compare this strict interest-only manual method against the standard bank quarterly compounding method (the ₹71,859 one), the standard bank method might actually beat it slightly, or you'll break even.

Why? Because the bank's automated system is perfect. It compounds on the gross amount perfectly on time down to the second. You, as a human, might have a day of lag here, a rounding error there.

So why are we doing this episode?

Because the manual structure is not the end goal. It's the means to an end. It allows you to do something that the standard cumulative structure absolutely forbids.

The pivot. The booster.

The Acceleration: The Booster Strategy

🚀 The Game-Changer: Fresh Capital Injection

This diagram reveals the secret sauce:

- Passive Flow: ₹6,000 monthly interest (in JetBrains Mono Medium font)

- Active Injection (The Booster): ₹10,000 personal savings added monthly

- New Compounding Base: ₹16,000 combined total each month

- Result: Accelerated growth curve - you're compounding on a principal base that expands by ₹16,000+ every month

The manual protocol allows you to inject fresh capital into the compounding cycle—something impossible with a locked Cumulative FD.

This is where it gets interesting. This is the difference between a savings account and a genuine wealth engine.

The Limitation of Standard FDs

Let me explain the limitation of the standard FD again, just so we are crystal clear on why we can't do this the easy way.

A standard FD is a vault. It's a sealed vault.

You put ₹10 lakhs in, the door shuts, it's locked for a year. Now, if next month you have a great month and you save ₹5,000 from your paycheck and you think, "Hey, I want to add this to my FD to get that great 7% rate," the bank says NO.

You cannot top up a fixed deposit. It is a fixed contract for a fixed amount. That's why it's called fixed.

So that ₹5,000 rupees just sits in your savings account earning 2.7%, maybe 3% if you're lucky. It's lazy money. It's sitting on the sidelines, losing to inflation every single day.

The Manual Advantage

But with the manual monthly strategy, think about what you are already doing every single month:

- You are already logging in

- You are already in the system

- You are already creating a new FD for your interest payout

- Your fingers are on the keyboard

So since you are creating a new contract every month anyway, you can make that contract whatever size you want. You are not limited to just the interest amount you received.

You take your ₹6,000 rupee interest payout and you grab that ₹10,000 rupees you saved from your salary, and you combine them. You create a new FD for ₹16,000 rupees.

Boom. That's the move. That is the entire game right there.

The Math Changes Dramatically

- Month 1: You have a new ₹16,000 rupee asset working for you at 7% (not just ₹6,000)

- Month 2: You get your main interest PLUS interest on ₹16,000, not ₹6,000. Then you add another ₹10,000 of your savings. The new FD is even bigger.

- The base is expanding exponentially. You're not just letting it grow on its own—you're actively building it wider and taller.

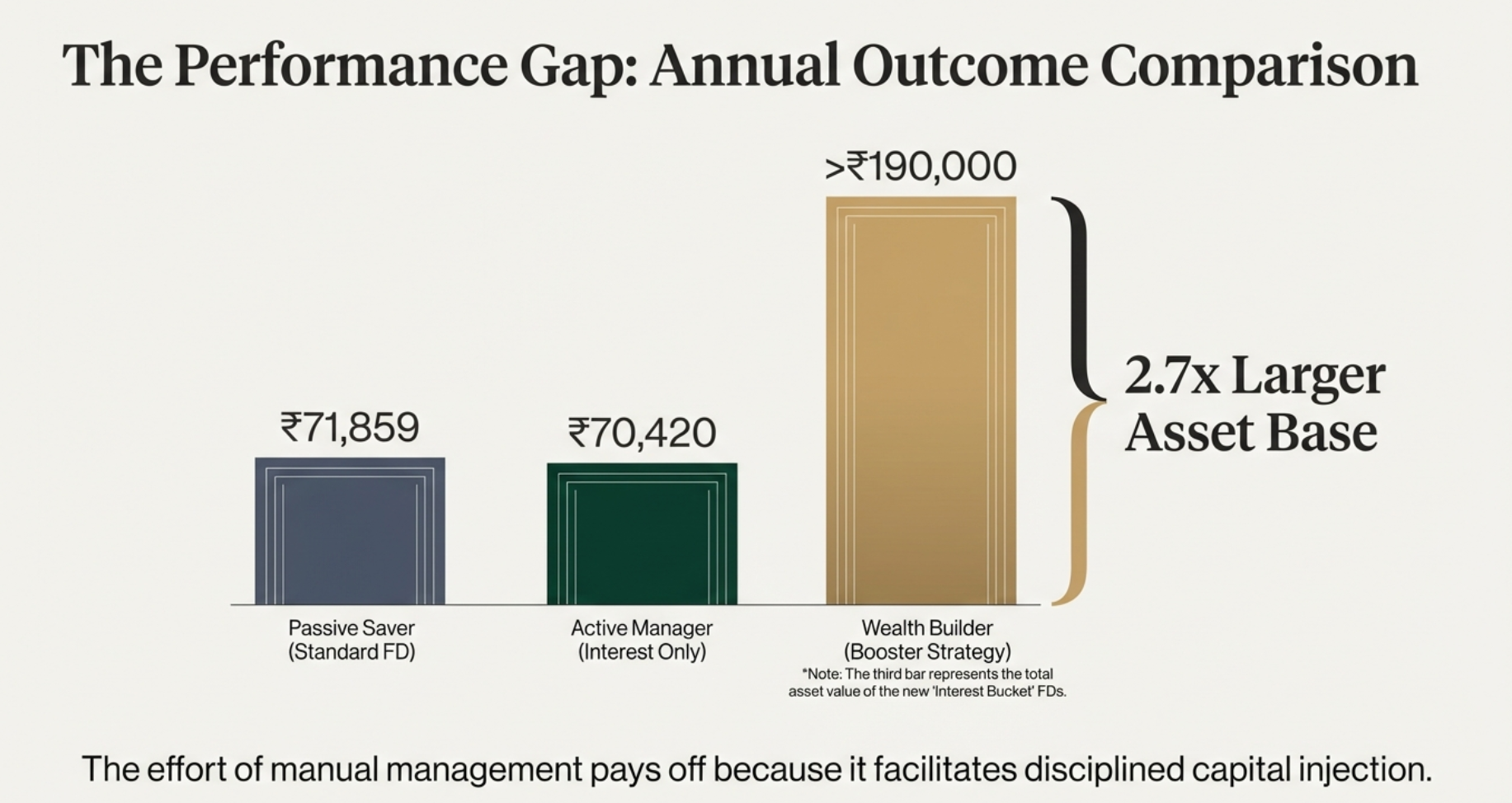

📊 The Performance Gap: Annual Outcome Comparison

This chart makes the case crystal clear:

- Standard FD (Passive): ₹71,859 in total interest after one year

- Manual Reinvest Only: ₹70,420 in value of new FDs (similar to standard)

- Manual + Booster: >₹190,000 in value of "Interest Bucket" FDs

- 2.7x Accumulation: The magic isn't just the rate—it's the disciplined injection of capital into a compounding engine

By combining savings with the engine, you more than double the accumulated capital.

The Comparison Numbers

Let's hit you with the comparison numbers, because this is the aha moment:

Imagine two people, both starting with ₹10 lakhs:

| Investor Type | Strategy | Year-End Result |

|---|---|---|

| Person A | Passive investor: ₹10L in cumulative FD, set and forget | Principal + ~₹71,859 interest |

| Person B | Booster investor: ₹10L FD with monthly payout + ₹10,000 monthly top-up | Principal + secondary FDs worth >₹190,000 |

From ₹71,000 to ₹190,000.

Now, we have to be completely transparent here. A huge chunk of that ₹190,000 is your own money. It's the ₹120,000 you saved (₹10,000 × 12 months). Sure. But that's the whole point!

That ₹120,000 wouldn't have been compounded at 7% otherwise. It would have been sitting in your savings account earning peanuts.

This strategy gives your active savings a high-yield home immediately.

Execution Protocol: The "30th Rule"

📅 Managing the Chaos: Single Monthly Action

This calendar-based workflow diagram shows the elegance of consolidation:

- Throughout the month: Interest from FD 1, FD 2, FD 3 accumulates in savings (you do nothing)

- On the 30th: Consolidate all credits, add ₹10K booster, create ONE new FD

- Result: You manage multiple FDs with a single 15-minute monthly ritual instead of constant logins

Managing multiple FDs is chaotic. We consolidate actions to a single day. Wait for credits to accumulate, sum them up on the 30th, inject the Booster, and execute one single transaction.

My brain is starting to hurt thinking about the paperwork—the digital paperwork. You're right. Month 1, I have one extra FD. Month 2, two extra FDs. By the end of month 12, do I seriously have 12 new FDs plus the main one?

And then next year it's 24? It sounds like my banking app is going to look like a CVS receipt. Just endless.

It absolutely could look messy if you don't have a system. If you have FDs maturing on the 3rd of the month, the 7th, the 12th, the 21st, you will spend your whole life logging into your banking app. You'll miss dates. You'll lose track. It will become a part-time job.

Which is why the source proposes a very elegant solution: The 30th Rule.

How the 30th Rule Works

It's basically a batching process. Digital hygiene. The rule is simple:

You designate one single admin day per month. The source suggests the 30th, but it can be any day that works for you.

Why the 30th Specifically?

It aligns with the natural rhythm of most people's cash flow. It's the end of the month. You've likely just been paid your salary. You're feeling rich for a day or two before the bills hit. This is the "pay yourself first" principle in action—before the money gets allocated elsewhere.

The Workflow on the 30th

- Throughout the month: You get those little notifications on your phone. Ding. ₹6,000 rupees interest credited. A few days later, ding. ₹35 rupees credited. Then ding. ₹70 rupees credited. You do absolutely nothing. You let them accumulate in the savings account. You resist the urge to log in.

- On the 30th: Your scheduled admin day. You pour yourself a cup of coffee. You log in once—just once.

- Check the total: You look at the total accumulated interest sitting there in the savings account. Maybe it's ₹6,105 rupees total from five different little FDs that paid out that month.

- Transfer your booster: That ₹10,000 rupees you've set aside from your salary into that same savings account. Now you have ₹16,105 rupees sitting there ready to go.

- Make one move: You create one single new FD with that combined total. One transaction. Done.

So you're not creating a dozen tiny FDs every month. You're creating one new consolidated significant FD every month.

After a year, yes, you will have 12 additional FDs, but they are substantial ones—₹16,000, ₹17,000, ₹18,000. They're real chunks of capital, not digital crumbs.

More importantly, you have organized the whole process into one 15-minute task per month. That feels manageable. Twelve distinct investments over a year isn't crazy at all.

The Tax Reality: Managing TDS Friction

💰 The Tax Deduction Reality

This "water tank" diagram visualizes the TDS impact:

- Gross Monthly Payout: ₹5,833

- TDS Threshold: >₹50k Interest/Year triggers 10% deduction (~₹583/month)

- Net Reinvestment: ₹5,250 (what you actually receive to reinvest)

Reality Check: Taxes reduce monthly cash flow. However, the 'Booster' injection (₹10k) ensures your new monthly FD remains substantial (₹15,250+) despite the tax cut, maintaining momentum.

Now we have to talk about the friction—the thing that slows the whole wheel down. Taxes. The inevitable TDS (Tax Deducted at Source).

Understanding TDS on FD Interest

If we're talking about a ₹10 lakh FD at 7%, we are earning ₹70,000 a year in interest. The government's threshold for TDS on interest income is, for most people, ₹50,000 rupees per year.

We are way over the limit.

This means the bank is legally required to skim 10% off the top of your interest before they even give it to you.

Going back to our example: Your ₹5,833 rupee monthly payout—you don't actually see that full amount in your savings account. The bank does the math: 10% of ₹5,833 is about ₹580 rupees.

What you'll actually see credited is roughly ₹5,250 rupees. The bank keeps that ₹580 and sends it directly to the income tax department on your behalf.

Does TDS Kill the Strategy?

Ouch. That really slows the snowball down, doesn't it? If I'm in the 30% tax bracket, which a lot of our listeners might be, it's not just the 10% TDS. I owe the government another 20% on that interest at the end of the year. My 7% return is effectively 4.9%.

At 4.9%, why am I doing all this work? Why not just put the money in a debt mutual fund where I can defer the taxes until I withdraw?

This is the heavyweight debate. This is the classic debt funds versus FDs argument.

🔄 TDS Recovery Cycle

This flowchart shows the refund mechanism:

- TDS Deducted (Monthly) → ITR Filing (End of Year)

- If Annual Income < ₹12 Lakhs → Refund Credited

- TDS is not necessarily a permanent cost - treat it like LTCG or STCG

- Even if not refunded, the strategy (with Booster) outperforms passive holding due to the capital accumulation habit

Two Reasons Why TDS Doesn't Ruin the Hack

Reason 1: Refunds

That TDS money isn't necessarily gone forever. TDS is just an advance tax payment. If your total annual income falls below the taxable limit or in a lower slab (the source mentions a figure around ₹12 lakhs as a reference point where you might get some back), you can claim that entire 10% back when you file your income tax return (ITR).

So it's a delayed payout. You lose the use of it for a few months, but you get the principal back at the end of the tax year.

You lose the compounding on it for those months (small drag), but you don't lose the capital itself.

Reason 2: The Booster Overpowers It

If you are adding ₹10,000 rupees of your own fresh capital every month, the difference between receiving ₹5,800 in interest and ₹5,200 starts to feel negligible.

The new FD you're creating is going to be ₹15,000+ regardless. The sheer force of your own savings rate—the power of the booster—it just overpowers the friction of the tax.

The Digital Requirement: Why Branches Won't Help

💻 Digital-Only Execution

This visual contrasts the two approaches:

- In-Branch Staff (STOP sign): Default to standard products. Often unaware of manual looping. Will likely set it to cumulative by muscle memory.

- Net Banking/App (Green checkmark): Mandatory for selecting 'Monthly Payout' setting. Required for executing the strategy independently.

Preferred Platforms: SBI, IDBI (or any interface allowing explicit payout selection).

I mentioned earlier that the source says bankers won't explain this. That's true. But the bigger hurdle is that the bankers literally can't help you do this efficiently.

Try walking into a physical bank branch and telling a human teller: "Hi, I'd like to open a new fixed deposit for ₹16,435 rupees. I want the maturity to be for 395 days, and please make sure the interest payout is set to monthly."

They will look at you like you have three heads. They will hate you, and they will probably mess it up. Their system isn't built for that kind of custom instruction. They'll just default it to cumulative out of sheer muscle memory.

This is a DIY job. This strategy is digital only.

You have to use the net banking portal or the mobile app. You have to be in the driver's seat.

Banking App Requirements

The source material mentions using banks like SBI or IDBI specifically. Why those two?

It seems to be an interface preference from the author of the notes. Some banking apps are very rigid—they only let you pick one year or two years. They hide that monthly payout option deep in some submenu, or they don't offer it at all for smaller amounts.

You need an app that gives you control. You need granular control.

The most important thing is you have to be able to find that toggle switch that says: "Interest Payout: Monthly / Quarterly / Maturity." If you leave that on the default (which is maturity), the whole strategy fails on day one.

Because if it defaults to cumulative, you don't get the cash, you can't add the booster, and the entire chain just breaks.

You need to be the pilot, and you need a plane that gives you access to the controls.

The Execution Checklist: 5 Steps to Implementation

✅ Your 5-Step Implementation Blueprint

- Setup Principal FD: Create ~₹10L FD. ENABLE "Monthly Payout" / DISABLE "Cumulative"

- Automate Flow: Confirm interest credits to Savings Account

- The Ritual: Set recurring calendar alert for the 30th of every month

- The Commitment: Decide on fixed Booster amount (e.g., ₹10,000)

- The Action: On the 30th, sum Interest + Booster → Create ONE New FD

Wealth is not a result of passive waiting. It is a result of active discipline.

Now let's put it all together into a clear, actionable checklist you can follow:

Your Month 1 Action Plan

- Step 1: Open your banking app (SBI, IDBI, or any bank with monthly payout options)

- Step 2: Create your main FD with your principal amount (e.g., ₹10 lakhs) at the best available rate

- Step 3: CRITICAL: Select "Monthly Interest Payout" (NOT cumulative, NOT quarterly)

- Step 4: Verify that interest will be credited to your savings account

- Step 5: Set a recurring calendar reminder for the 30th of each month with the title: "FD Compounding Day"

Your Monthly Ritual (Starting Month 2)

- Step 1 (Throughout the month): Ignore the small interest credit notifications - let them accumulate

- Step 2 (On the 30th): Log into your banking app and check your savings account balance

- Step 3: Note the total interest accumulated (e.g., ₹6,105 from multiple small FDs)

- Step 4: Transfer your monthly booster amount (e.g., ₹10,000) from your salary to savings

- Step 5: Create ONE new FD with the combined total (Interest + Booster)

- Step 6: Select "Monthly Payout" for this new FD as well

- Step 7: Close the app. You're done for the month.

Why It Wins: Discipline > Default Settings

Let's put it all side by side one last time.

| Feature | Standard FD (Passive) | Manual + Booster (Active) |

|---|---|---|

| Initial Setup | Set and forget | 5 minutes to select monthly payout |

| Monthly Effort | Zero (automatic) | 15 minutes on the 30th |

| Compounding Frequency | Quarterly (4x/year) | Monthly (12x/year) |

| Flexibility | Locked - cannot add funds | Full control - add variable amounts monthly |

| Result (₹10L at 7%, 1 year) | ~₹71,859 total interest | >₹190,000 in secondary FDs (with ₹10K/month booster) |

| Psychology | Out of sight, out of mind | Active engagement, visible progress |

On the left, you've got the standard passive FD. It's automatic, sure, but your money is locked up and it's inflexible.

On the right, you have our active booster strategy. It takes a few minutes a month, but you are constantly fueling the fire, adding new capital.

And the result? You don't just get a slightly better return. You create a whole separate pool of new FDs worth over ₹190,000.

It is a fundamentally different and way more powerful outcome.

Your Monthly Workflow: The Cycle of Growth

🔄 The Monthly Cycle Diagram

This circular workflow shows the complete monthly process:

- Invest Principal (Select Monthly Payout)

- Receive Cash (~₹6,000 credited)

- Wait for 30th (Consolidate credits)

- Inject Booster (+₹10,000 Savings)

- Reinvest (Create ONE new FD)

- Repeat Monthly → Exponential growth through continuous cycling

The beauty of this system is its simplicity once you understand the cycle. Every month, you're executing the same simple 5-step process.

It becomes a ritual. A wealth-building ritual that takes 15 minutes a month and compounds not just your interest, but your discipline and financial awareness.

The Final Question: Is It Worth It?

And that really brings us to the final question—the one only you can answer.

You've seen the numbers. You know the strategy. It takes just a few minutes each month to take back control and turn a passive investment into an active growth engine.

Stop leaving your interest idle. Take control on the 30th.

Thanks for reading. If this strategy resonates with you, set up that first monthly payout FD today. Your future self—12 months from now, looking at a portfolio of substantial secondary FDs—will thank you.