📚 Multimedia Learning Hub

Unpack the 2026 Budget through a video deep dive, a learning overview, and 80 interactive flashcards covering every sector and beneficiary stock

📚 Complete Learning Path

This article is a full dissection of the Union Budget 2026 — not the headline summaries, but the real story hiding inside the line items. One ministry saw a +626% budget hike. Another lost 83% of its flagship incentive scheme. The money is moving in directions that contradict almost every popular narrative about India's economic future. We follow it, sector by sector, stock by stock.

🎯 What You'll Master:

- The +626% Number: Why the Ministry of Coal — not Space, not AI — is the budget's single biggest winner, and what coal gasification actually means

- The Energy Hedge: How the government is simultaneously betting billions on coal and on battery storage — the ultimate fiscal hedge

- The Green Transition: Viability Gap Funding for BESS, the duck curve problem, and why ₹1,000 cr unlocks far more than ₹1,000 cr

- Two Shipbuildings: Why naval spending is flat while commercial ports got a 48% hike — economic security over military spending

- Defense Modernization: Aircraft (+31.2%), vehicles (+25.5%), and "other equipment" (+30.5%) — the shift from maintenance to acquisition

- The Tech Plot Twist: PLI slashed by 83%, but Semiconductor Mission 2.0 launched — screwdriver tech is graduating to deep tech

- Infrastructure & Niche Gems: Railways, roads, dairy (+27%), pharma (+12.5%), and the overlooked corners where alpha hides

- The Three Pillars: The meta-narrative that ties every number together — energy security, Make in India 2.0, and capital over consumption

💡 Key Takeaways:

- This budget rewards the builders, not the buyers — factory floors over car dashboards

- BHEL appears as a beneficiary in Coal, Atomic Energy, and Mining — the picks-and-shovels play of the entire budget

- The EV consumer subsidy was cut, but the EV manufacturing PLI was doubled — a supply-side, not demand-side, budget

- Coal India is a dual beneficiary across both the Ministry of Coal (+626%) and Ministry of Mines (+25%)

- The semiconductor allocation actually increased despite the ministry-wide 10% cut — money moved upstream

📖 Recommended Reading Order:

- Start with "The Opening Number" — it sets the entire frame

- Read "The Energy Juggernaut" next — coal gasification is the budget's defining bet

- The "Tale of Two Shipbuildings" section is the sharpest policy contrast in the document

- Pay close attention to "The Tech Plot Twist" — the PLI cut looks like a panic, but the numbers tell a different story

- Finish with "The Three Pillars" to see how every piece fits the same strategic frame

- Use all 80 flashcards to lock in the sector allocations and beneficiary stocks

🎬 Video Deep Dive

A full video breakdown of the 2026 Budget — covering the +626% coal hike, the defense modernization, the semiconductor pivot, and what it all means for the market. Watch the full story in one sitting.

India Budget 2026 Explained: The Great Pivot to Hard Assets (Winners, Losers & Big Signals) →

🎧 Audio Deep Dive

The full audio version of this Budget 2026 breakdown — every sector, every beneficiary stock, and the strategic logic that ties it all together. Listen on the go.

🎯 Test Your Knowledge

80 flashcards covering every ministry, allocation number, and beneficiary stock in this analysis. Click any card to reveal the answer. Use the search box to jump to a specific sector.

The Opening Number: +626%

Budget season is usually a ritual we all perform. A national holiday for accountants and a day of confusion for everyone else. We pretend to care about fiscal deficits and tax slabs for about 48 hours, nod at the TV screens like we all understand what a fiscal glide path is, and then go back to normal life. It is an exercise in incrementalism — a little bump here, a little cut there.

Not this year.

The numbers coming out of the Union Budget 2026 are not whispering politely. They are screaming. And the story they are telling is one of a massive, deliberate strategic shift — what we are calling The Great Pivot.

That is not a rounding error. That is not a typo. And understanding why that number exists is the key to reading this entire budget correctly. Because this budget is not a software budget. It is not a startup budget. It is a hardware budget in a software world — a pivot toward hard assets, energy security, and massive physical infrastructure, and away from the consumer tech incentives we have all gotten used to.

We have the full budget breakdown and a stack of sector-specific analysis documents in front of us. We are going to follow the money — not where the politicians say they want it to land, but where the cash is actually going. And we are going to name the specific stocks that catch it.

Section 1: The Energy Juggernaut

Let us unpack that 626% number. The Ministry of Coal received a budget increase that is, in government terms, almost violent. But this is 2026 — we are signatories to climate accords. We talk about net zero constantly. Coal is supposed to be the villain. So why is it getting the single largest allocation jump in the entire budget?

Coal Gasification: Cooking, Not Burning

The answer is a technology called coal gasification. And the difference between burning coal and gasifying it is the difference between a campfire and a chemistry lab.

Syngas is incredibly versatile. It can be burned for power — and it burns far cleaner than the coal it came from. But more importantly, it can be used as a chemical feedstock: to make fertilizers, urea, methanol, even petrochemicals. India has massive coal reserves. Coal gasification lets us use those reserves to reduce our import dependence on natural gas and key industrial chemicals.

The budget makes this crystal clear. It has allocated a very specific ₹3,525 crore for the Scheme for Promotion of Coal and Lignite Gasification. That is not a rounding error. That is a deliberate number — a clear signal that the government is not stranding this asset. It is transforming how we use it.

The Beneficiary Chain: Miner → Tech Provider → Distributor

The money does not disappear into a government void. It flows to specific executors — and the chain is a textbook vertically integrated play:

| Role | Company | Why They Win |

|---|---|---|

| Miner | Coal India, NLC India | They own the reserves. They execute the gasification projects at the mine mouth. |

| Technology Provider | BHEL | They have proprietary technology for high-ash Indian coal gasification — the pressurized, fluidized-bed gasifiers. Indian coal is different; you cannot just import a German gasifier. |

| Gas Distributor | GAIL | They own the pipeline infrastructure. Syngas produced at Jharkhand mines needs to reach fertilizer plants in UP or city gas grids in Delhi. GAIL owns those pipelines. |

Petroleum: The Reimbursement

The Ministry of Petroleum and Natural Gas is up +57%. In any other year, that would be the headline. But the number is largely driven by a one-time grant to public sector undertakings to cover LPG under-recoveries.

"Under-recoveries" is bureaucratic language for losses the government forced these companies to absorb. When global energy prices spiked, HPCL, BPCL, and IOC kept cooking gas prices stable for the Indian consumer — and took the hit on their own balance sheets. The government is now writing them a check to cover those past losses, restoring their financial health and freeing up cash flow that was tied up in debt servicing.

Section 2: The Green Transition & The Grid

The fossil fuel story is only one track. Running in parallel is an equally aggressive push into renewables. The Ministry of Power is up +37%. The Renewables allocation specifically is up +24%. The government is walking and chewing gum at the same time — funding the old and the new simultaneously.

The "Aha" Moment: Viability Gap Funding for Battery Storage

There is a brand new ₹1,000 crore allocation for Viability Gap Funding (VGF) for Battery Energy Storage Systems. This is the missing link in the renewable energy story — and here is why it matters so much.

The problem is that utility-scale lithium-ion batteries are incredibly expensive. The numbers do not pencil out for a private company — the cost to install and maintain them exceeds what they can earn by selling stored power at current electricity rates. There is a gap between cost and profit.

Viability Gap Funding is the government stepping in and saying: "We will pay that difference. We will write you a check for the gap to make this project profitable from day one." By putting ₹1,000 crore on the table, they are unlocking billions in private investment that was sitting on the sidelines waiting for the math to work.

| Player | Role | Why They Benefit |

|---|---|---|

| NTPC | Public generation giant | Needs storage to stabilize grid frequency and avoid blackouts |

| Power Grid | Transmission network | Manages the national grid; storage is essential for grid stability |

| Reliance Power | Private power player | Direct beneficiary of the BESS funding for large-scale storage projects |

| Adani Power | Private power player | Positioned to build the assets that define the future of the grid |

Solar at the Grassroots: PM KUSUM Doubled

The PM KUSUM Yojana — the scheme that helps farmers install solar-powered water pumps for irrigation — saw its funding nearly double, from ₹2,600 crore to ₹5,000 crore. This is a textbook win-win: the farmer gets free, reliable power that cuts their diesel bill to zero, and the national grid gets relieved of massive agricultural demand.

The stock that benefits most directly is Shakti Pumps — the market leader in solar-powered agricultural pumps. If the government doubles the budget to buy solar pumps, the company that makes them wins. It is a direct correlation.

Grid Solar & Domestic Manufacturing

Grid solar allocation is up a healthy +20%. The government wants those panels made in India — not imported. The two names highlighted in the analysis are Waaree Energies and Premier Energies, the dominant domestic solar panel manufacturers.

Section 3: The Tale of Two Shipbuildings

This was one of the most surprising parts of the budget breakdown. When you hear "defense modernization" and look at the map of the Indian Ocean, you assume we are building warships. We live in a volatile neighborhood. But the numbers tell a very different story this year — a massive divergence between naval defense and commercial shipping.

The Navy: Flat

The naval fleet allocation is up only +2.5%. The naval dockyard budget is completely flat. In inflation-adjusted terms, that is effectively a budget cut. If you were thinking we are pouring money into new destroyers and submarines this year, the budget says: think again.

Commercial Maritime: The Real Winner

The money went straight to the Ministry of Ports, Shipping and Waterways — up a massive +48%. That is nearly a doubling in one year. The government is pivoting to commercial maritime self-reliance: India's own merchant fleet, its own shipping containers, its own world-class ports.

The Smart Money: Credit Risk Coverage

Three new funds were created for this pivot:

- Maritime Development Fund: ₹1,000 crore — supports the broader shipping and maritime ecosystem

- National Shipbuilding Mission + SBFAS: ₹515 crore — direct funding for domestic shipbuilding

- Shipbuilding Development Scheme (SbDS): ₹250 crore — specifically for credit risk coverage

That last one is the clever one. Shipbuilding is incredibly capital-intensive. Banks are often scared to lend because projects can take years to complete and costs can overrun. By providing credit risk coverage, the government is telling banks: "Lend the money. If they default, we will cover a portion of your loss." It de-risks the loan, lowers the cost of borrowing, and lubricates the entire financial machinery of the sector. A very targeted use of a relatively small amount of money to unlock a huge amount of private lending.

| Beneficiary | Sector | What They Build or Operate |

|---|---|---|

| Adani Ports | Port Infrastructure | India's largest private port operator — direct beneficiary of the 48% hike |

| JSW Infrastructure | Port & Logistics | Port development and logistics capacity |

| GE Shipping | Shipping Vessels | Operates tankers and bulk carriers — benefits from the National Shipbuilding Mission |

| IWAI | Inland Waterways | Receives grants for waterway development — connects ports to the hinterland |

Section 4: Defense Capital Outlay — Modernization Over Maintenance

Defense is not being ignored — it is being redirected. The distinction between revenue expenditure (salaries, pensions, routine upkeep) and capital outlay (buying new equipment) is critical here. The capital outlay budget is up +21.8% to ₹2.19 lakh crore. That is a very healthy jump. But if it is not going to ships, where is it going?

Priority One: The Sky

Aircraft and aero engines at +31.2% is the single highest growth segment in the entire defense budget. This screams new orders — not patching up old MiGs. One name dominates: HAL (Hindustan Aeronautics Ltd). This is money for new orders on the Tejas MK2 fighter, new advanced helicopters, and the engines that power them. HAL is the undisputed king of this allocation.

Priority Two: The Ground

Heavy and medium vehicles at +25.5% — trucks, armored personnel carriers, tanks. The winners here are the heavy movers: Ashok Leyland, Force Motors, and Bharat Forge. Bharat Forge is particularly interesting — they have moved beyond traditional forging into artillery systems and specialized defense components. A 25% hike in vehicle and heavy equipment procurement goes straight to their order book.

Priority Three: The Mystery Category

"Other equipment" is up +30.5%. In defense budget language, "other equipment" is usually code for the high-tech stuff that does not fit neatly into trucks or planes: drones, advanced radars, electronic warfare suites, surveillance systems. The listed drone space in India is still maturing, but if you are a company making military-grade drones or advanced radar systems, this budget hike just expanded your total addressable market by nearly a third overnight.

Section 5: The Tech Plot Twist

This is the section of the budget that might upset some people who have been following the India tech story for the last few years. The Ministry of Electronics & IT — the overall budget is down 10%. And the slash to the PLI scheme is brutal: cut by 83%, from ₹9,000 crore to just ₹1,500 crore.

If you looked at that headline number alone, you would panic. You would think the government is giving up on electronics manufacturing entirely. But the dream is not over. It is evolving. It is getting more ambitious.

From Screwdriver Tech to Deep Tech

Where the Money Actually Went

The money did not disappear. It moved upstream — from the assembly bucket to the component and semiconductor buckets:

| Allocation | Amount | Direction |

|---|---|---|

| Electronics PLI (general assembly) | ₹9,000 cr → ₹1,500 cr | -83% cut |

| Semiconductor & Display Ecosystem | ₹7,000 cr → ₹8,000 cr | +14% increase |

| India Semiconductor Mission 2.0 | ₹1,000 cr (new) | Brand new line item |

| Electronic Components Manufacturing | ₹1,500 cr (new) | Brand new line item |

The money literally moved from one bucket to another. They want the printed circuit boards, the camera modules, the wafers, the fabs — made here. Not just assembled here.

The Winners Inside the "Losing" Sector

Dixon Technologies is a great example — they started with basic assembly but are aggressively moving into component manufacturing and more complex production. CG Power has made big moves into the OSAT space (semiconductor assembly and testing) — right in the bullseye of this new policy direction.

And then there is the value chain play: the infrastructure of the infrastructure. You cannot run a semiconductor fab without ultra-pure water. You cannot run it without specialized cooling solutions and industrial chemicals. The analysis points to companies in cooling, chemicals, and water recycling as indirect but massive beneficiaries of this semiconductor push.

The EV Subplot

The PM E-Drive scheme — the EV consumer subsidy — was cut from ₹4,000 crore to just ₹1,500 crore. That hurts the buyer waiting for a discount. But look at the contrast: the Auto PLI — the money given to companies to make the electric cars and their components — was doubled to ₹6,000 crore.

Section 6: The Infrastructure Backbone

We cannot do a budget breakdown without railways and roads — the bread and butter of the Indian economy, the reliable workhorses that keep everything else moving.

Railways: ₹2.81 Lakh Crore

The Railways allocation is ₹2.81 lakh crore — a solid +10% bump. The specific focus this year is not just laying more tracks. It is rolling stock: new trains, more Vande Bharat express trains, new modern freight wagons, modernized fleets across the board. The government wants to increase the velocity of freight movement and improve the passenger experience.

The beneficiaries span the full value chain: Titagarh Wagons (the classic wagon maker), IRFC (the financier), and the construction and engineering companies that lay tracks and do electrification — IRCON, RVNL. For overhead equipment and cabling, the analysis highlights APAR and Transrail.

Roads: ₹3.09 Lakh Crore

Roads received ₹3.09 lakh crore — up almost +8%. Steady, massive growth. The beneficiaries are obviously the big construction majors — but also the entire cement sector. You cannot build three lakh crore worth of roads without pouring absolute rivers of concrete.

Water: ₹67,000 Crore

The Jal Jeevan Mission continues with a significant ₹67,000 crore allocation for drinking water projects. The engineering stocks that benefit directly: Ion Exchange, VA Tech Wabag, Jash Engineering, and Astral Pipes.

Section 7: Niche Gems — Where the Alpha Hides

These are the smaller pockets of the budget that saw huge percentage jumps but might get lost in the headlines about coal and defense. This is often where stock pickers find the most alpha — in the overlooked corners.

Agriculture: Modest Overall, Explosive Sub-Sectors

The overall agriculture budget is up only +2.56% — barely keeping pace with inflation. But specific pockets are on fire:

- Fertilizer Subsidy: Up +9.2%. Beneficiaries: Coromandel International, Paradeep Phosphates, MB Agro.

- Animal Husbandry & Dairy: Up a massive +27%. This signals the government wants to formalize and modernize the dairy supply chain. Beneficiaries: Dodla Dairy, Hatsun Agro, Heritage Foods.

- Fisheries: The analysis points to Avanti Feeds — the market leader in shrimp feed. Any boost to aquaculture goes straight to their bottom line.

- Coconut & Cocoa: A very specific crop focus with Manorama Industries — a niche company that processes specialty fats. A great example of a very niche stock that is a direct beneficiary of a very specific allocation.

Healthcare & Pharma: Targeted but Healthy

The Department of Pharmaceuticals is up +12.5%. A brand new scheme called Bio-pharma SHAKTI has a ₹500 crore allocation specifically for biopharma research and manufacturing. Beneficiaries: Biocon, Laurus Labs, Poly Medicure.

But think about the supply chain too: the specialty chemical companies that supply active pharmaceutical ingredients. SRF, Deepak Nitrite, Navin Fluorine — a boom in domestic pharma manufacturing means a boom in domestic chemical consumption.

Ayurveda: Traditional Medicine Gets a Double-Digit Hike

The Ministry of Ayush is up +10%, bringing its allocation to ₹4,400 crore. The beneficiary noted is Jeena Sikho. It is fascinating to see traditional medicine getting a double-digit hike right alongside semiconductors and nuclear research — a budget of contrasts.

Mining: +25% and Deepening

The Ministry of Mines allocation is up +25% to ₹3,800 crore. Beneficiaries: NMDC, Coal India (again — a dual beneficiary across Coal and Mines), Vedanta, and GMDC. BHEL appears here too as a heavy equipment provider.

Section 8: The Nuclear Sleeper

One more sector that usually flies under the radar — and is making real noise this year. The overall budget for the Department of Atomic Energy is basically flat at ₹24,100 crore (+0.3%). On the surface, it looks boring. You skip over it.

But peel back the layers. The R&D budget for BARC — the Bhabha Atomic Research Centre — has jumped from ₹1,100 crore to ₹1,800 crore. That is a nearly +64% increase in pure research funding. That is not just for paying salaries and keeping the lights on.

BHEL is everywhere in this energy story — coal gasification, nuclear, mining. If it is big, complex, and makes power in India, chances are they are involved somehow. They are the quintessential picks-and-shovels play of the entire budget.

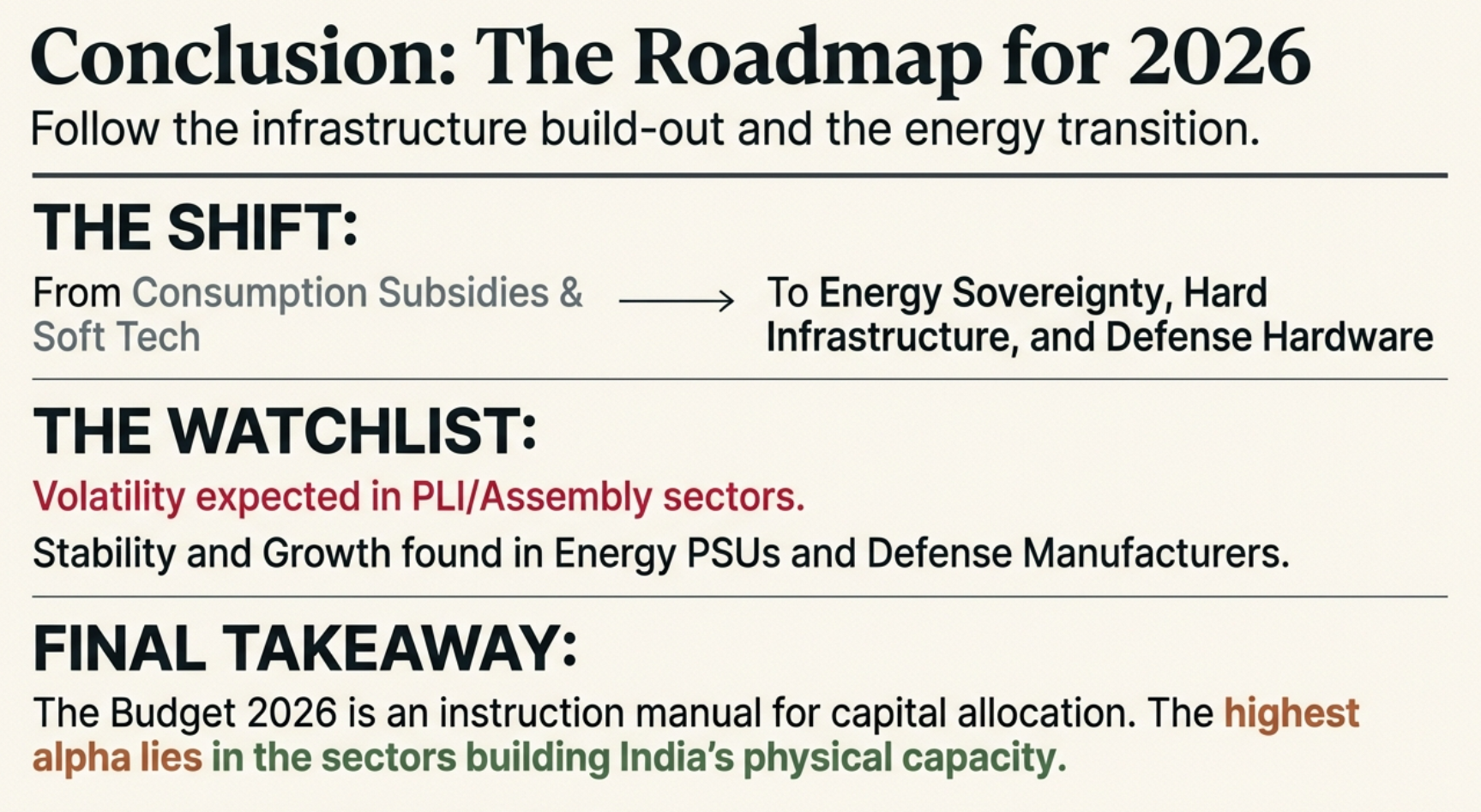

Section 9: The Three Pillars — The Big Picture

We have covered coal, batteries, ships, planes, chips, and even cows. What does all of it mean? Pull back far enough and three main pillars hold up this entire budget:

The Three Pillars of Budget 2026

- Pillar One — Energy Security Is King. It does not matter if it is clean or dirty. If it produces power reliably within our borders, it gets money. Coal India is funded. Battery storage for Adani and Reliance is funded. The absolute priority: the lights must stay on.

- Pillar Two — Make in India 2.0: The PhD Edition. The Make in India slogan has graduated from assembly to deep manufacturing. We are done subsidizing screwdriver tech. The money has moved upstream to the hard stuff: semiconductors, advanced components, complex gasification technology, modernized hardware. We are buying planes from HAL and trucks from Ashok Leyland. We are building commercial ports with Adani and JSW.

- Pillar Three — Capital Over Consumption. This budget is not spending on salaries or soft welfare schemes as much as it is spending on steel, concrete, and advanced machinery. It rewards the companies that build things, dig things, and move things. It strategically de-emphasizes consumer subsidies.

And the provocative question this budget leaves us with: in a world dominated by AI and software, India's 2026 budget is betting big on smokestacks and steel. On hard assets and self-reliance. It is a bold pivot. Whether it is the right one for the long run depends on one thing: whether the green future arrives on schedule. If the batteries scale, the coal was the bridge. If they do not, we are very glad we kept digging.

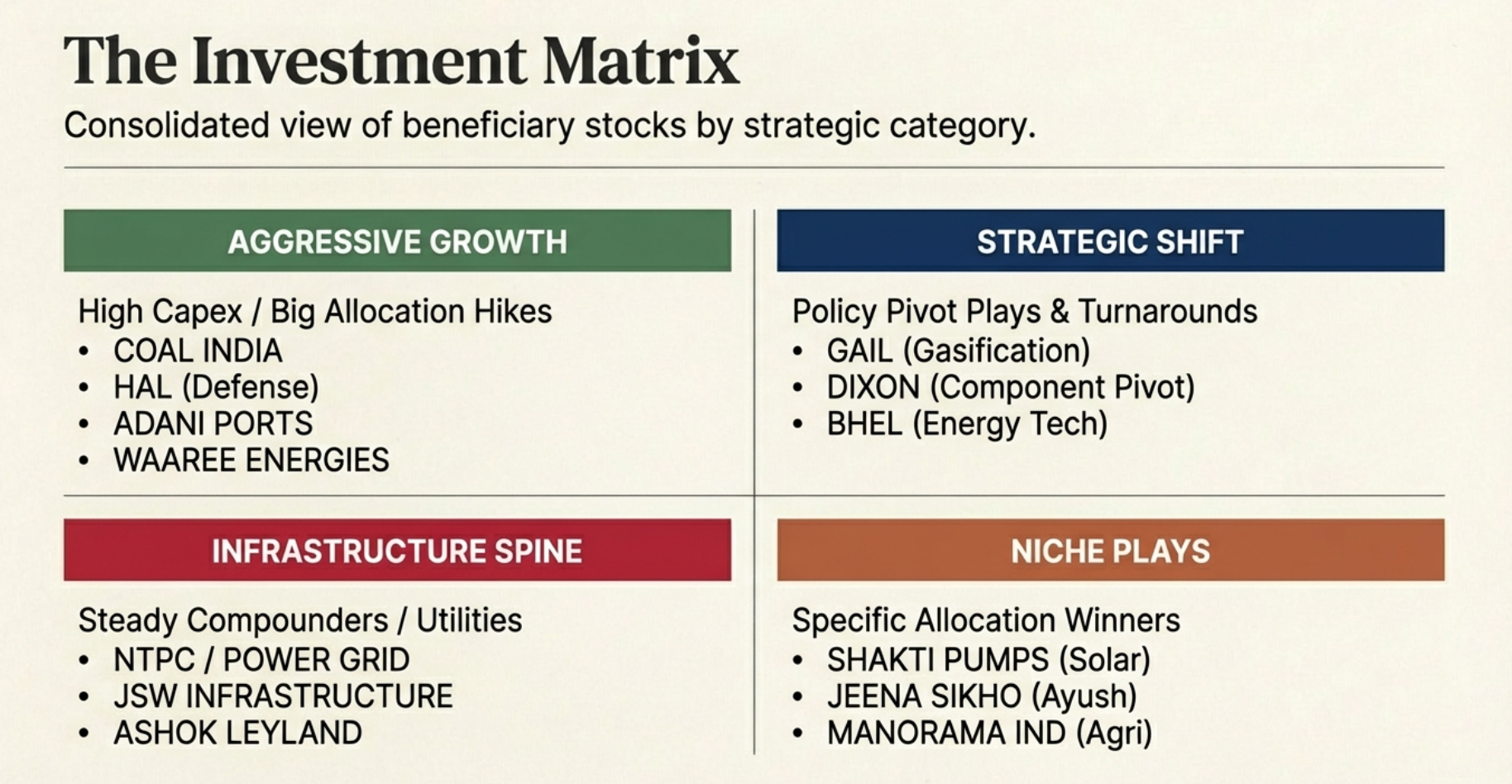

Master Beneficiary Stocks Table

A consolidated view of every sector, its allocation change, and the stocks the analysis identifies as direct beneficiaries. This is the quick-reference version of everything above.

| Sector / Ministry | Budget Change | Key Beneficiary Stocks |

|---|---|---|

| Coal | +626% | Coal India, NLC India, BHEL, GAIL |

| Petroleum & Natural Gas | +57% | HPCL, BPCL, ONGC, GAIL |

| Ports & Shipping | +48% | Adani Ports, JSW Infrastructure, GE Shipping |

| Power | +37% | Reliance Power, Adani Power, Power Grid, NTPC |

| Animal Husbandry & Dairy | +27% | Dodla Dairy, Hatsun Agro, Heritage Foods |

| Mines | +25% | Coal India, NMDC, Vedanta, GMDC |

| Renewables | +24% | Waaree Energies, Premier Energies, Shakti Pumps |

| Defense (Capital Outlay) | +21.8% | HAL, Ashok Leyland, Bharat Forge, Force Motors |

| Pharmaceuticals | +12.5% | Biocon, Laurus Labs, SRF, Deepak Nitrite, Navin Fluorine |

| Railways | +10% | IRFC, Titagarh Wagons, IRCON, RVNL, APAR, Transrail |

| Ayush | +10% | Jeena Sikho |

| Fertilizer Subsidy | +9.2% | Coromandel International, Paradeep Phosphates, MB Agro |

| Roads & Transport | +7.8% | Construction majors, Cement sector |

| Agriculture (overall) | +2.56% | Manorama Industries, Escorts Kubota, Avanti Feeds |

| Atomic Energy (R&D) | +64% (BARC R&D) | BHEL, MTAR, Walchand Industries, L&T |

| Auto & Components PLI | +100% (doubled) | Sona BLW, Mahindra & Mahindra, Maruti Suzuki |

| Semiconductors & Display | +14% | Dixon Technologies, CG Power, EMS companies |

| Electronics & IT (overall) | -10% | Dixon, CG Power (moving up the value chain) |

| Electronics PLI | -83% | Assembly players de-prioritized; deep tech winners emerge |

| PM E-Drive (EV subsidy) | -62.5% | Consumer EV buyers de-prioritized; manufacturers rewarded |